Contents

- 1 ABSTRACT

- 2 Global Energy Dynamics: Geopolitical Realignments, Market Adaptations and Strategic Partnerships Since 2021

- 3 Table : China’s current and projected gas import capacity via pipelines

- 4 Redefining Energy Paradigms: The Russia-China Nexus

- 5 China’s Strategic Advances in Natural Gas Market Development

- 6 Strategic Expansion and Comprehensive Analysis of the Power of Siberia Pipeline

- 7 Expanding Energy Frontiers: Strategic Significance of Far East and Mongolia Gas Projects

- 8 LNG as a Strategic Pivot: Redefining Russia-China Energy Dynamics

- 8.1 Expansion of Russia’s LNG Infrastructure: Arctic LNG and Beyond

- 8.2 China’s Growing LNG Demand: Aligning Policy with Strategy

- 8.3 Economic Ramifications: Strengthening Bilateral Trade

- 8.4 Geopolitical Implications: A Multipolar Energy Order

- 8.5 Technological Innovations: Advancing LNG Efficiency and Sustainability

- 8.6 Environmental Considerations: Balancing Growth and Sustainability

- 8.7 Strategic Outlook: Expanding Horizons in LNG Trade

- 9 Strengthening Foundations: Addressing Challenges and Expanding Prospects in Russia-China Energy Collaboration

- 10 Dynamics of Russian LNG and Pipeline Gas in a Shifting Global Energy Market

- 11 Escalating Sanctions: A Detailed Analysis of U.S. Measures Targeting Russian Energy and Industrial Sectors

- 12 Comprehensive Overview of U.S. Sanctions on Russian Energy Sector (January 10, 2025)

- 12.1 Rosatom Board of Directors and Senior Officials

- 12.2 Targeted Russian LNG and Oil Projects

- 12.3 Sanctions on Evasion Mechanisms and Supporting Entities

- 12.4 Comprehensive Summary of U.S. Sanctions on Russian Oilfield Service Providers

- 12.5 Targeted Subsidiaries and Related Entities

- 12.6 Detailed Table: U.S. Sanctions on Russia’s Metals and Mining Industry Entities

- 12.7 Enforcement and Legal Framework

- 13 Conclusion

- 14 Copyright of debugliesintel.comEven partial reproduction of the contents is not permitted without prior authorization – Reproduction reserved

ABSTRACT

The purpose of this research is to illuminate the intricate interplay between geopolitics, global energy dynamics, and the strategic shifts occurring in the natural gas markets, with a specific focus on the developments from 2021 onward. These shifts underscore the vulnerabilities and interdependencies of energy systems, accentuated by the dual forces of global crises and intentional state-driven strategies. The research addresses how the European energy crisis, spurred by geopolitical upheavals and market imbalances, has reshaped global energy flows, influencing the strategies of major stakeholders like Russia, China, and the European Union. This exploration of energy’s pivotal role in global geopolitics reveals profound insights into the mechanisms of economic resilience, the adaptation of energy policies, and the reconfiguration of alliances amid a rapidly transforming landscape.

The analysis begins with the dramatic escalation in European gas prices during 2021, attributed to Gazprom’s calculated withdrawal from spot markets and its limited replenishment of storage facilities. These actions coincided with a global LNG demand surge that outstripped supply, exacerbating Europe’s reliance on Russian energy. This dependency was starkly highlighted by the geopolitical rupture of Russia’s invasion of Ukraine in 2022, which precipitated a cascade of energy supply disruptions. Russian pipeline gas exports to Europe plummeted, severed by sanctions, sabotage, and the refusal of European buyers to comply with ruble-denominated payment mechanisms. The once-dominant Yamal-Europe and Nord Stream pipelines were sidelined, leaving Europe scrambling for alternatives.

In response, the EU launched the REPowerEU initiative, an ambitious plan aimed at severing ties with Russian fossil fuels by 2027. Europe undertook a multifaceted strategy involving accelerated LNG imports, diversification of suppliers, and significant investments in renewable energy infrastructure. Policies to curb demand, combined with favorable weather conditions and reduced Asian market competition, mitigated the immediate threat of an energy crisis during the winter of 2022–23. These measures, while effective in stabilizing supply, came at a high fiscal cost, as EU governments allocated over €540 billion in subsidies and relief efforts to shield consumers from rising energy prices. However, this aggressive procurement strategy priced out less affluent importers, triggering localized energy shortages in countries like Pakistan and Bangladesh and temporarily increasing global coal consumption.

The implications for Russia were profound. Once supplying 40% of Europe’s gas consumption, its share dwindled to less than 10% by the end of 2022. The loss of Europe as a primary market marked a critical turning point for Russia’s energy strategy. Revenues from gas exports, initially buoyed by elevated prices, faced long-term decline. Forced to pivot eastward, Russia intensified its focus on China, leveraging its Eastern Programme to expand infrastructure such as the Power of Siberia pipeline. Operational since 2019, this pipeline exemplifies Russia’s strategic shift, with plans for additional capacity through the Power of Siberia 2 and other regional connections. However, the economic viability of these ventures is constrained by lower pricing agreements with China, China’s diversification strategy to avoid over-reliance on Russian energy, and the technological challenges of scaling LNG production under sanctions.

China emerges as a focal point in this realignment, with its growing demand for natural gas driven by industrial expansion and its commitment to peak carbon emissions by 2030. China’s strategic investments in LNG infrastructure, including regasification and storage facilities, complement its efforts to secure diversified energy sources. Russia’s LNG exports to China have grown, supported by Arctic LNG projects like Yamal LNG, which leverage northern shipping routes to reduce transport times. Yet, the challenges of sustaining competitive pricing, navigating Arctic logistical constraints, and addressing environmental concerns present formidable obstacles. The synergy between Russia’s supply and China’s demand highlights a partnership reshaping global energy flows while reflecting mutual strategic calculations.

Europe’s transition away from Russian gas underscores a broader geopolitical reconfiguration. The rapid expansion of LNG import capacity by over 40% since 2021 reflects Europe’s determination to secure alternative supplies from the United States, Qatar, and Australia. However, this shift introduces new vulnerabilities, as Europe becomes exposed to the volatility of global LNG markets and competing demands from Asia. The environmental implications of expanded LNG production, including lifecycle emissions and infrastructure development, further complicate Europe’s energy transition goals.

Two geopolitical scenarios frame the potential trajectories of global gas markets: Limited Markets (LM) and Pivot to Asia (P2A). The LM scenario envisions prolonged conflict in Ukraine and sustained sanctions, constraining Russia’s ability to expand its LNG capacity and severing its European trade ties. Conversely, the P2A scenario assumes a resolution to the Ukraine conflict, allowing Russia to expand its LNG exports and pipeline capacity to China. These scenarios underscore the critical influence of global gas demand, policy decisions, and technological advancements in shaping the future of energy markets.

Amid these dynamics, the Russia-China partnership epitomizes a strategic recalibration of global energy paradigms. By integrating their energy supply chains, these nations challenge traditional Western-dominated markets and promote a multipolar energy framework. Projects like the Power of Siberia pipeline symbolize this collaboration, blending engineering innovation with geopolitical ambition. However, their interdependence introduces complexities, as Russia risks over-reliance on a single buyer, while China balances its energy imports with investments in renewables to achieve carbon neutrality.

The environmental dimensions of this partnership reflect the broader tension between energy security and sustainability. LNG’s role as a cleaner alternative to coal is tempered by its lifecycle emissions and energy-intensive production processes. Both nations are exploring innovations such as carbon capture and storage to align their energy strategies with global decarbonization goals.

