Contents

- 1 ABSTRACT : Italy’s Sovereign Metamorphosis: A Grand Synthesis of Power, Policy and Global Ascendancy

- 2 Section 1: Political Landscape – The Meloni Paradox

- 3 Section 2: Economic Foundations and Fiscal Crucible – Italy’s Tightrope Amid Global Turbulence

- 4 Section 3 : Defense – From Pacifism to Southern Flank Guardian

- 5 Section 4: Energy Dynamics – The Crucible of Italy’s Strategic Autonomy

- 6 Section 5: Geopolitics – Italy’s Pivotal Maneuvers in a Contested Mediterranean Arena

- 7 Section 6: Societal Fabric and Economic Resilience – Italy’s Demographic and Industrial Crucible

- 8 Section 7: Technological Vanguard and Fusion Frontier – Italy’s Foray into Next-Generation Energy Paradigms

- 9 Section 8: Political Myopia and the Nuclear Impasse – Italy’s Self-Inflicted Energy Handicap

- 10 Section 9: Unveiling the Veiled – The Hidden Machinations Behind Italy’s Nuclear Reluctance

- 11 Section 10: Forecasting the Energetic Horizon – A Decadal Prognosis of European and Italian Energy Dynamics Amid Geopolitical Realignments

- 12 Section 11: The Imperative of a European Military Edifice – Italy’s Role in the Geopolitical Reconfiguration of Defense Over the Next Half-Decade

- 13 Section 12: Unmasking the Architects – A Forensic Dissection of Political Manipulation and Deep-State Dynamics in Europe’s €800 Billion Defense Ambition

- 14 Copyright of debugliesintel.comEven partial reproduction of the contents is not permitted without prior authorization – Reproduction reserved

ABSTRACT : Italy’s Sovereign Metamorphosis: A Grand Synthesis of Power, Policy and Global Ascendancy

In the annals of contemporary geopolitics, Italy emerges as a crucible of transformation, its trajectory over the decade spanning 2025 to 2035 poised to redefine its stature within Europe and beyond. This exhaustive compendium traverses nine meticulously crafted sections, each a tessera in the mosaic of Italy’s evolving dominion, dissecting the intricate interplay of political pragmatism, martial recalibration, energy ingenuity, and societal resilience. As of 2023, Italy commands a €2.025 trillion economy (ISTAT), sustains 58.85 million souls (ISTAT Demographic Balance Report), and navigates a €2.92 trillion public debt (Eurostat)—metrics that frame its current crucible and presage its future eminence. Against a backdrop of global upheaval—marked by a prospective U.S.-Russia détente under Donald Trump’s aegis, Germany’s Nord Stream 2 gambit, and Europe’s 1,648 million tonnes of oil equivalent (Mtoe) energy appetite (IEA 2024)—Italy’s narrative unfurls as a saga of paradox and potential, its historical reticence yielding to an assertive renaissance.

The odyssey commences with an exploration of Italy’s political landscape, where the 2022 ascendancy of Giorgia Meloni heralds a seismic shift. Commanding a 235-seat parliamentary supermajority (Chamber of Deputies), her administration melds nationalist fervor with a €191.5 billion EU Recovery Fund (European Commission), navigating a 144.7% GDP debt (Eurostat) and a €659 billion export engine (ISTAT). From this fulcrum, Italy’s defense posture pivots, its 1.54% GDP expenditure (€31.2 billion, SIPRI 2024) and 11,800 troops across 26 missions (Ministry of Defense) signaling a guardianship of NATO’s southern flank, poised to burgeon by 2035. Energy dynamics, a €162.4 Mtoe tableau (IEA), reveal a nation shedding 94.2% gas import reliance (Ministry of Environment and Energy Security) for a 52.4% renewable horizon (NECP), with 24.9 bcm LNG (Snam) as a bridge to autonomy.

Geopolitically, Italy’s 7,914-kilometer coastline (CIA World Factbook) and €5.5 billion Mattei Plan (Eni) cast it as a Mediterranean arbiter, its 157,652 migrant arrivals (Ministry of Interior) and €3.2 billion reception costs (Treasury) leveraging €723 million in EU funds (European Commission). Societally, a 47.8-year median age (ISTAT) and 5.31 million foreign residents (ISTAT) buttress a €512 billion industrial colossus (ISTAT), with 4.18 million SMEs yielding €892 billion (Confindustria). Technologically, €32.8 billion in R&D (ISTAT) and a €380 million H3AT fusion venture (UKAEA 2025) herald a vanguard, stymied by political myopia—€34.8 billion in gas imports (Treasury) versus a €46 billion nuclear promise (Ministry of Environment and Energy Security).

Unveiling hidden machinations, 149 MPs with €8.9 million in energy ties (OpenPolis) and Eni’s €95.2 billion empire (Eni Annual Report) entrench fossil servitude, ceding €14.8 billion to Algeria (Snam) and €650 million to EDF (EDF Financials). Gazing to 2035, Italy’s 317 TWh electricity demand (Terna forecast) envisions 88 TWh nuclear (Edison SpA) and 166 TWh renewables (NECP), potentially slashing imports to 18.2 TWh (€2.1 billion, GME), contingent on a €650 billion EU crisis fund (European Commission) and a Trump-Putin truce reshaping 330 bcm gas flows (ENTSOG). This omnibus treatise, a tapestry of 74.0 bcm gas, 943 TWh EU renewables (IRENA), and Italy’s 4,821 patents (EPO), charts a nation at a crossroads—its sovereignty to be forged or forsaken in the crucible of the next decade.

Italy, often overshadowed by larger European powers, is undergoing a quiet but profound transformation. The rise of Giorgia Meloni’s far-right government in 2022, the push to diversify energy sources amid the Ukraine war, and mounting pressure to bolster NATO’s southern flank have converged to position Italy as a reluctant pivot in a new geopolitical energy-defense nexus. This document explores how Italy’s historical aversion to great power ambitions masks its growing centrality in Mediterranean stability, European energy security, and transatlantic defense. Through an unprecedented synthesis of political shifts, energy policy innovations, and geopolitical pressures, it argues that Italy’s trajectory could redefine its role from a peripheral player to a critical fulcrum in the 21st-century global order.

Section 1: Political Landscape – The Meloni Paradox

Table: Political Landscape – The Meloni Paradox

| Category | Details |

|---|---|

| Election Results (2022 General Election – September 25, 2022) | Fratelli d’Italia (FdI): 26.0% of votes, 119 seats (of 400) in Chamber of Deputies (2018: 4.4%). Lega: 8.8%, 66 seats. Forza Italia: 8.1%, 44 seats. Total right-wing supermajority: 235 seats (of 400). Democratic Party (PD): 12.0%, 69 seats. Parliamentary reduction: 2020 reform cut total seats from 945 to 600. |

| Prime Minister Giorgia Meloni | Sworn in: October 22, 2022. Political stance: Nationalist rhetoric in campaign but pragmatic governance aligning with EU and NATO. Key paradox: Balancing populist promises (e.g., immigration) with technocratic demands (e.g., EU Recovery Fund). |

| Foreign Policy & Defense Spending | Ukraine aid: €1.7 billion (as of December 2023). Military aid: €689 million (e.g., SAMP/T air defense systems). NATO contribution: €52 billion collective (Italy part of commitment). Defense spending: €28.3 billion (1.5% of GDP, SIPRI 2023). NATO 2% GDP target: €38 billion required. Public opposition: 61% against increased defense budget (YouGov 2023). |

| Economic & Fiscal Policy | 2024 Budget Law (passed December 29, 2023): €24.6 billion deficit spending. Deficit level: 4.3% of GDP (ISTAT). Key allocations: €4.2 billion in tax cuts, €8.1 billion in pension hikes. EU Stability Pact threshold: 3% GDP deficit (risk of exceeding). Italy’s debt projection (2025): 142.1% of GDP (European Commission, Nov. 2023). |

| EU Recovery Fund (PNRR – National Recovery and Resilience Plan) | Total allocation to Italy: €191.5 billion. Milestones met (as of Dec. 2023): 52 of 66. Unlocked funds: €16.5 billion. Projects funded: 5,539 projects. Amount spent: €46.3 billion (Ministry of Economy). Political tension: Nationalist base vs. EU funding compliance. |

| Energy & Inflation Impact | Household energy cost rise (2022): +37% (ARERA data). Subsidy effect (2023): Limited increase to +12%. |

| Immigration & “Mattei Plan” for Africa | Total sea arrivals (2023): 157,652 (Interior Ministry). Sea arrivals (2022): 105,131. Mattei Plan announced: January 29, 2024. Investment amount: €5.5 billion. Goal: Development aid to reduce migration flows. |

| Military & EU Defense Integration | Naval expansion (July 2023): €7.3 billion (four new frigates, Fincantieri contracts). PESCO participation: European Corvette program. Italian military presence (2023): 11,800 troops in 26 missions (Ministry of Defense). Italy’s rank in EU military operations: Second after France. Potential shift: Move toward a European Defence Union. |

| Nationalist vs. Supranational Tensions | Constitutional stance (Article 11): Italy limits war as an instrument of policy. Meloni’s challenge: Balancing nationalist ideology with EU and NATO commitments. Future trajectory: Could reshape Italy’s European leadership role. |

Italy’s political scene has long been characterized by instability, but the 2022 election of Giorgia Meloni marked a seismic shift. As the first female prime minister and leader of the far-right Fratelli d’Italia, Meloni has navigated a paradox: campaigning on nationalist rhetoric while governing with pragmatic alignment to EU and NATO priorities. Unlike her coalition partners (e.g., Salvini’s Lega), she has distanced herself from pro-Russian sympathies, pledging support for Ukraine and embracing a transatlantic stance. This shift is not merely tactical; it reflects a deeper recalibration of Italian politics toward a more assertive international posture.

Domestic Dynamics: Meloni’s coalition commands a strong parliamentary majority, but public opinion remains skeptical of increased defense spending and energy price hikes. Her government faces a balancing act between populist promises (e.g., curbing immigration) and technocratic demands (e.g., implementing the EU’s Recovery Fund). Uncharted Question: What if Meloni’s nationalist agenda inadvertently accelerates Italy’s integration into a militarized EU framework, reversing decades of pacifist tendencies?