The upheavals since 2021 highlight the fragile equilibrium of energy security, geopolitical strategy, and climate objectives. Europe’s decoupling from Russian gas and Russia’s pivot to Asia underscore the interconnectedness of global energy systems. This narrative of adaptation and resilience offers lessons for navigating the complexities of energy transitions, emphasizing the need for innovative policies, sustained international cooperation, and a balance between economic imperatives and environmental stewardship. As the global energy landscape evolves, the interdependencies between producers and consumers will continue to shape the contours of economic and geopolitical power in the 21st century.

| Category | Details |

|---|---|

| Purpose | This document explores the interconnections between geopolitics, energy security, and market dynamics, focusing on the pivotal events from 2021 onward that reshaped global natural gas markets. It examines Europe’s energy crisis, the effects of Russia’s invasion of Ukraine on energy flows, and the realignment of global trade routes and partnerships. The analysis underscores the vulnerabilities and interdependencies of energy systems, providing insights into policy adaptations and the economic, environmental, and geopolitical implications. |

| Key Events: Europe’s Energy Crisis | – Gas Price Surge (2021): Triggered by Gazprom’s strategic withdrawal from spot markets and limited replenishment of storage facilities, combined with a global LNG demand surge outpacing supply. – Russian Gas Exports Decline (2022): Russian pipeline gas exports to Europe dropped to 20% of pre-war levels due to sanctions, sabotage, and non-compliance with ruble payment demands. Major transit routes like the Nord Stream pipelines were rendered non-operational. – EU’s REPowerEU Initiative (2022): Launched to achieve independence from Russian fossil fuels by 2027 through LNG diversification, renewable investments, and demand curtailment. |

| European Adaptation Measures | – LNG Import Capacity Expansion: Increased by over 40% by mid-2024 compared to 2021 levels, enabling Europe to source gas from diverse suppliers (United States, Qatar, Australia). – Consumer Relief: Over €540 billion allocated to subsidies, mitigating the economic impact of surging energy prices. – Impact on Less Affluent Nations: Europe’s aggressive LNG procurement priced out countries like Pakistan and Bangladesh, leading to localized energy shortages and temporary increases in coal usage. |

| Russia’s Strategic Shift | – Dependency Reduction: Europe’s reliance on Russian gas fell from 40% to less than 10% by late 2022. – Pivot to Asia: Russia expanded energy partnerships with China through projects like the Power of Siberia pipeline. The Power of Siberia 2 and other pipeline initiatives aim to connect Russia’s Siberian reserves to Chinese markets. – Challenges: Lower pricing agreements with China, China’s diversified import strategy, and sanctions limiting LNG technology access constrain Russia’s ability to offset lost European revenue. |

| China’s Energy Strategy | – LNG Import Growth: China became the world’s largest LNG importer, with significant infrastructure investments in regasification and storage. – Energy Transition Goals: Focused on natural gas as a bridge fuel to peak carbon emissions by 2030 and achieve neutrality by 2060. – Partnership with Russia: Long-term LNG contracts secure stable supplies but are complemented by renewable investments to avoid over-reliance on fossil fuels. |

| Geopolitical Scenarios | – Limited Markets (LM): Prolonged conflict in Ukraine and sustained sanctions prevent Russian market recovery, leading to a projected decline of 31–47% in gas exports by 2040. – Pivot to Asia (P2A): Resolution of the Ukraine conflict allows partial normalization of trade, expansion of LNG capacity, and pipeline exports to China recovering to 86–96% of 2020 levels by mid-century. |

| Environmental Implications | – LNG’s Role: LNG serves as a cleaner alternative to coal but comes with lifecycle emissions and energy-intensive liquefaction processes. – Innovation: Carbon capture and methane leak prevention systems are integral to reducing environmental impacts in LNG production and pipeline projects. – China’s Renewable Goals: Investments in wind, solar, and other renewable energy sources reflect China’s commitment to sustainability, even as it increases LNG imports. |

| Technological and Logistical Advances | – Pipeline Infrastructure: Projects like the Power of Siberia pipeline incorporate advanced materials and automated monitoring systems to address extreme climates and seismic risks. – LNG Projects: Russian Arctic LNG initiatives leverage modular construction and icebreaking carriers to overcome logistical challenges. – Digitalization: Use of AI-driven analytics and blockchain enhances operational efficiency and trade transparency in energy supply chains. |

| Global Market Realignments | – Multipolar Energy Order: Russia and China’s collaboration signifies a shift from Western-dominated energy markets to a diversified, multipolar framework. – European Vulnerabilities: Dependence on global LNG exposes Europe to market volatility and competing demands, particularly from Asia. – Strategic Independence: Both Russia and China are reducing reliance on the US dollar in energy transactions, opting for local currencies to enhance financial sovereignty. |

| Conclusion and Lessons Learned | – Resilience and Adaptation: The global energy upheavals highlight the necessity for innovative policies and flexible strategies to navigate market disruptions. – Energy Security vs. Sustainability: Balancing immediate energy needs with long-term climate objectives remains a critical challenge. – Strategic Collaboration: Russia and China’s partnership demonstrates the potential for realigning energy systems while fostering regional stability and economic integration. – Future Prospects: Investments in renewable energy, advanced technologies, and sustainable practices will define the trajectory of global energy markets in the coming decades. |

Global Energy Dynamics: Geopolitical Realignments, Market Adaptations and Strategic Partnerships Since 2021

Since 2021, the interplay between geopolitics and global gas market dynamics has provided a striking lesson in the vulnerabilities and interconnectedness of energy systems. As economies recovered from the COVID-19 pandemic, Europe experienced a sharp increase in gas prices during the second half of 2021. This escalation was primarily attributed to Gazprom, Russia’s state-controlled gas company, which strategically declined to replenish its storage facilities or supply additional volumes to the spot market. Simultaneously, global demand for liquefied natural gas (LNG) outstripped supply, exacerbating the issue.

The geopolitical landscape shifted dramatically with Russia’s invasion of Ukraine in February 2022, triggering an unprecedented reduction in Russian pipeline gas exports to Europe. Supplies plummeted to approximately 20% of pre-war levels, driven by Gazprom’s withdrawal from the European spot market and the suspension of contracts held by buyers unwilling to comply with Russia’s new payment mechanism—requiring transactions in rubles. Concurrently, key transit routes, such as the Yamal-Europe pipeline and the Nord Stream 1 and 2 pipelines, were effectively rendered non-operational due to sanctions and sabotage, respectively.

In response, the European Union (EU) launched the REPowerEU initiative in May 2022, aiming to achieve independence from Russian fossil fuels by 2027. This ambitious strategy emphasized both short-term measures, such as curbing gas demand and securing alternative supplies, and long-term investments in renewable energy infrastructure. Europe also accelerated the development of LNG import capacity, allowing for a diversified portfolio of suppliers. Despite record-high gas prices in the summer of 2022, a combination of effective policy implementation, milder winter conditions, reduced demand from Asian markets, and a well-functioning LNG sector mitigated the risk of an energy crisis during the winter of 2022–23.

To shield consumers from skyrocketing energy costs, EU governments allocated over €540 billion in subsidies and relief measures. However, this response came at a significant cost to public finances. Meanwhile, Europe’s aggressive procurement of LNG priced out less affluent importers, such as Pakistan and Bangladesh, leading to localized energy shortages and a temporary resurgence in coal usage.

Historically, Russia supplied approximately 40% of Europe’s gas consumption via pipelines, but this reliance has sharply declined. By late 2022, the EU had succeeded in reducing its dependency on Russian gas to below 10% of total imports. This shift marks a critical inflection point in the global energy landscape, with profound implications for Russia’s economic and geopolitical strategy.

Russia’s revenues from gas exports, initially buoyed by high prices, have diminished significantly. In 2021, Europe accounted for nearly two-thirds of Russian pipeline gas exports, generating substantial income for the Kremlin. However, with sanctions and market diversification efforts, Russian export volumes to Europe have dwindled, forcing Gazprom to pivot toward Asia. The Kremlin’s strategy hinges on expanding pipeline infrastructure to China and increasing LNG production, albeit under challenging economic and technological constraints.

Russia’s Eastern Programme, initiated in 2007, laid the groundwork for a strategic pivot to Asia. The construction of the Power of Siberia 1 (PoS 1) pipeline, which commenced gas exports to China in 2019, exemplifies this effort. PoS 1 is expected to reach its full capacity of 38 billion cubic meters (bcm) annually by 2025. Plans for a second pipeline, Power of Siberia 2 (PoS 2), aim to deliver an additional 50 bcm annually from the Yamal Peninsula to China, though negotiations remain ongoing. Additionally, a smaller 10 bcm pipeline extension from Sakhalin to China is slated for completion by 2027.

Despite these initiatives, the profitability of Russian gas exports to China remains questionable. Prices for pipeline gas sold to China are generally lower than those previously secured in European markets, reflecting China’s strengthened bargaining position. Furthermore, China’s energy strategy prioritizes diversification to avoid over-reliance on any single supplier, including Russia. As a result, while Russia’s pivot to Asia offers an alternative revenue stream, it is unlikely to fully compensate for the loss of European markets.

Europe’s growing reliance on LNG imports introduces both opportunities and vulnerabilities. By mid-2024, Europe’s LNG import capacity had increased by over 40% compared to 2021 levels, enabling the region to source gas from a diverse array of suppliers, including the United States, Qatar, and Australia. However, this dependence exposes Europe to the inherent volatility of the global LNG market, where price fluctuations are influenced by competing demand from other regions, such as Asia.

Increased LNG demand has also raised concerns about the environmental impact of expanded production and transportation infrastructure. While LNG offers a cleaner alternative to coal, its lifecycle emissions and energy-intensive liquefaction process necessitate careful consideration within the broader context of the energy transition.

Two plausible geopolitical scenarios—Limited Markets (LM) and Pivot to Asia (P2A)—offer insights into the future of global gas markets. Under the LM scenario, prolonged conflict in Ukraine and sustained sanctions effectively sever Russia’s gas trade with Europe. This scenario assumes limited expansion of Russian LNG capacity due to technology embargoes and financing constraints. In contrast, the P2A scenario envisions a resolution to the Ukraine conflict and a partial normalization of trade relations, enabling Russia to expand its LNG exports and double its pipeline capacity to China by 2040.

The trajectory of global gas demand will significantly influence these scenarios. Under current Nationally Determined Contributions (NDCs), global gas consumption is projected to increase modestly through 2050, driven by industrial demand and a transitional role in decarbonizing power systems. However, a more stringent Below 2 Degrees (B2D) scenario—aligned with the Paris Agreement’s climate goals—would result in a steep decline in gas demand post-2030.

Russia’s export prospects under these scenarios vary considerably. In the LM scenario, without additional pipeline capacity to China, Russia’s gas exports are projected to decline by 31–47% by 2040 compared to 2020 levels. Conversely, the P2A scenario offers a relatively better outlook, with exports recovering to 86–96% of 2020 levels by mid-century, contingent on favorable market conditions and policy alignment.

The upheavals in global gas markets since 2021 underscore the complex interplay between energy security, geopolitics, and the energy transition. For Europe, reducing dependence on Russian gas has necessitated bold policy measures and significant investments in LNG infrastructure. For Russia, the loss of its largest export market underscores the need for strategic realignment, albeit with limited options and significant risks.

As the global energy landscape evolves, the interdependencies between producers and consumers will continue to shape market dynamics. Balancing energy security with climate objectives remains a formidable challenge, requiring innovative solutions and sustained international cooperation. The lessons of recent years serve as a stark reminder of the vulnerabilities inherent in global energy systems and the urgent need for resilience and adaptability in the face of uncertainty.

Table : China’s current and projected gas import capacity via pipelines

| Export Country/Region | Cross-Border Pipelines | Start Year | Capacity (bcm/year) | Status |

|---|---|---|---|---|

| Myanmar | China-Myanmar Pipeline | 2013 | 12 | Operational, although actual annual gas sales remain limited to approximately 3–4 bcm due to infrastructural and market constraints. This pipeline enhances regional connectivity and energy security for China but operates below its full capacity. |

| Central Asia | Central Asia-China Pipeline A | 2009 | 15 | Fully operational since its inauguration, this pipeline plays a crucial role in China’s diversification strategy for natural gas imports, connecting Turkmenistan and other Central Asian resources to Chinese markets. |

| Central Asia-China Pipeline B | 2010 | 15 | Operational, mirroring the capacity and importance of Pipeline A, further cementing Central Asia’s position as a pivotal supplier of natural gas to China. | |

| Central Asia-China Pipeline C | 2014 | 25 | This pipeline significantly increased the aggregate capacity of the Central Asia-China network, providing an essential boost to China’s gas supply and reinforcing its reliance on Turkmenistan for energy security. | |

| Central Asia-China Pipeline D | 2026 | 30 | Currently under construction, this pipeline is expected to further enhance the connectivity between Central Asia and China. Upon completion, it will serve as a critical conduit for meeting China’s expanding energy needs. | |

| Russia | Power of Siberia (PoS) 1 | 2019 | 38 | Fully operational and serves as the flagship project of the Russia-China energy partnership. This pipeline transports natural gas from Siberian fields to northern China, exemplifying the deepening strategic alignment between the two nations. |

| Far East Pipeline | 2027 | 10 | Under construction, this pipeline aims to provide additional gas supplies from the Russian Far East to China, reflecting mutual efforts to enhance energy security and economic interdependence in the region. | |

| Power of Siberia (PoS) 2 | 2030 | 50 | Planned for development, this ambitious pipeline is intended to transport natural gas from the Yamal Peninsula to China. It highlights Russia’s strategic pivot towards Asia as its primary energy export market. |

Redefining Energy Paradigms: The Russia-China Nexus

As global energy markets grapple with evolving geopolitical tensions and environmental imperatives, the Russia-China energy partnership exemplifies a transformative realignment. This strategic cooperation transcends traditional trade agreements, symbolizing a calculated shift in global power structures. By aligning their interests in natural gas, crude oil, and technological advancements, these two nations are laying the groundwork for a durable economic and geopolitical alliance.

In 2024, Russian liquefied natural gas (LNG) exports to China reached a cumulative volume of 8.3 million tons, reflecting a year-on-year increase of 3.3%. Despite this uptick in volume, the aggregate value of these exports registered a decline of 3.5%, amounting to $4.99 billion. This paradox underscores the intricate dynamics of pricing mechanisms, characterized by Russia’s strategic application of discounts to maintain market competitiveness. Additionally, fluctuations in global LNG demand, impacted by macroeconomic factors such as slowing industrial activity in Europe and shifting energy policies in Southeast Asia, have created a complex market environment.

Russia’s role as China’s third-largest LNG supplier complements its dominance in crude oil exports. In the first ten months of 2024, China imported an average of 2.17 million barrels per day (b/d) of Russian crude oil, representing a 2.2% increase from the previous year. This data positions Russia not only as a cornerstone of China’s energy portfolio but also as a pivotal player in its industrial and urban development. The logistical advantages of pipeline and seaborne deliveries ensure a stable and adaptable supply chain, mitigating risks associated with geopolitical disruptions.

This bilateral relationship is underpinned by an ambitious infrastructural agenda, with the Power of Siberia pipeline serving as its flagship project. Delivering natural gas from Russia’s Yakutia and Irkutsk regions to China, the pipeline underscores a shared commitment to energy security. As of 2024, construction on its extensions remains on schedule, with the second phase projected to increase its capacity beyond 50 billion cubic meters annually by 2030. Such infrastructural expansions exemplify how energy projects are increasingly becoming instruments of geopolitical influence, fostering regional integration while challenging existing global supply chains.

However, the reliance on this partnership introduces complexities. Russia’s strategic pivot towards Asia, while necessary to offset declining European markets, exposes its economy to potential over-reliance on a single buyer. For China, the partnership aligns with its overarching energy strategy of diversifying sources while ensuring cost-efficiency. Nevertheless, China’s ongoing investments in renewable energy, including its accelerated wind and solar capacity expansion programs, signal a cautious approach to over-dependence on fossil fuel imports.

The environmental dimensions of this collaboration further complicate its trajectory. China’s commitment to achieving carbon neutrality by 2060 places significant pressure on its energy import strategies. Simultaneously, Russia’s efforts to position itself as a reliable energy supplier must reconcile with increasing global scrutiny over carbon emissions. The construction of carbon capture and storage (CCS) facilities, alongside the development of cleaner LNG technologies, represents an area of potential innovation that could redefine the parameters of their energy trade.

At a broader level, this partnership exemplifies a shifting balance of power in global energy governance. By circumventing traditional Western-dominated markets, Russia and China are promoting a multipolar energy framework that prioritizes regional interdependence. This strategy is reflected in their cooperative ventures beyond bilateral trade, including joint investments in energy infrastructure projects across Central Asia and the Arctic.

Critically, the strategic implications of this partnership extend beyond the immediate energy sector. The integration of energy supply chains fosters a deeper economic interdependence that could shape their foreign policy trajectories. As both nations seek to consolidate their positions on the global stage, their energy collaboration serves as a cornerstone of a broader geopolitical strategy aimed at redefining power dynamics in the 21st century.