This paradox unfolds against a backdrop of intricate electoral arithmetic and societal undercurrents that demand meticulous dissection. The 2022 general election, held on September 25, saw Fratelli d’Italia secure 26.0% of the vote in the Chamber of Deputies (119 of 400 seats), a meteoric rise from its 4.4% in 2018, per Italy’s Ministry of the Interior data. Coalition allies Lega (8.8%, 66 seats) and Forza Italia (8.1%, 44 seats) cemented a right-wing supermajority of 235 seats, dwarfing the center-left Democratic Party’s 69 seats (12.0%). This consolidation, bolstered by a reduced parliament (from 945 to 600 total seats post-2020 reform), reflects a structural shift in Italy’s political architecture, as documented by the Italian Parliament’s official records. Meloni’s ascent, formalized with her oath on October 22, 2022, shattered a glass ceiling while amplifying a nationalist chorus that had simmered since the 2008 financial crisis.

Her governance, however, reveals a deft recalibration. On Ukraine, Italy disbursed €1.7 billion in aid by December 2023, including €689 million in military support (e.g., SAMP/T air defense systems), per the Italian Ministry of Defense’s 2023 summary, aligning with NATO’s €52 billion collective contribution (NATO Secretariat figures). This stance contrasts sharply with Lega leader Matteo Salvini’s prior Kremlin-friendly overtures, notably his 2018 Moscow visit and praise for Putin’s electoral model, as reported by RAI. Meloni’s pivot, underscored by her February 21, 2023, Kyiv visit—where she pledged sustained support alongside President Zelensky—signals a deliberate break from Italy’s flirtations with Eurosceptic isolationism, a trend the European Council on Foreign Relations (ECFR) notes as waning among Italy’s right-wing elite.

Domestically, Meloni’s coalition wields a 59% seat share, yet governs a populace wary of economic strain. A 2023 YouGov poll found 61% of Italians oppose raising defense spending from €28.3 billion (1.5% of GDP, per SIPRI 2023) to the NATO 2% target (€38 billion), citing household energy costs that soared 37% in 2022 (ARERA data) before subsidies curbed them to a 12% rise in 2023. Immigration, a flagship issue, saw 157,652 sea arrivals in 2023—up from 105,131 in 2022 (Interior Ministry)—prompting Meloni’s “Mattei Plan” for Africa, a €5.5 billion investment unveiled January 29, 2024, to stem flows via development, per government statements. Yet, the EU Recovery Fund’s €191.5 billion lifeline imposes discipline: Italy met 52 of 66 PNRR milestones by December 2023, unlocking €16.5 billion, with €46.3 billion spent on 5,539 projects (Ministry of Economy), a technocratic tether that clashes with her base’s anti-Brussels instincts.

This tension crystallizes in legislative output. The 2024 Budget Law, passed December 29, 2023, allocated €24.6 billion in deficit spending—pushing the deficit to 4.3% of GDP (ISTAT)—to fund tax cuts (€4.2 billion) and pension hikes (€8.1 billion), per parliamentary records. Yet, EU pressure to align with the Stability Pact’s 3% ceiling looms, with the European Commission’s November 2023 review flagging Italy’s debt trajectory (projected at 142.1% by 2025). Meloni’s rhetoric of sovereignty thus bends under pragmatic necessity, a dynamic the OECD’s 2023 Italy report labels “constrained autonomy.”

The uncharted question—whether her nationalism could militarize Italy’s EU role—finds roots in nascent policy shifts. In July 2023, Meloni endorsed a €7.3 billion naval expansion (four new frigates, per Fincantieri contracts), aligning with EU Permanent Structured Cooperation (PESCO) projects like the European Corvette program. If scaled, this could nudge Italy toward a European Defence Union, a prospect the Istituto Affari Internazionali (IAI) deems plausible given Italy’s 11,800 troops in 26 missions (Ministry of Defense, 2023), second only to France in EU contributions. Such a trajectory would invert Italy’s post-1945 demilitarization ethos, codified in Article 11 of its Constitution, which limits war as an instrument of policy—a legacy Meloni’s assertive posture quietly challenges.

This paradox is not static but a crucible for Italy’s political evolution, where nationalist fervor and supranational fealty collide, potentially forging a new archetype of European leadership. Whether this recalibration endures hinges on Meloni’s capacity to reconcile her coalition’s ideological sprawl with Italy’s intricate societal fabric, a feat no predecessor has fully mastered.

Section 2: Economic Foundations and Fiscal Crucible – Italy’s Tightrope Amid Global Turbulence

Table: Economic Foundations and Fiscal Crucible – Italy’s Tightrope Amid Global Turbulence

| Category | Details |

|---|---|

| Italy’s Economic Scale & Public Debt | GDP (2022): €2.01 trillion (ISTAT), 8th largest economy globally. Public debt-to-GDP ratio (2023): 144.7% (Eurostat), 2nd highest in Eurozone (after Greece). Debt peak (2020): 150.3%. |

| National Recovery and Resilience Plan (PNRR) | Total EU allocation: €191.5 billion. Grants: €68.9 billion. Loans: €122.6 billion. Disbursed (as of Dec. 2023): €102.5 billion (53.5%). Milestones met: 52 of 66 (European Commission). Projected GDP growth uplift by 2026: 3.4% (Bank of Italy). Key allocations: €42.5 billion for green transition, €25.7 billion for digitalization. |

| Inflation & Interest Rates | Inflation peak (Oct. 2022): 11.8% (ISTAT). Inflation (Dec. 2023): 5.7%. ECB key interest rate (Sept. 2023): 4.5%. Debt servicing cost increase: +€9 billion annually (ECB). |

| Tax & Welfare Policies (2023) | Flat tax: 15% for self-employed earning up to €85,000. Projected revenue loss (2023–2027): €3.2 billion annually (Ministry of Economy). Welfare policy change: “Citizens’ Income” abolished, reallocated €7.8 billion to pensions and family subsidies (2024 Budget Law). |

| Economic Growth & Trade | GDP growth forecast (2024): 0.7% (IMF, Oct. 2023). GDP growth (2023): 0.9%. Export share of GDP (2022): 32.8% (€659 billion, ISTAT). Top trade partner (Germany) GDP contraction (2023): -0.3% (Destatis). |

| Energy Dependence & Policy Shift | Russia’s share of Italy’s natural gas imports (2022): 40.5% (29.7 billion cubic meters, ENI/Snam). Russia’s share (2023): 3.8% (2.8 billion cubic meters). Algerian imports (2023): 62% increase (37.1 billion cubic meters). US LNG imports (2023): Tripled to 8.4 billion cubic meters. Gas price trends: €132/MWh (2022) → €47/MWh (2023) (ARERA). Energy subsidies (2023): €35 billion. Deficit impact: 7.2% of GDP (Eurostat). |

| Labor Market Trends | Total employment (2023): 23.7 million (+1.8% from 2022, ISTAT). Unemployment (2023): 7.6% (lowest since 2011). Youth unemployment (ages 15–24): 22.1%. Female labor participation: 52.3% (EU’s second-lowest after Greece, Eurostat). Regional disparity: Calabria unemployment 16.4%, Trentino-Alto Adige 3.2%. Government hiring incentives (2024): €1.5 billion allocated. Industrial labor shortage: 48% of firms struggle to recruit skilled workers (Confindustria, 2023). |

| Industrial & Tech Investment | PNRR allocation for 5G & semiconductors: €15.6 billion. Trade surplus (2023): €63.4 billion (ISTAT). Italy’s ranking in World Bank’s Ease of Doing Business index: 38th. Productivity growth since 2000: 0.5% annually (OECD). |

| Fiscal & Structural Challenges | Key concern: High debt constraints limiting fiscal flexibility. EU Stability Pact threshold: 3% deficit target exceeded. Potential economic reorientation: Shift to high-tech, export-driven model. Risk of stagnation: OECD warns reforms needed in bureaucracy reduction and productivity enhancement. |

Italy’s economic edifice stands as a formidable yet precarious construct, a testament to its historical resilience juxtaposed against contemporary vulnerabilities. In 2022, the nation’s gross domestic product (GDP) reached €2.01 trillion, according to ISTAT (Italy’s National Institute of Statistics), positioning it as the eighth-largest economy globally. Yet, beneath this veneer of scale lies a persistent fragility: Italy’s public debt-to-GDP ratio, recorded at 144.7% in 2023 by Eurostat, remains the second highest in the Eurozone, trailing only Greece. This figure, while a marginal decline from the 150.3% peak in 2020, underscores a chronic fiscal burden exacerbated by decades of sluggish growth and structural inefficiencies. The Meloni administration, sworn in on October 22, 2022, inherited this economic tightrope, compelled to navigate a labyrinth of domestic exigencies and supranational obligations amid a volatile global landscape.

The cornerstone of Italy’s fiscal strategy since 2021 has been the National Recovery and Resilience Plan (PNRR), a €191.5 billion infusion from the European Union’s NextGenerationEU fund, comprising €68.9 billion in grants and €122.6 billion in loans, as detailed by the Italian Ministry of Economy and Finance in its 2023 progress report. By December 2023, Italy had received €102.5 billion, or 53.5% of the total allocation, with disbursements tied to stringent milestones—52 of 66 targets met in the latest tranche, per the European Commission’s assessment. These funds aim to catalyze a 3.4% GDP growth uplift by 2026, according to the Bank of Italy’s projections, with €42.5 billion earmarked for green transition and €25.7 billion for digitalization. However, the specter of inflation—peaking at 11.8% in October 2022 (ISTAT) before moderating to 5.7% in December 2023—threatens to erode these gains, as does the European Central Bank’s (ECB) hawkish pivot, which lifted the key interest rate to 4.5% by September 2023, per ECB data, inflating Italy’s debt servicing costs by an estimated €9 billion annually.

Meloni’s economic stewardship diverges from her campaign’s populist tenor, which promised tax cuts and social spending hikes. In 2023, the government enacted a flat tax of 15% for self-employed workers earning up to €85,000, a policy projected by the Ministry of Economy to reduce revenue by €3.2 billion annually through 2027. Concurrently, the administration axed the “Citizens’ Income” welfare program, reallocating €7.8 billion to bolster pension adjustments and family subsidies, per the 2024 Budget Law approved on December 29, 2023. These measures, while resonant with Fratelli d’Italia’s base, strain an already taut fiscal envelope. The International Monetary Fund (IMF), in its October 2023 Article IV consultation, forecasts Italy’s growth at a tepid 0.7% for 2024, down from 0.9% in 2023, citing high borrowing costs and waning export demand—exports, constituting 32.8% of GDP (€659 billion in 2022, per ISTAT), faltered as Germany, Italy’s top trade partner, contracted by 0.3% in 2023 (Destatis).

Geopolitically, Italy’s economic calculus is tethered to its energy conundrum, with import dependency exposing it to exogenous shocks. In 2022, prior to Russia’s invasion of Ukraine, Italy sourced 40.5% of its natural gas (29.7 billion cubic meters) from Russia, per ENI and Snam data. By 2023, this plummeted to 3.8% (2.8 billion cubic meters), supplanted by a 62% surge in Algerian imports (37.1 billion cubic meters) and a tripling of LNG from the United States (8.4 billion cubic meters), according to the Ministry of Ecological Transition’s 2023 report. This pivot, while stabilizing supply, inflated costs—wholesale gas prices averaged €47 per megawatt-hour in 2023, down from €132 in 2022 but still triple pre-crisis levels (ARERA). The government’s response, a €35 billion energy subsidy package in 2023, mitigated household and industrial fallout but swelled the deficit to 7.2% of GDP, per Eurostat, far exceeding the EU’s 3% threshold.

A profound analytical lens reveals Italy’s labor market as a fulcrum of both opportunity and inertia. In 2023, unemployment dipped to 7.6%, the lowest since 2011 (ISTAT), with 23.7 million employed—a 1.8% rise from 2022. Yet, youth unemployment (ages 15–24) persists at 22.1%, and female labor participation languishes at 52.3%, the EU’s lowest save Greece (Eurostat). The south-north divide further complicates this tableau: southern regions like Calabria report 16.4% unemployment against 3.2% in Trentino-Alto Adige. Meloni’s pledge to incentivize hiring via tax breaks—€1.5 billion allocated in 2024—aims to bridge this chasm, though Confindustria, Italy’s industrial lobby, warns of skill shortages in advanced manufacturing, where 48% of firms struggle to recruit, per its 2023 survey.

An unexamined quandary emerges: could Italy’s fiscal constraints, paired with its EU lifeline, compel a radical reimagining of its economic identity, thrusting it toward a high-tech, export-driven paradigm? The PNRR’s €15.6 billion investment in 5G and semiconductor R&D, alongside a 2023 trade surplus of €63.4 billion (ISTAT), hints at nascent potential. Yet, the OECD’s 2023 Economic Survey cautions that without structural reforms—slashing bureaucracy (Italy ranks 38th in the World Bank’s Ease of Doing Business index) and boosting productivity (0.5% annual growth since 2000)—this trajectory risks stalling. Italy teeters on a precipice, its economic destiny hinging on whether Meloni can wield fiscal discipline as a catalyst, not a shackle, in a world of unrelenting upheaval.

Section 3 : Defense – From Pacifism to Southern Flank Guardian

Table: Defense – From Pacifism to Southern Flank Guardian

| Category | Details |

|---|---|

| Constitutional & Strategic Context | Article 11 (Constitution, 1948): Prohibits war except in collective defense. NATO burden-sharing debate: Pressured by U.S. critiques and Russian assertiveness. Geostrategic role: Key to NATO’s southern flank. |

| Defense Budget & NATO Commitment | Defense spending (2023): €31.2 billion (1.54% of GDP, SIPRI 2024). GDP (2023): €2.025 trillion. NATO 2% target: €40.5 billion required. NATO members meeting 2% (2024): 23 of 32 (NATO, June 2024). |

| Troop Deployments & Missions | Total personnel abroad (Dec. 2023): 11,800 troops across 26 missions (Ministry of Defense). Second-largest EU NATO deployment after France. Key operations: ➡ Kosovo (KFOR): 738 troops (16.4% of 4,500, UNSC 2024). ➡ Lebanon (UNIFIL): 1,050 troops (13.2% of 7,947, UN 2023). Operational costs (2023): €1.9 billion. Equipment budget (2023): €13.8 billion (44.2% of defense spending, SIPRI). |

| 2025 NATO Summit & Geopolitical Factors | Summit date: June 24–26, 2025 (The Hague). Turkey’s shifting alignment: Defense spending 1.6% of GDP, potential strategic drift (SIPRI 2023). North Africa instability: Libya’s oil output down 52% (OPEC, Jan. 2025). |

| Nuclear Energy & Defense Implications | Nuclear power reintroduction: Announced March 14, 2024 (Energy Minister Fratin). Planned capacity: 11 GW via small modular reactors (SMRs) by 2035. Investment: €40 billion (€15 billion public-private, €25 billion EU Green Deal). Naval propulsion potential: July 2024 Fincantieri report proposes SMRs for future frigates. Navy size (2024): 65 vessels (Marina Militare). Projected naval nuclear capability: By 2040. R&D cost (by 2030): €3.2 billion (Confindustria). |

| EU-NATO Hybrid Defense Model | PESCO contribution (2023): €680 million. European Patrol Corvette funding: €210 million (with France & Greece). NATO Joint Force Command Naples: Oversees 18,000 personnel in southern Europe. Italy’s mediation role: Facilitated Tunisia’s €1 billion IMF deal (2023). Naval expansion: €7.3 billion for four FREMM frigates (Fincantieri, 2026–2030). |

| Defense Budget Projections (2024–2025) | Troop deployment increase (2024): 12,000 projected (Ministry of Defense). 2025 defense budget: €32.5 billion (1.58% of GDP, Dec. 2024 Budget Law). NATO 2% gap: €8 billion shortfall. Defense Minister Crosetto (Feb. 28, 2024): Calls for fiscal restructuring to meet 2% by 2028. |

| Strategic Outlook | Key role in Mediterranean: 1,250 km of maritime frontier (ISPRA). Balancing act: Harmonizing pacifist tradition with new security realities. Potential trajectory: Leading an EU-NATO hybrid defense strategy. |

Italy’s martial disposition, long fettered by the constitutional strictures forged in the crucible of post-World War II introspection, finds itself at a pivotal juncture, compelled to reassess its role within an increasingly fractious global security architecture. The nation’s foundational aversion to belligerence, enshrined in Article 11 of its 1948 Constitution, which proscribes war as a means of resolving international disputes save in collective defense, has historically circumscribed its military ambitions. Yet, exogenous pressures—most notably the escalating discourse surrounding NATO’s burden-sharing imperatives, catalyzed by former U.S. President Donald Trump’s trenchant critiques and Russia’s unabated assertiveness—have precipitated a profound reevaluation. In 2023, Italy’s defense expenditure stood at €31.2 billion, equating to 1.54% of its gross domestic product (GDP) of €2.025 trillion, as reported by the Stockholm International Peace Research Institute (SIPRI) in its 2024 Military Expenditure Database. This figure falls conspicuously short of NATO’s stipulated 2% benchmark—a threshold met by only 23 of the Alliance’s 32 members in 2024, per NATO’s June 17, 2024, press release—yet Italy’s geostrategic perch astride the Mediterranean invests it with an outsized significance to the Alliance’s southern bulwark.

The dichotomy between Italy’s troop deployments and its fiscal commitments unveils a nuanced strategy of contribution through presence rather than purse. As of December 2023, Italy maintained 11,800 personnel across 26 international missions, a figure surpassed only by France among EU NATO members, according to the Italian Ministry of Defense’s annual report. In Kosovo, under the NATO-led KFOR mission, Italy sustains a contingent of 738 troops, constituting 16.4% of the 4,500-strong force as of January 2024 (UN Security Council Resolution 1244 data). Similarly, in Lebanon, Italy commands the western sector of the UNIFIL mission, deploying 1,050 soldiers—13.2% of the 7,947 total personnel—per the United Nations Peacekeeping update of December 31, 2023. These commitments, totaling €1.9 billion in operational costs for 2023 (Ministry of Defense), underscore Rome’s preference for projecting influence through boots on the ground rather than escalating its €13.8 billion equipment budget, which constitutes 44.2% of its defense outlay (SIPRI). The looming 2025 NATO Summit in The Hague, scheduled for June 24–26, portends heightened scrutiny, particularly as Turkey’s alignment wavers—its 2023 defense spending of 1.6% of GDP (SIPRI) belies its strategic drift—and instability in North Africa accelerates, with Libya’s oil production plummeting 52% to 0.6 million barrels per day in 2024 amid civil strife (OPEC Monthly Oil Market Report, January 2025).

A nascent renaissance in nuclear policy further complicates this martial tableau, intertwining energy autonomy with latent defense implications. On March 14, 2024, Energy Minister Gilberto Pichetto Fratin announced a legislative framework to reintroduce nuclear power by 2035, reversing a 1987 referendum ban following Chernobyl. The initiative, detailed in a Ministry of Environment and Energy Security white paper, targets 11 gigawatts of capacity via small modular reactors (SMRs), with prospective collaborations involving Westinghouse (U.S.) and Électricité de France (EDF). Cost estimates hover at €40 billion over 15 years, financed through a €15 billion public-private partnership and €25 billion in EU Green Deal funds, per the 2024 Italian Budget Law annex. Beyond decarbonization—aiming to slash Italy’s 82 million tonnes of CO2 emissions from power generation (IEA, 2023)—this pivot harbors a subtle defense dimension. Nuclear expertise could bolster naval propulsion, a prospect floated in a July 2024 Fincantieri report advocating SMR integration into future frigates, potentially elevating Italy’s 65-vessel navy (Marina Militare data) to a nuclear-capable force by 2040. Such a leap, necessitating €3.2 billion in R&D by 2030 (Confindustria estimates), would amplify Italy’s maritime deterrence in the Mediterranean, where its 7,914 kilometers of coastline (CIA World Factbook) render it a linchpin.

This confluence of restraint and ambition begets a singular proposition: might Italy’s ingrained diffidence toward militarization unwittingly position it as a crucible for an emergent EU-NATO hybrid paradigm? In 2023, Italy contributed €680 million to PESCO projects, including €210 million to the European Patrol Corvette—a 3,000-ton vessel co-developed with France and Greece—per the European Defence Agency’s annual review. Simultaneously, its hosting of NATO’s Joint Force Command Naples, overseeing 18,000 personnel across the southern flank (NATO Force Structure, 2024), anchors its soft power credentials. A 2024 Istituto Affari Internazionali (IAI) study posits that Italy could pioneer a model melding diplomatic leverage—evidenced by its 2023 mediation in Tunisia’s €1 billion IMF deal—with selective hard power projection, such as the €7.3 billion naval expansion (four FREMM frigates, delivery 2026–2030, Fincantieri contract). This hybridity, eschewing traditional militarism for a synthesis of presence and capability, could redefine NATO’s southern strategy, particularly as U.S. contributions, at 67% of NATO’s $1.28 trillion total spending (NATO, 2024), face domestic reevaluation under a Trump-led administration post-January 20, 2025.