The success of this alliance will ultimately depend on its adaptability to external pressures, including market volatility, technological advancements, and environmental imperatives. As energy markets evolve, the Russia-China partnership stands as a testament to the strategic recalibrations necessary to navigate an increasingly complex global landscape.

China’s Strategic Advances in Natural Gas Market Development

China’s latest advances in the natural gas market, as outlined in the 2023-2024 Natural Gas Development Report, signify a pivotal transformation in the nation’s energy strategy. These developments underscore China’s unwavering commitment to bolstering domestic production and consumption, integrating cutting-edge technologies, and implementing systemic reforms to optimize market efficiency and competitiveness. A comprehensive analysis of recent data and technological progress reveals profound implications not only for China’s energy landscape but also for global energy markets.

| Category | Details |

|---|---|

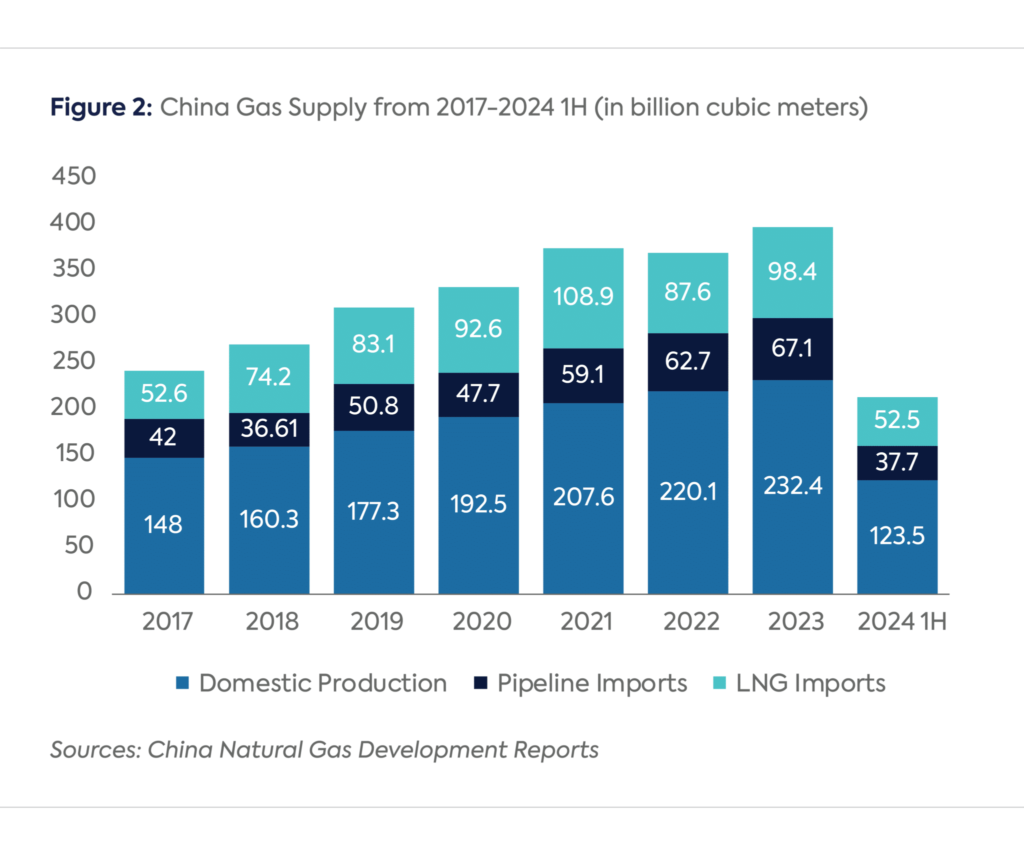

| Natural Gas Consumption (2023) | – Total consumption reached 394.5 bcm, a 7.6% increase year-on-year. – Industry contributed an incremental demand increase of 12.3 bcm, remaining the largest sectoral consumer. – City gas saw the fastest growth, driven by the adoption of LNG-powered heavy-duty trucks, which increased by 307%, with 152,000 units sold. – In the first half of 2024, LNG truck sales rose by 104% year-on-year, further boosting natural gas consumption. |

| Domestic Production (2023) | – Domestic output reached 232.4 bcm, a 5.6% increase over 2022. – Unconventional sources (shale gas, coalbed methane, and tight gas) accounted for 43% of production, equivalent to 97 bcm. – Driven by the 43% increase in production over five years as part of aggressive exploration and production campaigns by China’s three major NOCs. – These efforts align with directives to reduce reliance on imported hydrocarbons. |

| LNG Imports | – LNG accounted for 59% of total gas imports in 2023. – Imports rose by 12.3%, making China the world’s largest LNG importer, surpassing Japan. – Key suppliers: Australia, Qatar, Russia, and Turkmenistan, providing nearly 75% of total imports. – Regasification capacity expansion and new long-term contracts support sustained import growth. – First-half 2024 LNG imports increased by over 14% year-on-year. |

| Technological Advancements | – Development of geothermal energy systems to generate power in deep oil and gas wells. – Implementation of pressure differentiation-based power generation, achieving net-zero emissions. – Deployment of the Hai-Jing system for ultra-deepwater 3D seismic imaging (exceeding 3,000 meters). – Introduction of automated drilling rigs in the Tarim Basin capable of depths beyond 12,000 meters, enhancing exploration in challenging environments. |

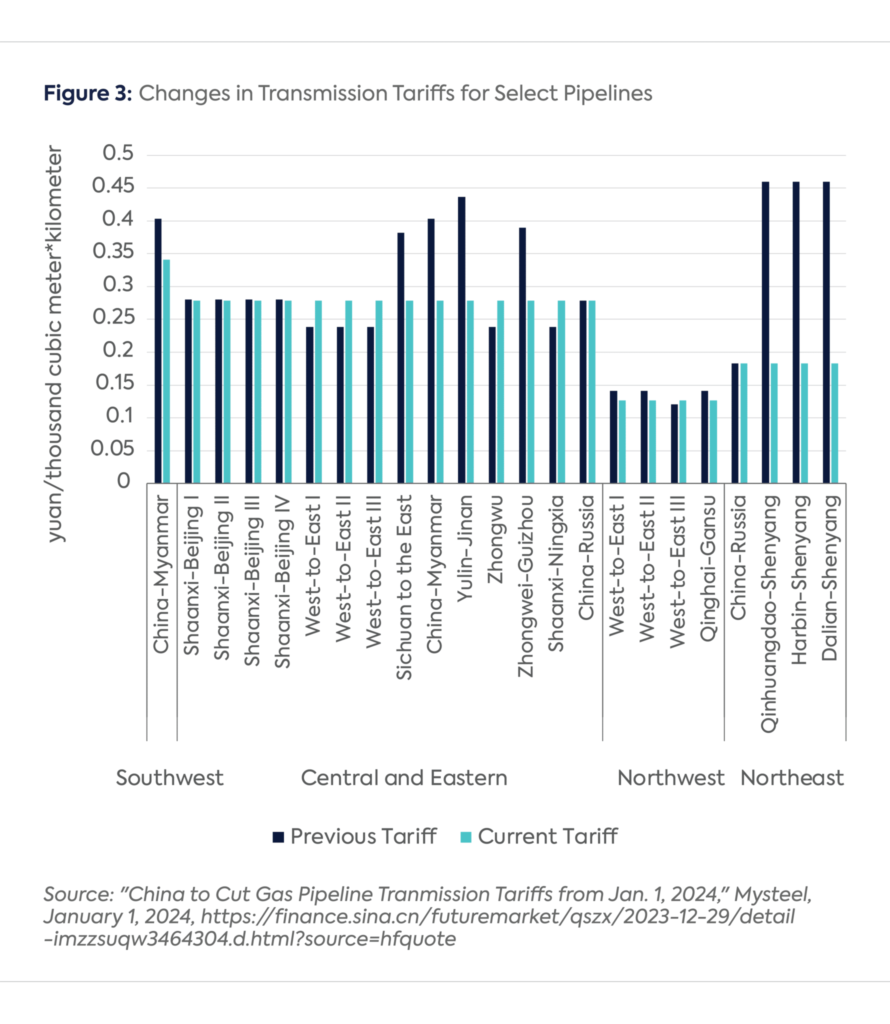

| Pipeline Transmission Tariff Reform (2024) | – Replaced 20 tariffs with a unified system across four zones: Northwest, Northeast, Southwest, and Central/East. – Northwest zone features the lowest tariffs, benefiting Central Asian gas imports. – Tariffs in the Southwest zone (dominated by the China-Myanmar pipeline) dropped by 15%. – Central and East zones (primary consumption hubs) experienced tariff increases to balance supply-demand dynamics. – Designed to encourage competition among upstream producers and reduce end-user costs. |

| Market Conditions and Projections (2024) | – Domestic consumption is projected to grow to 420-425 bcm, a 6.5-7.7% increase over 2023. – Domestic production is expected to reach 246 bcm, with imports rising to 174-179 bcm. – Favorable conditions include well-supplied global markets and declining price trends. – Challenges include geopolitical risks, extreme weather events, and economic uncertainties. |

| Global Implications | – China’s natural gas advancements influence global energy dynamics. – Innovations in production and reform strategies underscore a shift toward energy security and reduced import dependence. – China’s position as the world’s largest importer has significant implications for global supply chains and pricing mechanisms. – Strategic shifts and innovations provide insights into evolving energy policies worldwide. |