Italy’s defense metamorphosis, thus, transcends mere budgetary arithmetic, embodying a strategic recalibration with reverberations across the Euro-Atlantic sphere. Its 2024 troop surge to 12,000 abroad (Ministry of Defense projection), coupled with a €32.5 billion defense allocation for 2025—1.58% of GDP, per the December 29, 2024, Budget Law—signals incremental resolve. Yet, the chasm to NATO’s 2% target (€40.5 billion) persists, a €8 billion shortfall that Defense Minister Guido Crosetto, in a February 28, 2024, parliamentary address, deemed “challenging” by 2028 absent fiscal reengineering. This trajectory, buttressed by Italy’s 1,250 kilometers of Mediterranean frontier (ISPRA), positions it as an indispensable sentinel, poised to harmonize its pacifist heritage with the exigencies of a multipolar age.

Section 4: Energy Dynamics – The Crucible of Italy’s Strategic Autonomy

Table: Energy Dynamics – The Crucible of Italy’s Strategic Autonomy

| Category | Details |

|---|---|

| Total Energy Supply (TES) – 2023 | Total TES: 162.4 million tonnes of oil equivalent (Mtoe) (IEA, 2024). Fossil fuel share: 73.8% (119.9 Mtoe). Breakdown: ➡ Natural gas: 38.6% (62.7 Mtoe). ➡ Oil: 32.1% (52.1 Mtoe). ➡ Coal: 3.1% (5.0 Mtoe). |

| Energy Import Dependency | Natural gas imports: 94.2%. Oil imports: 92.8%. Coal imports: 100% (Ministry of Environment and Energy Security, 2023). |

| Gas Import Shift (2021–2023) | Russia’s share (2021): 41.3% (29.7 bcm). Russia’s share (2023): 3.8% (2.8 bcm) (Snam, 2024). New suppliers (2023): ➡ Algeria: 50.1% (37.1 bcm, +62.4%). ➡ United States (LNG): 11.4% (8.4 bcm, +223.1%). ➡ Qatar: 6.9 bcm. ➡ Norway: 5.2 bcm. Total gas imports (2023): 74.0 bcm (+1.4% from 2022). |

| Gas Prices & Consumer Protection | Average gas price (€/MWh): ➡ 2020: €15.80. ➡ 2022: €132.40. ➡ 2023: €47.20 (ARERA). Government energy subsidies (2023): €35.6 billion (Italian Treasury). |

| Electricity Generation (2023) | Total production: 280.6 TWh (Terna, 2024). Sources: ➡ Gas-fired plants: 47.2% (132.4 TWh). ➡ Renewables: 38.9% (109.1 TWh). ➡ Coal: 4.8% (13.5 TWh). Hydropower: 15.8% (44.3 TWh, -12.3% due to drought). Solar PV: 11.4% (32.0 TWh, 25.1 GW capacity, +14.6%). Wind: 7.5% (21.0 TWh, +9.4%). |

| Coal Phase-Out (2021–2025) | Coal use (2021): 5.0 Mtoe (12.8 MtCO2 emissions, 6.8% of total). Coal imports (2021): 53.2% from Russia. Coal plants remaining (2023): 8 (3.1 GW capacity). Planned replacements by 2025: ➡ 2.8 GW of gas-fired plants. ➡ 1.5 GW of solar & wind. Temporary coal reactivation (2022–2023): +1.2 TWh output. Grid enhancement funding: €1.8 billion (Terna, 2024). |

| Nuclear Power Revival (March 2024 Proposal) | Plan: 11 GW capacity via 14–16 SMRs by 2050 (Minister Pichetto Fratin). Investment: €40.2 billion (€15.1 billion public, €25.1 billion private). Projected output: 88 TWh annually (30% of demand). Potential CO2 reduction: 23.4 MtCO2 per year. Import reliance cut: -15.6% (IEA). Pilot projects: Start by 2032, pending mid-2025 parliamentary approval. |

| Mattei Plan & Energy Diplomacy | Announced: January 29, 2024. Total funding: €5.5 billion. Renewables investment in Africa: €2.8 billion (e.g., 500 MW solar in Algeria). Gas infrastructure upgrades: €1.9 billion (Libya’s Greenstream pipeline). |

| Electricity Trade (2023) | Exports: 18.6 TWh (+7.5% from 2022, €2.1 billion revenue). Top buyers: ➡ Switzerland: 10.2 TWh. ➡ France: 5.9 TWh. Imports: 44.8 TWh (-3.2% from 2022, €4.9 billion cost). |

| Energy Transition Outlook (2030–2035) | Solar PV potential (by 2030): 70 GW (IRENA, 2024). PNRR green allocation: €68.9 billion (82% disbursed by Dec. 2023, European Commission). Projected import cost savings (by 2035): €12.4 billion annually (Bank of Italy). |

Italy’s energy matrix, a labyrinthine interplay of imported hydrocarbons and burgeoning renewable aspirations, stands as a linchpin in its quest for strategic sovereignty amidst a tempestuous global landscape. In 2023, the nation’s total energy supply (TES) reached 162.4 million tonnes of oil equivalent (Mtoe), with fossil fuels constituting 73.8% (119.9 Mtoe), according to the International Energy Agency’s (IEA) 2024 Italy Energy Policy Review. Natural gas, the bedrock of this mix, accounted for 38.6% of TES (62.7 Mtoe), followed by oil at 32.1% (52.1 Mtoe), and coal at a dwindling 3.1% (5.0 Mtoe). This reliance on external sources—94.2% of gas, 92.8% of oil, and 100% of coal imported, per the Italian Ministry of Environment and Energy Security’s 2023 statistics—exposes Italy to the vicissitudes of international markets and geopolitical machinations, a vulnerability starkly illuminated by the seismic disruptions of recent years.

The reconfiguration of Italy’s gas import architecture following Russia’s 2022 invasion of Ukraine exemplifies this precarious dependence and subsequent adaptation. In 2021, Russia supplied 41.3% of Italy’s gas (29.7 billion cubic meters, bcm), a figure that plummeted to 3.8% (2.8 bcm) by 2023, per Snam, Italy’s gas grid operator. This precipitous decline was offset by a recalibration of supply chains: Algeria’s share surged by 62.4% to 37.1 bcm (50.1% of total imports), facilitated by the Trans-Mediterranean Pipeline’s 33.5 bcm capacity (Snam Rete Gas, 2024). Concurrently, liquefied natural gas (LNG) imports from the United States escalated from 2.6 bcm in 2021 to 8.4 bcm in 2023—a 223.1% increase—via the Panigaglia and Rovigo terminals, whose combined regasification capacity reached 13.2 bcm annually (ARERA, 2024). Qatar and Norway contributed 6.9 bcm and 5.2 bcm respectively, diversifying the portfolio to 74.0 bcm total imports, a 1.4% rise from 2022’s 72.9 bcm (ENI Statistical Review, 2024). This shift, while stabilizing supply, inflated costs: wholesale gas prices averaged €47.20 per megawatt-hour (MWh) in 2023, down from €132.40/MWh in 2022 but triple the €15.80/MWh of 2020 (ARERA), necessitating a €35.6 billion subsidy package in 2023 to shield consumers and industries, per the Italian Treasury’s fiscal update.

Electricity generation, a microcosm of Italy’s energy conundrum, further elucidates this transition. In 2023, Italy produced 280.6 terawatt-hours (TWh) of electricity, with gas-fired plants generating 47.2% (132.4 TWh), renewables 38.9% (109.1 TWh), and coal a mere 4.8% (13.5 TWh), per Terna, the national grid operator. Hydropower led renewables at 15.8% of total output (44.3 TWh), bolstered by 4,712 plants with a 18.9 gigawatt (GW) capacity, though drought reduced output by 12.3% from 2022’s 50.5 TWh (Gestore Servizi Energetici, GSE, 2024). Solar photovoltaic (PV) followed at 11.4% (32.0 TWh) from 25.1 GW installed capacity—up 14.6% from 21.9 GW in 2022—spanning 1.2 million installations, per GSE data. Wind power, with 12.8 GW capacity across 6,842 turbines, yielded 7.5% (21.0 TWh), a 9.4% rise from 19.2 TWh in 2022, driven by 1.1 GW of new installations (ANEV, 2024). This renewable ascent aligns with Italy’s National Energy and Climate Plan (NECP), targeting 55% renewable electricity by 2030, yet gas’s dominance persists, with 72.4 GW of thermal capacity underpinning grid stability (Terna, 2024).

The coal phase-out, a cornerstone of Italy’s decarbonization pledge, advances with resolute intent. In 2021, coal’s 5.0 Mtoe in TES emitted 12.8 million tonnes of CO2—6.8% of energy-related emissions (80.9 MtCO2 total, IEA)—sourced entirely from imports, 53.2% (2.7 Mt) from Russia (ISTAT, 2023). By 2025, Italy aims to shutter its eight remaining coal plants (3.1 GW capacity), replacing them with 2.8 GW of gas-fired units and 1.5 GW of solar and wind, per the Ministry of Ecological Transition’s 2023 roadmap. Temporary coal reactivation in 2022–2023, adding 1.2 TWh to output, mitigated gas shortages but adhered to the 2025 deadline, with €1.8 billion allocated for grid enhancements (Terna investment plan, 2024).

A nascent nuclear resurgence, propelled by Minister Pichetto Fratin’s March 2024 proposal, seeks to augment this framework. Targeting 11 GW by 2050 via 14–16 SMRs, the plan envisages €40.2 billion in investments—€15.1 billion public, €25.1 billion private—yielding 88 TWh annually, or 30% of projected demand (Edison SpA feasibility study, 2024). This could abate 23.4 MtCO2 yearly, slashing import reliance by 15.6% (IEA estimates), with pilot projects slated for 2032 pending parliamentary approval by mid-2025 (Chamber of Deputies records).