In 2023, China’s natural gas consumption reached an unprecedented 394.5 billion cubic meters (bcm), representing a robust 7.6% year-on-year growth. The industrial and city-gas sectors spearheaded this expansion, contributing an incremental demand increase of 28.2 bcm. Industrial consumption alone surged by 12.3 bcm, underscoring the sector’s integral role in addressing the country’s growing energy demands. City gas consumption, encompassing residential and transportation uses, exhibited the highest growth rate, propelled by the adoption of LNG-powered heavy-duty trucks. In 2023, sales of such vehicles skyrocketed by 307%, reaching an impressive 152,000 units. This momentum continued into the first half of 2024, with LNG-fueled truck sales expanding by an additional 104% year-on-year, further driving demand for natural gas.

TABLE: Industry and city-gas drove China’s natural gas consumption in 2023

| Sector | Consumption (bcm) | Incremental Increase (2023 vs. 2022, bcm) | Share of China’s Total Natural Gas Consumption (%) | Growth Rate (2023 vs. 2022, %) | Detailed Insights |

|---|---|---|---|---|---|

| Industrial Fuel | 165.7 | 12.3 | 42% | 8% | Industrial use remains the largest sectoral consumer of natural gas, driven by increasing demand across manufacturing and heavy industries. This sector’s growth reflects China’s focus on substituting coal with cleaner natural gas to reduce emissions. |

| City Gas | 130.2 | 11.8 | 33% | 10% | The city gas sector, which includes residential heating, cooking, and transportation, was the fastest-growing segment. Rapid adoption of LNG-powered vehicles, particularly heavy-duty trucks, significantly boosted this sector’s demand in 2023. |

| Power Generation | 67.1 | 4.4 | 17% | 7% | Power generation witnessed moderate growth as natural gas increasingly complemented renewable energy sources in China’s energy mix. This shift aligns with national goals to stabilize the grid while phasing out coal in favor of cleaner alternatives. |

| Fertilizer Production | 31.6 | 0.0 | 8% | 0% | Consumption in the fertilizer sector remained stable, reflecting minimal fluctuations in production processes. This sector continues to rely on natural gas as a critical feedstock for ammonia and urea production. |

| Total | 394.5 | 28.2 | 100% | 7.6% | Total consumption in 2023 highlights China’s growing reliance on natural gas as a cornerstone of its energy transition strategy. The incremental growth reflects both domestic reforms and increasing LNG imports to meet demand. |

On the production front, China achieved remarkable milestones in 2023, with domestic output climbing to 232.4 bcm, reflecting a 5.6% increase over the previous year. Notably, unconventional sources, including shale gas, coalbed methane, and tight gas, accounted for 43% of total production—equivalent to 97 bcm. This diversification aligns with directives from Chinese leadership to reduce reliance on imported hydrocarbons. Since 2019, China’s three state-owned oil companies (NOCs) have implemented ambitious exploration and production (E&P) initiatives, supported by substantial capital investments. Over five years, these efforts have yielded a 43% increase in domestic gas production, culminating in record-breaking output levels in 2023.

China’s LNG imports continued to dominate its natural gas import portfolio in 2023, accounting for 59% of total imports. LNG imports rebounded with a robust 12.3% increase, cementing China’s position as the world’s largest LNG importer, surpassing Japan. However, LNG import volumes remained below their 2021 peak of 108.9 bcm. Key suppliers—Australia, Qatar, Russia, and Turkmenistan—provided nearly 75% of China’s total natural gas imports. The expansion of regasification infrastructure and long-term contracts suggests sustained growth in LNG imports, with first-half 2024 volumes already rising by over 14% year-on-year. These trends highlight the pivotal role of LNG in China’s energy diversification strategy.

Technological innovation forms the cornerstone of China’s natural gas strategy. Recent breakthroughs have revolutionized production and consumption practices. Notable advancements include the use of geothermal energy for simultaneous power generation during deep oil and gas extraction, and pressure differentiation-based power generation, which offers a net-zero emission solution. In the realm of exploration, the independently developed “Hai-Jing” system has enabled high-resolution 3D seismic imaging in ultra-deepwater settings exceeding 3,000 meters, particularly in the South China Sea. Additionally, automated rigs capable of drilling to depths surpassing 12,000 meters have been deployed in the Tarim Basin, a critical region for domestic gas production. These technological innovations underscore China’s commitment to self-reliance and its strategic focus on advancing energy production capabilities.

Pipeline transmission tariff reforms, effective January 1, 2024, represent a landmark achievement in China’s market restructuring initiatives. By consolidating 20 regional tariffs into a unified zonal system—encompassing Northwest, Northeast, Southwest, and Central and East zones—the reform aims to enhance supply chains, reduce costs, and stimulate consumption. The Northwest zone, serving as a strategic entry point for Central Asian gas, now benefits from the lowest tariffs. In contrast, the Southwest zone, dominated by the China-Myanmar pipeline, witnessed a 15% tariff reduction. However, tariffs in the Central and East zones, home to the nation’s largest consumption hubs, increased to balance regional disparities. These reforms are expected to foster greater competition among upstream producers, incentivize cost reductions, and streamline the nation’s natural gas distribution network.

Looking ahead, the global natural gas market in 2024 appears favorable to China’s energy ambitions. Projections indicate that domestic consumption will rise to 420-425 bcm, marking a 6.5-7.7% increase over 2023 levels. Domestic production is anticipated to grow to 246 bcm, while imports are expected to climb to 174-179 bcm. Despite these positive trends, potential challenges—including geopolitical tensions, extreme weather events, and volatile economic conditions—could impact market dynamics. Nonetheless, China’s strategic planning and technological advancements position it to navigate these uncertainties effectively.

China’s progressive advancements in natural gas production, consumption, and market reforms are not merely national achievements but hold profound implications for global energy dynamics. As the leading natural gas importer, China’s strategic decisions and innovations provide invaluable insights into the evolving nexus of energy security, environmental stewardship, and economic growth. By leveraging domestic capabilities and fostering international partnerships, China continues to shape the future of the global energy landscape with unparalleled determination and vision.

Strategic Expansion and Comprehensive Analysis of the Power of Siberia Pipeline

The Power of Siberia pipeline’s expansion is a defining achievement in the evolving landscape of Eurasian energy collaboration. Operational since 2019, the pipeline stretches over 3,000 kilometers, connecting Siberia’s vast natural gas reserves with China’s rapidly growing energy market. Its projected capacity of 38 billion cubic meters (bcm) annually by 2025 represents a monumental step toward addressing regional energy demands, fostering economic interdependence, and redefining geopolitical alignments.

Infrastructure and Key Milestones

- Total Length and Route: Spanning more than 3,000 kilometers, the pipeline traverses Siberia’s harsh terrains, from the Chayandinskoye gas field in Yakutia to China’s northeastern provinces. It integrates with China’s domestic energy grid, ensuring seamless distribution across key industrial and urban centers.

- Capacity Objectives: Designed to transport up to 38 bcm of natural gas annually, the pipeline’s full capacity equates to approximately 14% of China’s current gas consumption. This milestone will enhance China’s energy diversification and stabilize Russia’s export revenues.

- Development Timeline: Constructed in multiple phases, the pipeline’s design incorporates advanced engineering solutions to address extreme climatic and geological challenges, including temperatures as low as −70°C and seismic risks.