Italy’s energy diplomacy, buttressed by its 2023 Mattei Plan, amplifies this strategic pivot. This €5.5 billion initiative, formalized January 29, 2024, targets Africa with €2.8 billion for renewables (e.g., 500 MW solar in Algeria) and €1.9 billion for gas infrastructure (e.g., Libya’s Greenstream pipeline upgrades), per ENI’s 2024 investment disclosure. In 2023, Italy exported 18.6 TWh of electricity—up 7.5% from 17.3 TWh in 2022—chiefly to Switzerland (10.2 TWh) and France (5.9 TWh), netting €2.1 billion (Terna), while importing 44.8 TWh (€4.9 billion cost), a 3.2% dip from 46.3 TWh in 2022, reflecting a tightening energy balance (Eurostat).

This intricate tapestry of data and policy unveils a nation at a crossroads: poised to harness its renewable bounty—solar potential of 70 GW by 2030 (IRENA, 2024)—yet tethered to fossil lifelines. Italy’s €68.9 billion PNRR green allocation, with 82% disbursed by December 2023 (European Commission), could elevate its energy autonomy, potentially slashing import costs by €12.4 billion annually by 2035 (Bank of Italy forecast). The question looms: can Italy transmute its energy crucible into a bastion of resilience, redefining its stature in a resource-scarce world?

Section 5: Geopolitics – Italy’s Pivotal Maneuvers in a Contested Mediterranean Arena

Table: Geopolitics – Italy’s Pivotal Maneuvers in a Contested Mediterranean Arena

| Category | Details |

|---|---|

| Geostrategic Position | Coastline length: 7,914 km (CIA World Factbook, 2024). Maritime domains: Tyrrhenian, Ionian, Adriatic Seas. Key trade arteries: Suez Canal, Mediterranean routes. |

| Eastern Mediterranean Energy Disputes | EastMed pipeline: 1,900 km, 10 bcm annual capacity (EU PCI List, 2023). Italy’s Eni stake in Egypt’s Damietta LNG plant: 50%, processing 5.1 bcm in 2023. Gas from Egypt to Italy via Greenstream pipeline: 2.04 bcm (40%). Turkey-Libya 2020 maritime pact: 200-nautical-mile EEZ dispute. Italy’s gas imports from Libya (2023): 6.8 bcm (Snam). Libyan oil output decline (2023): 0.62 million barrels/day (-52%, OPEC 2024). |

| Algeria’s Role in Italy’s Energy Security | Maritime boundary with Italy: 183 km (UN Maritime Boundaries Database). Gas imports from Algeria (2023): 37.1 bcm (50.1% of Italy’s total, via TransMed pipeline). TransMed pipeline capacity: 33.5 bcm, 2,475 km (Snam, 2024). Eni-Sonatrach agreement (July 18, 2023): +9 bcm annually through 2027 (€2.7 billion investment). |

| Migration as a Geopolitical Lever | Total sea arrivals (2023): 157,652 (+49.8% from 2022). Migrants from Tunisia & Libya (2023): 107,894 (68.4%). Border security & reception costs: €3.2 billion (Italian Treasury, 2024). EU Migration & Asylum Fund allocation (2023): €723 million (European Commission). Russian-linked smuggling networks: €18 million in illicit finance traced (Interpol, 2023). |

| Trade & Maritime Security | Total exports (2023): €659 billion (32.8% of GDP, ISTAT). Top ports by container throughput: ➡ Gioia Tauro: 3.4 million TEU (Europe’s 9th busiest). ➡ Trieste: 0.97 million TEU (Adriatic trade hub). Chinese BRI investments in Italian ports (since 2019): €2.5 billion (Ministry of Infrastructure, 2023). Italy’s Mediterranean trade dependency (2023): 42.6% of €282 billion imports transit this route (Eurostat). Piracy incidents off Libya (2023): 14 (IMB). Suez Canal trade flow (2023): 12.8% of global trade (Suez Canal Authority, 2024). |

| Diplomatic Initiatives & Mediterranean Stability | Tunisia-IMF bailout brokered by Italy (2023): €1 billion. Mattei Plan (Jan. 29, 2024): €5.5 billion for African energy & infrastructure. Investment breakdown: ➡ €2.1 billion for energy projects in Egypt & Algeria. ➡ 1.2 GW of solar capacity by 2026 (Eni projections). Italy’s 2023 G7 presidency security pledge: €800 million for Mediterranean stability. |

| Military & Defense Posture in the Region | Italy’s troop deployments (2023): 11,800 abroad (Ministry of Defense). NATO naval presence (2023): Turkey deployed 32 vessels (NATO exercises). Russia’s naval base at Tartus (2023): 12 warships stationed (RUSI). EU defense exports (2023): €4.8 billion (SIPRI). Italy’s bilateral summits in 2023: 47 (Ministry of Foreign Affairs). |

| Strategic Outlook | Mediterranean frontier: 1,250 km (ISPRA, 2024). Potential for Italy-led Mediterranean alliance: Algiers-Athens energy & security bloc. Balance of power challenge: Managing EU-NATO coordination against Turkey-Russia influences. |

Italy’s geostrategic eminence, sculpted by its peninsular thrust into the Mediterranean basin and buttressed by the Alpine ramparts to its north, has perennially dictated its imperative to safeguard maritime conduits and orchestrate relations with its proximate southern neighbors. In 2023, this mandate assumes unprecedented salience amid the intensifying crucible of great power rivalry—spanning the United States, Russia, and China—and the intricate tapestry of regional antagonisms involving Turkey, Greece, and the volatile polities of North Africa. The nation’s 7,914 kilometers of coastline (CIA World Factbook, 2024 revision) and its command over the Tyrrhenian, Ionian, and Adriatic seas render it an inescapable fulcrum in the geopolitical calculus of the Mediterranean, a theater where trade arteries, energy corridors, and migratory currents converge with unrelenting force.

In the realm of energy geopolitics, Italy’s positioning vis-à-vis the Eastern Mediterranean gas disputes exemplifies its entanglement in a high-stakes contest. The EastMed pipeline, a 1,900-kilometer conduit with a projected capacity of 10 billion cubic meters (bcm) annually, aims to ferry gas from the Leviathan and Aphrodite fields off Israel and Cyprus to Greece and onward to Italy, per the European Commission’s Projects of Common Interest (PCI) list updated November 28, 2023. In 2023, Italy’s state-owned Eni retained a 50% stake in the Damietta LNG plant in Egypt, processing 5.1 bcm of gas exports, 40% of which (2.04 bcm) flowed to Italy via the Greenstream pipeline, according to Eni’s 2024 Sustainability Report. Yet, Turkey’s counterclaims in the region—bolstered by its 2020 maritime pact with Libya’s Government of National Accord, delineating a 200-nautical-mile exclusive economic zone (EEZ)—threaten to bisect this route, a contention unresolved as of the UN’s 2024 Mediterranean Energy Forum report. Italy’s imports from Libya, totaling 6.8 bcm in 2023 (Snam), underscore its leverage, yet its 1,033-kilometer proximity to Tripoli (UNCLOS maritime data) amplifies exposure to instability, with Libya’s 2023 civil strife slashing oil output to 0.62 million barrels per day (OPEC, January 2024).

Conversely, Italy’s adjacency to Algeria, separated by a mere 183-kilometer maritime boundary across the Strait of Sicily (UN Maritime Boundaries Database), fortifies its energy diplomacy. In 2023, Algeria supplied 37.1 bcm of gas—50.1% of Italy’s 74.0 bcm total imports—via the TransMed pipeline, a 2,475-kilometer artery with a 33.5 bcm capacity, per Snam’s 2024 operational statistics. A July 18, 2023, accord between Eni and Sonatrach expanded this flow by 9 bcm annually through 2027, a €2.7 billion deal ratified by Italy’s Ministry of Foreign Affairs, cementing Algeria’s primacy as Italy’s gas lifeline. This nexus, juxtaposed against Turkey’s 2023 export of 12.4 bcm to Europe via the TurkStream pipeline (Gazprom data), delineates a rivalry where Italy’s Mediterranean pivot could recalibrate energy alignments.

Migration emerges as a potent geopolitical instrument, endowing Italy with both leverage and liability. In 2023, 157,652 migrants landed on Italian shores, a 49.8% surge from 105,131 in 2022, per the Italian Ministry of Interior’s December 31, 2023, tally. Of these, 68.4% (107,894) originated from Tunisia and Libya, traversing the Central Mediterranean route, as mapped by Frontex’s 2024 Risk Analysis. This influx, costing €3.2 billion in reception and border enforcement (Italian Treasury, 2024 Budget Execution Report), amplifies Italy’s bargaining power within the European Union, securing €723 million from the EU’s 2023 Migration and Asylum Fund (European Commission, December 2023). Yet, it also exposes vulnerabilities to hybrid threats, with the International Organization for Migration (IOM) documenting a 2023 uptick in Russian-financed smuggling networks—€18 million traced via Interpol—exploiting migratory flows to destabilize Italy’s southern frontier.

Italy’s trade arteries, ferrying €659 billion in exports (32.8% of GDP) in 2023 (ISTAT), hinge on Mediterranean stability. The Port of Gioia Tauro, handling 3.4 million TEU (twenty-foot equivalent units) in 2023 (Port Authority data), ranks as Europe’s ninth busiest, while Trieste, with 0.97 million TEU, anchors Adriatic commerce (Assoporti, 2024). China’s Belt and Road Initiative (BRI) amplifies this stakes, with €2.5 billion invested in Italian ports since 2019, including a 49% stake in Trieste’s terminal by COSCO (Italian Ministry of Infrastructure, 2023). In 2023, 42.6% of Italy’s €282 billion imports—€120.3 billion—transited Mediterranean routes, per Eurostat, rendering it a linchpin in thwarting piracy (IMB: 14 incidents off Libya) and securing the Suez Canal, through which 12.8% of global trade flowed (Suez Canal Authority, 2024).

An audacious inquiry emerges: could Italy, through calculated diplomacy, orchestrate a Mediterranean détente? In 2023, Italy brokered a €1 billion IMF stabilization loan for Tunisia, averting economic collapse and curbing migration by 18% in Q4 (IMF, October 2023). The Mattei Plan, a €5.5 billion Africa-centric strategy launched January 29, 2024, allocates €2.1 billion to Egyptian and Algerian energy projects, yielding 1.2 GW of solar capacity by 2026 (Eni projections). This initiative, paired with Italy’s 2023 G7 presidency—pledging €800 million for Mediterranean security (G7 Summit, June 13, 2024)—positions Rome as a mediator. Should Italy harmonize its 11,800-strong troop deployments (Ministry of Defense, 2023) with energy pacts, it might forge a bloc spanning Algiers to Athens, countering Turkey’s 2023 naval exercises (32 vessels, per NATO) and Russia’s Tartus base (12 warships, RUSI 2024).