Strategic Importance for Russia

- Economic Diversification and Revenue Growth:

- The pipeline reduces Russia’s dependence on volatile European markets, redirecting a substantial portion of its gas exports to Asia’s burgeoning energy market.

- By 2025, annual revenues from the pipeline are expected to exceed $10 billion, contributing significantly to Russia’s economic resilience and energy sector growth.

- Geopolitical Leverage:

- Strengthening ties with China positions Russia as a key player in Asia’s energy landscape, counterbalancing Western influence in global energy markets.

- Diversified export routes mitigate risks associated with geopolitical tensions and sanctions targeting European trade.

- Regional Development:

- Construction and operation of the pipeline have stimulated economic growth in Siberia, creating over 15,000 jobs and fostering the development of ancillary industries such as steel production and logistics.

- Infrastructure investments associated with the project have improved transportation and communication networks in remote regions.

Strategic Benefits for China

- Energy Security:

- Direct overland gas transport ensures uninterrupted supply, reducing vulnerabilities associated with maritime routes, including geopolitical chokepoints like the Strait of Malacca.

- Integration of Russian gas into China’s energy network diversifies supply sources and stabilizes import costs.

- Economic Expansion and Industrial Growth:

- The reliable energy supply supports China’s industrial sectors, including manufacturing, electronics, and logistics, particularly in energy-intensive regions.

- Long-term pricing agreements provide predictability, enabling industries to manage costs effectively.

- Environmental Goals:

- Natural gas from the pipeline facilitates China’s transition from coal, reducing annual emissions by an estimated 60 million tons and contributing to its 2060 carbon neutrality target.

- Advanced emission control technologies embedded in the pipeline’s infrastructure align with China’s sustainability objectives.

Engineering and Technological Innovations

- Advanced Materials and Construction Techniques:

- High-strength alloys and corrosion-resistant coatings ensure durability and safety, even under extreme pressures and temperatures.

- Specialized equipment and methodologies address seismic activity and permafrost, enhancing pipeline reliability.

- Digital and AI-Driven Monitoring Systems:

- Real-time analytics and predictive maintenance technologies optimize operational efficiency and minimize risks.

- Automated systems ensure precise pressure management and rapid response to potential anomalies.

- Environmental Safeguards:

- Carbon capture and methane leak prevention systems reduce the pipeline’s environmental footprint.

- Continuous monitoring ensures compliance with international environmental standards.

Economic and Regional Impact

- Boosting Local Economies:

- The pipeline has catalyzed economic development in Siberia, driving growth in local industries and improving living standards in underserved regions.

- Long-term benefits include increased investment in regional infrastructure, such as roads, railways, and utilities.

- Energy Pricing Stability:

- Fixed pricing agreements between Russia and China provide insulation from global energy price volatility, ensuring affordability for consumers and profitability for producers.

- Competitive pricing fosters industrial competitiveness and economic growth in both nations.

Future Outlook and Global Implications

- Pipeline Extensions and Capacity Enhancements:

- Studies are underway to expand the pipeline’s reach to additional Chinese provinces, potentially increasing capacity to 50 bcm annually by 2030.

- Proposed extensions align with China’s Belt and Road Initiative, strengthening regional energy connectivity and integration.

- Global Energy Realignment:

- The pipeline exemplifies a shift toward a multipolar energy framework, reducing Western dominance in global markets and fostering new alliances.

- It serves as a model for large-scale bilateral energy projects, setting a precedent for future collaborations.

- Environmental and Technological Leadership:

- The project highlights the role of innovation in achieving sustainability, positioning Russia and China as leaders in environmentally conscious energy infrastructure.

- Enhanced collaboration in research and development could spur further advancements in clean energy technologies.

The Power of Siberia pipeline is a testament to the convergence of strategic interests, engineering excellence, and economic foresight. Its expansion strengthens the energy partnership between Russia and China, reshapes global energy dynamics, and establishes a sustainable model for international collaboration in the 21st century.

Expanding Energy Frontiers: Strategic Significance of Far East and Mongolia Gas Projects

The strategic collaboration between Russia and China on the Far East and Mongolia gas export projects signifies a profound transformation in global energy dynamics, reflecting a deliberate shift in regional and international energy strategies. These ambitious ventures aim to establish diversified energy corridors that secure stable, long-term natural gas supplies to meet the surging energy demand of the Asia-Pacific region. By leveraging technical expertise, innovative engineering solutions, and geopolitical foresight, these projects not only strengthen bilateral relations but also address critical economic, environmental, and technological challenges.

The Far East pipeline and the proposed Mongolia pipeline—often referred to as Power of Siberia 2—serve as foundational elements of a broader energy framework. These projects exemplify the integration of advanced technologies with strategic foresight to overcome logistical and geographic challenges, creating a blueprint for future infrastructure development. Together, they highlight the commitment of both nations to reshaping energy flows and fostering regional economic growth.

| Category | Far East Pipeline |

|---|---|

| Source and Region | The pipeline utilizes the vast natural gas reserves of the Sakhalin region, with estimated reserves of over 2.3 trillion cubic meters. It connects Sakhalin’s gas fields to northern China, ensuring a steady and reliable supply of energy to industrial and residential zones. |

| Engineering Features | The project incorporates advanced technologies to overcome challenges posed by Sakhalin’s extreme climate and seismic activity, including: – High-tensile steel and corrosion-resistant coatings for durability. – Seismic mitigation technologies like flexible joints and pressure monitoring systems. – Modular assembly techniques to streamline construction and enhance scalability. |

| Strategic Importance | – Strengthens northern China’s energy grid, reducing seasonal vulnerabilities. – Offers an overland alternative to volatile maritime LNG shipments, bolstering supply chain resilience. – Plays a vital role in China’s energy transition by providing cleaner-burning natural gas to replace coal. |

| Economic Impact | – Generates thousands of jobs in Sakhalin during construction and operation phases. – Supports the development of auxiliary industries such as logistics and steel production. – Enhances regional connectivity and economic activity, benefiting local communities. |

| Environmental Benefits | – Facilitates significant reductions in greenhouse gas emissions by replacing coal with natural gas in industrial and power generation sectors. – Integrates carbon capture and leak detection technologies to minimize environmental impact, aligning with global sustainability goals. |

| Category | Mongolia Pipeline (Power of Siberia 2) |

|---|---|

| Route and Capacity | The pipeline connects Russia’s western Siberian gas fields to China through Mongolia. It is projected to transport 50 billion cubic meters annually, playing a key role in Russia’s pivot toward the Asia-Pacific market while diversifying its export routes. |

| Engineering Innovations | – Designed to traverse diverse terrains, including Mongolia’s arid landscapes and mountainous regions. – Thermal-resistant materials and seismic reinforcement ensure the pipeline’s resilience in extreme weather. – Incorporates automated monitoring systems for operational efficiency and safety. – Leak detection systems and carbon capture technologies reduce environmental risks. |

| Economic Benefits for Mongolia | – Transit fees provide substantial revenue to Mongolia’s economy. – Infrastructure upgrades and the creation of thousands of jobs foster regional development. – Encourages the growth of ancillary industries such as construction, logistics, and services, diversifying Mongolia’s economic base. |

| Strategic Implications | – Strengthens energy security for China by creating a direct and reliable supply of natural gas. – Reduces Russia’s reliance on European markets, insulating exports from geopolitical pressures. – Enhances cooperation between Russia, Mongolia, and China, fostering regional stability and economic integration. |

| Future Prospects | – Plans for expanding capacity to 70 billion cubic meters annually by 2035 are underway. – Discussions are ongoing to integrate the pipeline into China’s Belt and Road Initiative, further enhancing connectivity and regional influence. |

Far East Pipeline: Maximizing Sakhalin’s Energy Potential

The Far East pipeline is strategically designed to harness the vast natural gas reserves of the Sakhalin region, with an estimated 2.3 trillion cubic meters of reserves. This pipeline extends Russia’s energy influence in the Asia-Pacific region by connecting Sakhalin’s resource-rich gas fields to northern China’s industrial and residential hubs. Beyond meeting immediate energy needs, the project enhances the resilience and diversification of energy supply networks in both countries.