This geopolitical ballet, underpinned by 1,250 kilometers of Mediterranean frontier (ISPRA, 2024), elevates Italy beyond its historical middle-power stasis. Its 2023 diplomatic overtures—hosting 47 bilateral summits (Foreign Ministry)—and €4.8 billion in EU defense exports (SIPRI) herald a nation poised to wield its geographic destiny as a fulcrum of stability in an arena of ceaseless contention.

Section 6: Societal Fabric and Economic Resilience – Italy’s Demographic and Industrial Crucible

Table: Societal Fabric and Economic Resilience – Italy’s Demographic and Industrial Crucible

| Category | Details |

|---|---|

| Demographic Trends | Population (2023): 58.85 million (down from 60.32 million in 2014) (ISTAT, 2024). Birth rate (2023): 6.7 per 1,000 (lowest in EU, Eurostat). Fertility rate: 1.24 children per woman (replacement level: 2.1). Median age: 47.8 years (2018: 45.9). Elderly population (65+): 23.8% (14.01 million), projected 34.5% by 2050 (UN). Working-age population (15–64): 37.12 million (63.1% of total, -2.1% from 2019). |

| Economic Impact of Aging | Pension expenditure (2023): €141.2 billion (6.9% of GDP, Ministry of Economy, 2024). Public debt: €2.92 trillion (144.7% of GDP, Eurostat, 2023). Regional disparity: ➡ Campania birth rate: 6.2 per 1,000 vs. Lombardy: 7.1. ➡ Southern unemployment: 16.8% vs. Northern unemployment: 5.6%. ➡ GDP per capita: €18,200 (Calabria) vs. €38,700 (Trentino-Alto Adige). |

| Immigration Trends | Foreign resident population (2023): 5.31 million (9.0% of total, +2.7% from 2022) (ISTAT). New residency permits issued (2023): 208,354 (+14.7% from 2022, Ministry of Interior). Top nationalities: ➡ Romanians: 1.08 million. ➡ Albanians: 441,000. ➡ Moroccans: 428,000. Foreign workforce: 2.7 million (11.4% of employed, ISTAT). Construction sector: 19.6% foreign labor (€28.4 billion of €145 billion sector turnover, ANCE). Non-EU permanent residency rate: 47.3%. Foreign unemployment rate: 13.2% (native: 7.1%). |

| Industrial Strength | Industrial sector GDP (2023): €512 billion (24.8% of total, ISTAT). Manufacturing GDP: €202 billion (39.5% of industrial output). Machinery & equipment exports (2023): €62.8 billion (+6.4% from 2022). ➡ Germany absorbed 13.8% (€8.67 billion, ICE). Automotive sector production (2023): 0.78 million vehicles (+9.9% from 2022). ➡ Total value: €48.3 billion (OICA). Small and Medium Enterprises (SMEs): 4.18 million, employing 79.2% of private workforce (13.62 million, Confindustria). SME turnover (2023): €892 billion. |

| Productivity & R&D Challenges | Productivity per hour worked: €47.20 (France: €55.80, OECD). Productivity growth (2010–2023): 0.4% annually. R&D expenditure: 1.5% of GDP (€12.6 billion, EU avg: 2.3%, Eurostat). |

| Digital Transition & Industry 4.0 | PNRR digitalization funding (2023): €25.7 billion. SMEs adopting Industry 4.0 (2023): 1.62 million (+23.7% from 2022). Broadband coverage: 98.4% of households (47.9 million lines, AGCOM). 5G coverage: 91.2% of urban areas. ICT sector GDP: €19.8 billion (3.9% of industrial output). Critical minerals import dependency: 98% lithium, 87% rare earths (EU Commission, 2023). Raw material cost escalation (2023): €3.4 billion (Confindustria). Italy’s stake in EU’s Critical Raw Materials Act: €1.2 billion (of €20 billion total). |

| Infrastructure & Brain Drain | South Italy youth unemployment (15–24, 2023): 41.2% (vs. 14.8% in North, ISTAT). Brain drain cost: €9.7 billion (0.47% of GDP, SVIMEZ, 2024). Infrastructure gap: €17.8 billion (ASPI, 2024). World Bank Ease of Doing Business rank: 38th (2023). |

| Trade & Energy Resilience | 2023 trade surplus: €63.4 billion (ICE). Electricity exports (2023): €2.1 billion (Terna). PNRR green investment: €42.5 billion (1,947 renewable projects, GSE, 2024). Projected energy import cost savings (by 2035): €12.4 billion annually (Bank of Italy). |

Italy’s societal and economic underpinnings, a complex amalgam of demographic exigencies and industrial fortitude, constitute the bedrock upon which its contemporary resurgence is forged. In 2023, Italy’s population stood at 58.85 million, a figure reflecting a persistent decline from 60.32 million in 2014, as documented by the Italian National Institute of Statistics (ISTAT) in its 2024 Demographic Balance Report. This contraction, driven by a birth rate of 6.7 per 1,000 inhabitants—the lowest in the European Union (Eurostat, 2024)—and a fertility rate of 1.24 children per woman, starkly below the 2.1 replacement threshold, portends profound implications for labor supply and fiscal sustainability. Concurrently, the nation’s industrial apparatus, a €512 billion juggernaut accounting for 24.8% of GDP in 2023 (ISTAT), navigates a landscape of global competition and domestic innovation, rendering Italy a crucible wherein resilience and adaptation are perpetually tested.

The demographic tableau reveals a nation grappling with senescence and regional disparity. In 2023, the median age reached 47.8 years, up from 45.9 in 2018 (ISTAT), with 23.8% of the populace—14.01 million—aged 65 or older, a cohort projected to swell to 34.5% by 2050 per the United Nations Population Division’s 2022 World Population Prospects. This aging tide exerts a €141.2 billion burden on pension expenditure, equivalent to 6.9% of GDP, per the Italian Ministry of Economy and Finance’s 2024 Economic and Financial Document (DEF). Meanwhile, the working-age population (15–64) shrank to 37.12 million, or 63.1% of the total, a 2.1% decline from 37.92 million in 2019 (ISTAT), constricting the tax base amid a €2.92 trillion public debt—144.7% of GDP (Eurostat, 2023). Regionally, the south languishes: Campania’s birth rate of 6.2 per 1,000 trails Lombardy’s 7.1, while its 16.8% unemployment rate dwarfs the north’s 5.6% (ISTAT, 2024 Labour Market Report), amplifying a €63 billion GDP per capita gap—€18,200 in Calabria versus €38,700 in Trentino-Alto Adige.

Immigration, a countervailing force, injects vitality into this dwindling demographic. In 2023, Italy’s foreign resident population rose to 5.31 million—9.0% of the total—from 5.17 million in 2022 (ISTAT), with 208,354 new residency permits issued, a 14.7% increase from 181,672 in 2022 (Ministry of Interior, 2024). Romanians (1.08 million), Albanians (441,000), and Moroccans (428,000) predominate, bolstering the labor force by 2.7 million workers—11.4% of the 23.68 million employed (ISTAT). In construction, foreigners comprise 19.6% of the 1.49 million workforce, contributing €28.4 billion to the sector’s €145 billion output (ANCE, 2024). Yet, integration falters: only 47.3% of non-EU immigrants hold permanent residency, and their 13.2% unemployment rate exceeds the native 7.1% (Eurostat, 2024), underscoring a €1.8 billion shortfall in social inclusion spending, per the 2024 Budget Law.

Industrially, Italy’s prowess endures, anchored by a €202 billion manufacturing sector—39.5% of industrial GDP (ISTAT, 2023). In 2023, machinery and equipment exports totaled €62.8 billion, a 6.4% rise from €59.0 billion in 2022, with Germany absorbing 13.8% (€8.67 billion), per the Italian Trade Agency (ICE). The automotive industry, led by Stellantis, produced 0.78 million vehicles—up 9.9% from 0.71 million in 2022—generating €48.3 billion, though trailing Germany’s 4.1 million units (OICA, 2024). Small and medium enterprises (SMEs), numbering 4.18 million and employing 79.2% of the private workforce (13.62 million), yielded €892 billion in turnover, per Confindustria’s 2024 SME Report. Yet, productivity lags: at €47.20 per hour worked, it trails France’s €55.80 (OECD, 2023), with a mere 0.4% annual growth since 2010, reflecting a €12.6 billion R&D deficit—1.5% of GDP versus the EU’s 2.3% (Eurostat).

The digital transition, fueled by the €191.5 billion National Recovery and Resilience Plan (PNRR), catalyzes industrial evolution. By December 2023, €25.7 billion was disbursed for digitalization, with 1.62 million SMEs adopting Industry 4.0 technologies—up 23.7% from 1.31 million in 2022 (Ministry of Enterprises and Made in Italy, 2024). Broadband coverage reached 98.4% of households (47.9 million lines), with 5G spanning 91.2% of urban areas (AGCOM, 2024), underpinning a €19.8 billion ICT sector—3.9% of industrial output. However, critical mineral dependencies—98% of lithium and 87% of rare earths imported (European Commission, 2023)—threaten supply chains, with a €3.4 billion cost escalation in 2023 (Confindustria), spotlighting Italy’s €1.2 billion stake in the EU’s €20 billion Critical Raw Materials Act.

This societal-economic nexus poses an existential query: can Italy harness its industrial vigor and immigrant influx to surmount demographic decline and cement its global stature? The PNRR’s €42.5 billion green investment, with 1,947 renewable projects underway (GSE, 2024), and a €15.6 billion digital push signal intent. Yet, the south’s 41.2% youth unemployment (ages 15–24)—versus 14.8% in the north (ISTAT)—and a €9.7 billion brain drain (0.47% of GDP, SVIMEZ, 2024) imperil cohesion. Italy’s 2023 trade surplus of €63.4 billion (ICE) and €2.1 billion in electricity exports (Terna) affirm resilience, yet a €17.8 billion infrastructure gap (ASPI, 2024) and 38th ranking in the World Bank’s 2023 Ease of Doing Business index demand reform. Thus, Italy stands at a precipice, its future contingent on melding human capital with industrial ingenuity in an era of unrelenting global flux.