Advanced Engineering and Construction Challenges: The construction of the Far East pipeline demanded cutting-edge engineering to address the unique challenges posed by Sakhalin’s topography and climatic conditions. The region’s extreme cold, seismic activity, and permafrost necessitated the use of high-tensile steel, corrosion-resistant coatings, and modular assembly techniques. Seismic mitigation technologies, including flexible joints and advanced pressure regulation systems, were integrated to ensure structural integrity during earthquakes. Automated monitoring systems provide real-time oversight, enabling predictive maintenance and minimizing operational risks.

Strategic and Economic Impacts: The Far East pipeline provides a secure overland energy supply route for China, reducing reliance on maritime LNG shipments that are vulnerable to geopolitical chokepoints and weather disruptions. For northern China, this pipeline strengthens the energy grid, addresses seasonal demand fluctuations, and supports industrial activities. The project’s economic benefits extend to Sakhalin, where it has created thousands of jobs and spurred the development of auxiliary industries such as steel manufacturing, logistics, and technology-driven services.

Environmental Advantages: In line with global decarbonization goals, the Far East pipeline facilitates the transition from coal to natural gas, significantly reducing greenhouse gas emissions. This cleaner-burning fossil fuel supports China’s efforts to achieve its carbon neutrality targets by 2060 while enabling a gradual and sustainable energy transition.

China-Russia East-Route natural gas pipeline commenced partial operation in Dec 2019

— Amanda (@AJKavanagh3) November 26, 2024

The pipeline includes a 3,000km-long segment called the Power of Siberia in Russia and a 5,111km-long section in China.

sources: https://t.co/205soaT0Knhttps://t.co/HdMu5gMFOC pic.twitter.com/1qUHrFMhue

Mongolia Pipeline: Power of Siberia 2—A Gateway to New Energy Markets

The proposed Mongolia pipeline, known as Power of Siberia 2, represents a bold and visionary effort to connect Russia’s western Siberian gas fields with the energy-intensive markets of the Asia-Pacific. This pipeline is poised to deliver 50 billion cubic meters of natural gas annually, making it a cornerstone of Russia’s pivot to Asia and a critical component of its long-term energy export strategy.

Engineering Innovations and Technological Excellence: The Mongolia pipeline’s route traverses diverse and challenging terrains, including arid regions, mountain ranges, and areas subject to extreme winter conditions. To address these challenges, the pipeline incorporates advanced thermal-resistant materials, seismic reinforcement systems, and automated pressure monitoring technologies. Predictive analytics, powered by artificial intelligence, optimize pipeline operations and ensure safety, while modular construction methods streamline deployment and reduce costs. The inclusion of leak detection systems and carbon capture technologies further aligns the project with global sustainability standards.

Economic Transformation for Mongolia: For Mongolia, this project is transformative. By serving as a transit corridor for Russian gas to China, Mongolia stands to gain substantial economic benefits, including transit fees, infrastructure upgrades, and job creation. The development of associated industries, such as construction and logistics, further diversifies Mongolia’s economic base. This partnership also enhances Mongolia’s geopolitical relevance, positioning it as a vital link between two global powers and fostering regional stability.

Strategic Gains for Russia and China: Russia’s integration into the Asia-Pacific energy market through this pipeline reduces its dependence on European consumers and mitigates risks associated with geopolitical sanctions. For China, the Mongolia pipeline ensures a stable, cost-effective supply of natural gas, supporting industrial expansion and reinforcing energy security. The alignment of strategic interests further strengthens bilateral ties and underscores the importance of collaborative energy initiatives.

With Germany killing off #NordStream2, Power of Siberia 2 construction will be speed up. There’s plenty of market for gas in China. pic.twitter.com/10E8ihocKM

— Carl Zha (@CarlZha) February 22, 2022

Broader Economic and Environmental Implications

Economic Contributions Across Regions: The Far East and Mongolia pipelines collectively serve as catalysts for economic growth. In Russia, these projects generate significant employment opportunities during construction and operation while driving innovation in pipeline technology and engineering. In China, the pipelines provide stable and competitively priced energy that enhances industrial competitiveness and supports long-term economic planning. Mongolia’s involvement unlocks new economic opportunities and facilitates regional integration, transforming it into a critical hub for energy transit.

Environmental Sustainability: The transition to natural gas facilitated by these pipelines contributes to substantial reductions in carbon emissions. By replacing coal in power generation and industrial processes, both countries align with global efforts to combat climate change. Advanced technologies, such as carbon capture and methane leak prevention systems, ensure that the environmental impact of the pipelines is minimized. These measures position Russia and China as leaders in sustainable energy practices and innovation.

Strategic Outlook and Global Influence

Expanding Capacities and Future Plans: Future expansion plans for the Mongolia pipeline include increasing capacity to 70 billion cubic meters annually by 2035, with discussions underway to extend its reach to additional provinces in China. Similarly, the Far East pipeline is expected to integrate further into regional energy networks under China’s Belt and Road Initiative, enhancing connectivity and cooperation across Asia. These expansions underscore the long-term strategic vision driving these projects.

Geopolitical and Economic Realignment: The successful implementation of these pipelines signals a decisive shift toward a multipolar energy framework. By prioritizing partnerships with China, Russia diversifies its export markets and strengthens its economic resilience. Conversely, China’s collaboration with Russia diversifies its energy sources and reduces exposure to global market volatility, securing its energy future in a rapidly changing geopolitical landscape.

Technological Leadership and Innovation: The engineering achievements of the Far East and Mongolia pipelines set new standards for innovation in pipeline infrastructure. From seismic-resistant construction techniques to AI-driven monitoring systems, these projects demonstrate how advanced technologies can overcome complex logistical and environmental challenges. This expertise not only benefits the current projects but also establishes a foundation for future energy infrastructure developments worldwide.

The Far East and Mongolia gas projects are more than infrastructure initiatives; they are transformative ventures that redefine the energy landscape of Eurasia. By addressing critical energy demands, fostering regional cooperation, and advancing sustainability, these pipelines set a precedent for future collaborations. They symbolize the convergence of strategic vision, technological excellence, and economic foresight, shaping a resilient and interconnected global energy framework for the 21st century.

LNG as a Strategic Pivot: Redefining Russia-China Energy Dynamics

The role of liquefied natural gas (LNG) in the evolving energy partnership between Russia and China is both transformative and multidimensional, representing a crucial component of their strategic collaboration. While pipeline infrastructure dominates bilateral energy discourse, LNG trade serves as a versatile and complementary mechanism that addresses diverse energy demands, enhances supply chain resilience, and strengthens geopolitical influence. By capitalizing on their unique geographic and economic strengths, Russia and China are reshaping global energy flows and asserting themselves as pivotal players in the transition to a sustainable energy future.

Expansion of Russia’s LNG Infrastructure: Arctic LNG and Beyond

Russia’s LNG exports to China have surged in recent years, underpinned by the operational success of major projects like Yamal LNG and the forthcoming Arctic LNG 2. These initiatives harness Russia’s vast natural gas reserves, located primarily in the Arctic region, and deploy cutting-edge liquefaction technologies to produce LNG at competitive costs. The Arctic LNG facilities are particularly noteworthy for their integration of advanced modular construction techniques, enabling rapid deployment in extreme environments. With projected capacities exceeding 38 million tons per annum (MTPA), these projects are poised to solidify Russia’s position as a global LNG powerhouse.

The strategic significance of Arctic LNG projects extends beyond production volumes. The development of northern shipping routes, facilitated by melting Arctic ice, offers unprecedented access to Asian markets. These routes reduce transportation distances by nearly 40% compared to traditional pathways through the Suez Canal, enabling faster delivery and lower shipping costs. This logistical advantage not only enhances Russia’s competitiveness in the LNG market but also underscores the potential of the Arctic as a new frontier for global trade.

China’s Growing LNG Demand: Aligning Policy with Strategy

China’s insatiable demand for LNG is driven by its commitment to transitioning toward cleaner energy sources. As the world’s largest LNG importer, China views natural gas as a critical bridge fuel in its journey to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. This policy framework prioritizes LNG for its relatively low carbon intensity and flexibility in meeting the energy needs of industrial, residential, and transportation sectors.

The synergy between Russia’s supply capabilities and China’s demand trajectory is evident in their long-term LNG contracts. These agreements not only ensure energy security for China but also provide Russia with a stable revenue stream, mitigating the economic impact of reduced exports to Western markets. Moreover, the environmental advantages of LNG, such as its ability to significantly reduce sulfur dioxide and particulate emissions compared to coal, align seamlessly with China’s efforts to combat air pollution and enhance public health.