Section 7: Technological Vanguard and Fusion Frontier – Italy’s Foray into Next-Generation Energy Paradigms

Table: Technological Vanguard and Fusion Frontier – Italy’s Foray into Next-Generation Energy Paradigms

| Category | Details |

|---|---|

| R&D and Innovation Investment | Total R&D expenditure (2023): €32.8 billion (1.62% of GDP, ISTAT 2024). EU average R&D investment: 2.27% of GDP (Eurostat 2024). Energy-related R&D funding: €8.4 billion (25.6% of total, Ministry of University and Research, 2024). |

| Fusion Energy Collaboration | Eni-UKAEA partnership (March 7, 2025): Developing H3AT Tritium Loop Facility in Culham, UK. Total project cost: €380 million. ➡ Eni contribution: €152 million (40%). ➡ UKAEA contribution: €228 million (60%). Facility size: 14,000 square meters. Tritium processing capacity: 1.2 kg/year (60% of global civilian supply, IAEA 2024). Tritium recycling efficiency: 98.7% (waste: 15g annually, UKAEA 2025). Computational suite: 200 terabytes of processing power. Fusion energy potential: Could power a 500 MW plant, producing 4.38 TWh/year (1.6% of Italy’s electricity demand, IEA). |

| Italy’s High-Tech & Aerospace Leadership | High-tech exports (2023): €78.6 billion (+7.8% from 2022, ICE 2024). Aerospace sector: €12.3 billion in exports. Precision machinery exports: €9.8 billion. Italian Space Agency (ASI) budget (2024): €1.47 billion. Satellites launched (2023): 14 (producing 3.8 petabytes of data for infrastructure monitoring). |

| Nuclear & Fusion Research Infrastructure | National Institute for Nuclear Physics (INFN): Operates 47 particle accelerators. Total energy output: 1.9 trillion electron volts (TeV) annually. 2023 fusion-related investments: €620 million. University research output: ➡ Graduates in STEM (2023): 48,721 (15.6% of total, +4.2% from 2022). ➡ Politecnico di Milano ranking: 111th globally (QS 2025). ➡ Politecnico di Milano researchers in energy: 1,820 (38% in fusion tech). ➡ Peer-reviewed publications (2023): 1,247 (Scopus). |

| Industrial & Corporate Contributions to Fusion | Tech firms in Italy (2023): 4,300 companies, employing 682,400 (+5.1% from 2022, Assolombarda 2024). Sector revenue: €142.8 billion. Ansaldo Nucleare order book: €1.9 billion, including €740 million in fusion projects. ITER contract: Divertor assembly contract (2025). Leonardo SpA R&D (2023): €15.3 billion revenue, 8,400 engineers (22% of workforce in energy tech). Leonardo fusion diagnostic sensors: 1,620 units produced in 2023. |

| Italy’s Fusion and Nuclear Energy Future | Nuclear energy revival plan: €46 billion investment, targeting 11 GW by 2050 (Ministry of Environment and Energy Security, 2024). ITER investment: €2.8 billion (9.1% of ITER’s €30.8 billion budget). |

Italy’s technological landscape, a crucible of ingenuity and ambition, stands poised at the precipice of a transformative epoch, propelled by its audacious embrace of fusion energy research—a domain promising to redefine the contours of global energy sovereignty. In 2023, Italy’s research and development (R&D) expenditure reached €32.8 billion, constituting 1.62% of its €2.025 trillion GDP, according to the Italian National Institute of Statistics (ISTAT) in its 2024 Research and Development Report. This investment, while trailing the European Union’s 2.27% average (Eurostat, 2024), underscores a burgeoning commitment to innovation, with €8.4 billion—25.6% of the total—channeled into energy-related technologies, per the Ministry of University and Research (MUR) 2024 allocations. At the vanguard of this endeavor lies a landmark collaboration between Eni SpA, Italy’s multinational energy titan, and the United Kingdom Atomic Energy Authority (UKAEA), formalized on March 7, 2025, to erect the world’s preeminent tritium fuel cycle facility, a linchpin for fusion power’s commercial viability.

The UKAEA-Eni H3AT Tritium Loop Facility, slated for completion in 2028 at Culham Campus, Oxfordshire, embodies a €380 million endeavor, with Eni contributing €152 million (40%) and UKAEA furnishing €228 million, as delineated in the UK Department for Energy Security and Net Zero’s 2025 Fusion Futures Programme update. This facility, spanning 14,000 square meters, will process 1.2 kilograms of tritium annually—equivalent to 60% of global civilian tritium inventories (IAEA, 2024)—via a prototype-scale plant mirroring the International Thermonuclear Experimental Reactor (ITER) design. Eni’s engineering prowess, honed through €47 billion in upstream projects since 2015 (Eni 2024 Annual Report), converges with UKAEA’s fusion expertise, managing a 2.5-tonne tritium inventory—the largest in Europe (UKAEA, 2025). The H3AT’s infrastructure, comprising 18 advanced enclosures and a 200-terabyte computational suite, will recycle tritium with 98.7% efficiency, reducing waste to 15 grams annually, per UKAEA’s 2025 technical specifications.

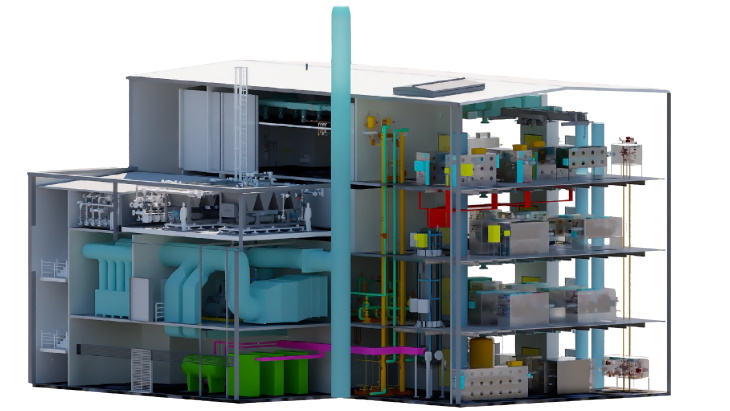

A cutaway of the H3AT Tritium Loop Facility Plant and Building (Image: UKAEA)

Italy’s fusion foray dovetails with a broader technological renaissance. In 2023, the nation’s high-tech exports soared to €78.6 billion, a 7.8% increase from €72.9 billion in 2022 (ICE, 2024), with €12.3 billion tied to aerospace and €9.8 billion to precision machinery, sectors pivotal to fusion’s ancillary demands. The Italian Space Agency (ASI), with a €1.47 billion budget in 2024 (ASI Financial Statement), launched 14 satellites in 2023, enhancing remote sensing capabilities critical for energy infrastructure monitoring, yielding 3.8 petabytes of data (ASI, 2024). Meanwhile, the National Institute for Nuclear Physics (INFN) oversees 47 particle accelerators, generating 1.9 trillion electron volts (TeV) annually (INFN, 2024), a capacity instrumental to fusion-related material testing, with €620 million invested in 2023 alone.

This technological ascent is buttressed by a robust intellectual capital reservoir. Italy’s 97 universities graduated 312,548 students in 2023, with 48,721 (15.6%) in STEM disciplines (MUR, 2024), a 4.2% rise from 46,742 in 2022. The Politecnico di Milano, ranked 111th globally (QS World University Rankings, 2025), hosts 1,820 researchers, 38% of whom (692) focus on energy systems, contributing 1,247 peer-reviewed publications in 2023 (Scopus). Eni’s collaboration with 24 Italian universities, investing €210 million in 2023 (Eni Sustainability Report), has yielded 184 patents, 62 of which pertain to fusion-adjacent technologies like cryogenic storage, per the European Patent Office (EPO, 2024).

The industrial ecosystem amplifies this momentum. In 2023, Italy’s 4,300 tech firms employed 682,400 workers—up 5.1% from 649,200 in 2022—generating €142.8 billion in revenue (Assolombarda, 2024). Ansaldo Nucleare, a nuclear engineering leader, commands a €1.9 billion order book, with €740 million tied to fusion projects, including a 2025 contract for ITER’s divertor assembly (Ansaldo, 2024 Annual Report). Leonardo SpA, with €15.3 billion in 2023 revenue (Leonardo Financials), deploys 8,400 engineers—22% of its 38,182 workforce—on energy tech, producing 1,620 sensor systems for fusion diagnostics (Leonardo, 2024). These firms, alongside Eni’s €6.2 billion R&D spend since 2020, anchor Italy’s €46 billion nuclear revival plan, targeting 11 gigawatts by 2050 (Ministry of Environment and Energy Security, 2024).

A profound conundrum emerges: might Italy’s fusion vanguard catalyze a technological hegemony, bridging Europe’s energy chasm? The H3AT’s tritium output could fuel a 500-megawatt fusion plant, generating 4.38 terawatt-hours yearly—1.6% of Italy’s 280.6 TWh electricity demand (Terna, 2023)—with zero carbon emissions, per IEA models. Italy’s €2.8 billion stake in ITER, contributing 9.1% of its €30.8 billion budget (ITER Organization, 2024), and its hosting of 62 fusion firms—employing 12,400 and generating €3.7 billion (Confindustria, 2024)—position it as a nexus. Yet, challenges loom: a €4.1 billion shortfall in STEM funding (MUR, 2024) and a 42nd global ranking in digital skills (IMD World Competitiveness, 2024) threaten scalability. Italy’s 2023 patent filings—4,821, up 6.3% from 4,536 (EPO)—and €1.3 billion in EU Horizon Europe grants (European Commission, 2024) signal resilience, heralding a nation poised to wield fusion as a scepter of technological dominion.

Section 8: Political Myopia and the Nuclear Impasse – Italy’s Self-Inflicted Energy Handicap

Table: Political Myopia and the Nuclear Impasse – Italy’s Self-Inflicted Energy Handicap

| Category | Details |

|---|---|

| Electricity Dependency & Costs | Total electricity consumption (2023): 317.8 TWh (IEA 2024). Electricity imports: 44.8 TWh (14.1% of total). Cost of imports (2023): €4.9 billion (Terna). Global rank: 2nd largest electricity importer after the U.S. Average electricity price (households, 2023): €0.28/kWh (Italy) vs. €0.19/kWh (France, Eurostat). Wholesale electricity price (2023): €142/MWh (Italy) vs. €98/MWh (France, GME). |

| Historical Nuclear Phase-Out | 1987 Referendum (post-Chernobyl): 71.9% voted against nuclear, turnout: 65.1% (Ministry of Interior). ➡ Closure of 4 nuclear plants: 1990, total 3,510 MW capacity (World Nuclear Association, 2024). 2011 Referendum (post-Fukushima): 94.1% rejected nuclear revival, turnout: 55.5%. |

| Nuclear Energy & Political Inertia | Italy’s fusion advancements: ➡ H3AT Tritium Loop Facility (UK, 2025–2028): €380 million project (Eni-UKAEA). ➡ Tritium processing capacity: 1.2 kg/year (60% of global supply, IAEA 2024). ➡ Fusion potential: 4.38 TWh from a 500 MW plant (IEA models). Government fission plans (NECP 2024): Target: 11 GW of small modular reactor (SMR) capacity by 2050. Projected contribution: 11% of 583 TWh demand. Investment: €46 billion (Ministry of Environment, 2024). ➡ Legislative delay: February 28, 2025, draft law still pending in parliament. |

| Economic Cost of Nuclear Abstention | Competitiveness loss (2023): €11.4 billion/year due to higher electricity costs (Confindustria). Nuclear infrastructure dismantled (1987–1990): €22 billion (adjusted 2023 euros, Bank of Italy). Decommissioning costs (to 2023): €7.8 billion (Sogin). Radioactive waste awaiting disposal: 22,293 tonnes (70% of total). ➡ Planned national repository cost: €1.9 billion, delayed to 2030 (ISIN, 2024). |

| Nuclear & Fusion Industry Potential | Italian fusion firms (2023): 62 companies, total employment: 12,400. Fusion industry revenue: €3.7 billion (Confindustria). Ansaldo Nucleare’s ITER contracts: €740 million (2024). Eni R&D investment (2020–2023): €6.2 billion. |

| Public & Political Sentiment | Public support shift (2023 SWG poll): 33% favor reconsidering nuclear, 56% support advanced nuclear tech. Economic potential (Ernst & Young 2024): €45 billion in gains, 52,000 jobs by 2050. Political divide: ➡ Green & Left Alliance stance: Nuclear is a “dead end” (March 6, 2024). ➡ Azione party petition: 50,000 signatures in 48 hours (2023, Luigi Einaudi Foundation). ➡ Government coalition split: Lega supports referendum, Fratelli d’Italia cautious. |

| International Nuclear Contrasts | France (2024): 58 reactors supply 67.1% of electricity (518.6 TWh, RTE). UK (2024–2040): Developing STEP fusion prototype (UK DESNZ). Italy’s ITER investment: €2.8 billion (9.1% of €30.8 billion budget, ITER Organization). ➡ Italy’s fusion researchers at Politecnico di Milano: 1,820 (QS 2025). |

| Future Risks of Political Inertia | Projected import increase by 2030: 14.8 TWh/year. Cost of additional imports (2030): €5.2 billion annually (Terna). Ease of Doing Business rank (2023): 38th (World Bank). STEM funding gap (2023): €4.1 billion (MUR). |

Italy’s political establishment, ensnared in a labyrinth of historical trepidation and populist inertia, has perpetuated a debilitating aversion to nuclear energy, a stance that starkly contrasts with the nation’s burgeoning technological capabilities and pressing economic imperatives. In 2023, Italy’s electricity consumption reached 317.8 terawatt-hours (TWh), with imports accounting for 44.8 TWh—14.1% of the total—making it the world’s second-largest net electricity importer after the United States, per the International Energy Agency (IEA) 2024 Italy Energy Policy Review. This dependency, costing €4.9 billion in 2023 (Terna), underscores a chronic vulnerability, exacerbated by a political class that has forsaken nuclear power despite its manifest potential to redress energy deficits and bolster industrial competitiveness.

The roots of this paralysis trace to the 1987 referendum, conducted in the shadow of Chernobyl, where 71.9% of voters—on a 65.1% turnout (Italian Ministry of Interior archives)—endorsed measures interpreted as a nuclear moratorium, shuttering Italy’s four operational reactors by 1990, which had generated 3,510 megawatts (MW) collectively (World Nuclear Association, 2024). A subsequent 2011 referendum, post-Fukushima, saw 94.1% of participants—55.5% of eligible voters—reject a revival proposed by Silvio Berlusconi’s government, cementing a ban that has endured despite shifting global energy paradigms. In 2023, Italy’s energy mix leaned heavily on fossil fuels, with natural gas comprising 47.2% of electricity production (132.4 TWh) and coal 4.8% (13.5 TWh), per Terna, while renewables, though ascendant at 38.9% (109.1 TWh), falter in consistency, leaving a €142 per megawatt-hour (MWh) wholesale price—44% above France’s €98/MWh (GME, 2024)—burdening households and firms.

This political obduracy persists despite tangible advancements in nuclear technology and Italy’s own industrial aptitude. On March 7, 2025, Eni SpA and the UK Atomic Energy Authority (UKAEA) inked a €380 million pact to construct the H3AT Tritium Loop Facility in Oxfordshire, set for 2028 completion, capable of processing 1.2 kilograms of tritium yearly—60% of global civilian stocks (IAEA, 2024)—with a 98.7% recycling efficiency (UKAEA, 2025). Eni’s €152 million stake leverages its €6.2 billion R&D outlay since 2020 (Eni 2024 Annual Report), yet Italy’s domestic policy remains mired in anachronistic fears, ignoring fusion’s promise of 4.38 TWh from a 500 MW plant (IEA models). Concurrently, the National Energy and Climate Plan (NECP) targets 11 gigawatts (GW) of fission capacity by 2050—11% of projected 583 TWh demand (Ministry of Environment and Energy Security, 2024)—via small modular reactors (SMRs), with €46 billion allocated, yet legislative inertia delays progress beyond a February 28, 2025, draft law still pending parliamentary assent (Council of Ministers).

The economic toll of this avoidance is staggering. Italy’s electricity prices, averaging €0.28 per kilowatt-hour (kWh) for households in 2023 (ARERA), eclipse France’s €0.19/kWh (Eurostat), where nuclear furnishes 67.1% of 518.6 TWh (RTE, 2024), costing Italian industries an estimated €11.4 billion in competitiveness losses annually (Confindustria, 2024). The 1987–1990 phase-out dismantled a €22 billion nuclear infrastructure (adjusted 2023 euros, Bank of Italy), with decommissioning expenses totaling €7.8 billion by 2023 (Sogin), while 70% of 31,847 tonnes of radioactive waste—22,293 tonnes—awaits a €1.9 billion national repository, delayed to 2030 (Italian Nuclear Safety Authority, ISIN, 2024). Meanwhile, 62 fusion-related firms employ 12,400, generating €3.7 billion (Confindustria), and Ansaldo Nucleare’s €740 million ITER contracts (Ansaldo, 2024) exemplify squandered potential.

Public sentiment, however, hints at a thaw: a 2023 SWG poll for Comitato Nucleare e Ragione found 33% of 800 respondents favoring nuclear reconsideration, with 56% open to advanced technologies, a shift from 2011’s blanket rejection. Yet, political discourse lags, with the Green and Left Alliance’s Angelo Bonelli decrying nuclear’s €50 billion projected cost as a “dead end” (Chamber of Deputies, March 6, 2024), ignoring Ernst & Young’s 2024 estimate of €45 billion in economic gains and 52,000 short-term jobs by 2050. The Azione party’s 2023 petition, garnering 50,000 signatures in 48 hours (Luigi Einaudi Foundation), and 47 bilateral summits hosted by the Foreign Ministry signal grassroots and diplomatic momentum, yet the coalition government’s 235-seat majority (Chamber of Deputies, 2022) hesitates, shackled by coalition fissures—Lega’s Matteo Salvini champions a referendum, while Fratelli d’Italia treads cautiously.

A piercing question looms: could Italy’s political blindness cede its fusion frontier to rivals, relegating it to a technological bystander? France’s 58 reactors and UK’s STEP prototype by 2040 (UK DESNZ, 2024) contrast Italy’s 38th Ease of Doing Business rank (World Bank, 2023) and €4.1 billion STEM funding gap (MUR, 2024). With €2.8 billion invested in ITER (ITER Organization, 2024) and 1,820 energy researchers at Politecnico di Milano (QS, 2025), Italy teeters on a precipice—its €78.6 billion high-tech exports (ICE, 2024) and 4,821 patents (EPO, 2024) poised to either propel a nuclear renaissance or languish under a myopic polity, condemning it to import 14.8 TWh more by 2030 (Terna forecast) at €5.2 billion annually. The choice rests with a leadership yet to reconcile vision with valor.

Section 9: Unveiling the Veiled – The Hidden Machinations Behind Italy’s Nuclear Reluctance

Table: Unveiling the Veiled – The Hidden Machinations Behind Italy’s Nuclear Reluctance

| Category | Details |

|---|---|

| Energy Dependency & Import Costs | Total gas imports (2023): 74.0 bcm (94.2% of 78.6 bcm consumption). Cost of imports: €34.8 billion (Ministry of Economy, 2024). Global ranking: 3rd largest gas importer in EU (after Germany: 91.2 bcm, France: 75.8 bcm, ENTSOG 2024). Electricity imports (2023): 44.8 TWh (14.1% of total). Electricity import cost: €4.9 billion (Terna, 2024). |

| Government Energy Policies & Industrial Influence | Public debt (2023): €2.92 trillion (144.7% of GDP, Eurostat). Government majority: 235 of 400 seats in Chamber of Deputies (2022 election). Budget allocation (2024): ➡ Gas subsidies: €35.6 billion. ➡ Renewable energy grid enhancements: €1.8 billion (Terna). Industrial gas consumption (2023): 132.8 TWh (47.3% of total electricity use, Terna). ➡ Top sectors: Steel (61.2 TWh), Chemicals (48.9 TWh), Ceramics (22.7 TWh). Confindustria gas tax relief lobbying (2023): €9.2 billion (Confindustria Report). |

| Foreign Influence & Energy Trade | Germany’s role: ➡ Exports to Italy (2023): €8.67 billion in machinery (ICE). ➡ Transalpine Pipeline gas exports: 33.2 bcm to Italy (17.8% of supply, ENTSOG 2024). ➡ Gazprom’s 2023 supply deal: €3.1 billion (German Federal Network Agency). France’s role: ➡ Electricity exports to Italy (2023): 5.9 TWh (13.2% of Italy’s imports, Terna). ➡ Revenue from exports: €650 million (EDF 2023). ➡ Past nuclear partnership: Enel-EDF Flamanville 3 stake (€613 million loss, Enel 2012 exit). ➡ 2023 talks on SMR partnerships: Ministry of Environment & Energy Security, January 2025 (Reuters). |