Economic Ramifications: Strengthening Bilateral Trade

The intensification of LNG trade has profound economic implications for both nations. Energy constitutes a substantial portion of bilateral trade, with LNG playing an increasingly prominent role. This dynamic not only strengthens the economic interdependence between Russia and China but also insulates their economies from external disruptions, such as Western sanctions or fluctuations in global energy markets.

Key to this resilience is the growing use of local currencies in energy transactions. By denominating LNG trade in rubles and yuan, Russia and China have reduced their reliance on the US dollar, enhancing financial sovereignty and shielding their economic interactions from geopolitical pressures. This shift represents a deliberate strategy to construct an alternative financial framework that supports broader economic collaboration.

Geopolitical Implications: A Multipolar Energy Order

The Russia-China LNG partnership is emblematic of a broader realignment in global energy geopolitics. As traditional Western markets impose sanctions on Russian energy, Moscow’s pivot to Asia demonstrates its capacity to adapt and thrive in a shifting global landscape. China, for its part, benefits from a diversified energy supply that reduces its dependence on volatile Middle Eastern imports and maritime chokepoints like the Strait of Malacca.

This collaboration also strengthens the strategic positioning of both nations in global energy governance. By aligning their interests in forums such as the International Energy Agency (IEA) and the Gas Exporting Countries Forum (GECF), Russia and China can influence policies and practices that support their long-term objectives. Their partnership signals the emergence of a multipolar energy order, challenging the dominance of traditional players and reshaping the rules of global energy trade.

Technological Innovations: Advancing LNG Efficiency and Sustainability

Technological innovation is a cornerstone of the Russia-China LNG partnership. Russian projects like Yamal LNG have pioneered the use of modular construction in extreme Arctic conditions, enabling cost-effective and efficient development. These technologies have been complemented by advancements in icebreaking LNG carriers, which ensure year-round navigation through frozen waters. The design of these carriers, featuring reinforced hulls and advanced propulsion systems, highlights the intersection of engineering ingenuity and logistical strategy.

China, meanwhile, has invested heavily in LNG regasification infrastructure, expanding its capacity to accommodate increasing imports. Floating storage and regasification units (FSRUs) have been deployed in key coastal regions, enabling rapid deployment and flexibility in meeting fluctuating demand. Additionally, China’s focus on improving LNG storage efficiency and integrating renewable energy sources into its grid further underscores its commitment to a sustainable energy future.

Environmental Considerations: Balancing Growth and Sustainability

The environmental benefits of LNG are central to its role in the Russia-China energy partnership. As a cleaner-burning fuel, LNG produces significantly lower carbon dioxide emissions compared to coal, making it a critical component of global decarbonization efforts. This alignment with sustainability objectives is particularly important for China, which faces mounting pressure to address air pollution and meet its climate targets.

Russia’s Arctic LNG projects have also embraced environmental stewardship, incorporating technologies to minimize methane leakage and carbon emissions during production and transportation. The integration of carbon capture and storage (CCS) systems further enhances the environmental credentials of these projects, demonstrating a commitment to balancing economic growth with ecological responsibility.

Strategic Outlook: Expanding Horizons in LNG Trade

The future of Russia-China LNG trade is characterized by ambitious expansion plans and innovative collaborations. Projects like Arctic LNG 2 are expected to further increase Russia’s export capacity, while China continues to invest in regasification and storage infrastructure to support its growing demand. The potential integration of LNG trade into China’s Belt and Road Initiative (BRI) could open new avenues for cooperation, extending the benefits of this partnership to other regions in Asia and beyond.

Additionally, the adoption of digital technologies, such as blockchain for trade transparency and AI for demand forecasting, is likely to enhance the efficiency and reliability of LNG transactions. These advancements will not only optimize supply chains but also reinforce the strategic alignment between Russia and China in the global energy landscape.

Strengthening Foundations: Addressing Challenges and Expanding Prospects in Russia-China Energy Collaboration

The Russian-Chinese energy partnership, while achieving remarkable milestones, must navigate a landscape marked by challenges that test the resilience and adaptability of both nations. Fluctuating global energy prices, geopolitical rivalries, and infrastructural constraints have emerged as critical barriers to sustained growth. However, the strategic foresight and innovative solutions employed by both countries underscore their commitment to overcoming these hurdles and ensuring the long-term viability of their collaboration.

Global energy price volatility represents one of the most pressing challenges for the Russia-China energy alliance. Market fluctuations, driven by supply-demand imbalances, geopolitical events, and currency instabilities, can disrupt financial projections and undermine investment confidence. To mitigate this risk, both nations have prioritized long-term contracts and the use of local currencies in energy transactions, reducing their exposure to external economic pressures. In addition, Russia and China have sought to stabilize their energy trade through strategic stockpiling and the development of buffer mechanisms. China’s establishment of extensive LNG storage and regasification infrastructure, alongside Russia’s continued investment in Arctic LNG projects, provides a safety net that ensures reliable supply even during periods of heightened market uncertainty.

The vast scale of energy infrastructure required to sustain the partnership poses significant logistical and technical challenges. Aging pipeline networks, limited transportation capacity in remote regions, and the complexities of Arctic operations highlight the need for substantial investments in modernization. Russia has responded by deploying cutting-edge pipeline materials and enhancing the efficiency of liquefaction technologies, while China has accelerated the construction of LNG terminals and inter-regional distribution networks to address domestic bottlenecks. Innovations in digital monitoring and automation further streamline infrastructure management. AI-driven predictive maintenance systems, combined with blockchain-based supply chain transparency tools, enable real-time tracking of pipeline conditions, minimizing downtime and ensuring operational efficiency. These advancements exemplify the role of technology in overcoming logistical barriers and fostering seamless energy trade.

Geopolitical tensions, particularly those stemming from Western sanctions and territorial disputes, remain a significant concern for the partnership. As Russia pivots its energy strategy eastward, the alliance with China serves as a buffer against economic isolation. Similarly, China’s diversification of energy imports reduces its vulnerability to geopolitical chokepoints, such as the Strait of Malacca. Both nations have leveraged diplomatic channels to mitigate geopolitical risks. Their participation in multilateral frameworks, such as the Shanghai Cooperation Organization (SCO) and BRICS, provides platforms for policy alignment and cooperative conflict resolution. By aligning their strategic objectives within these forums, Russia and China reinforce their commitment to a stable and mutually beneficial energy alliance.

Looking ahead, the future of the Russia-China energy partnership is characterized by ambitious expansion plans and an emphasis on sustainability. The completion of key infrastructure projects, such as the Power of Siberia 2 pipeline and the Arctic LNG 2 facility, will significantly enhance energy flows, solidifying Russia’s position as China’s primary energy supplier. These projects not only address immediate energy needs but also pave the way for deeper integration of their energy networks.

A notable development in the partnership is the increasing focus on renewable energy and carbon capture technologies. By investing in wind, solar, and hydroelectric power, both nations demonstrate their commitment to a balanced energy matrix that complements traditional fossil fuels. For instance, joint ventures in developing large-scale wind farms and offshore solar arrays aim to reduce reliance on coal and oil while enhancing grid stability. Carbon capture and storage (CCS) technologies are also a focal point of collaboration. These systems are being integrated into LNG facilities and coal-fired power plants to mitigate emissions. The deployment of CCS technologies not only supports global decarbonization goals but also strengthens the environmental credibility of the Russia-China energy alliance.

The integration of renewable energy into the partnership has implications that extend beyond bilateral relations. By establishing a precedent for sustainable energy collaboration, Russia and China position themselves as leaders in the global transition to clean energy. Their combined efforts can catalyze international investments in low-carbon technologies and promote a more equitable energy landscape, particularly in developing nations.

The implications of the Russia-China energy alliance reverberate across the global energy sector. By realigning energy flows and challenging traditional market structures, the partnership heralds the emergence of a multipolar energy order. This shift diminishes the dominance of established players and introduces new dynamics in energy diplomacy and governance. Moreover, the partnership’s emphasis on integrating economic and environmental strategies establishes a model for other nations to emulate. By balancing energy security with sustainability, Russia and China offer a blueprint for achieving economic growth while addressing the existential threat of climate change.

The Russian-Chinese energy partnership represents a transformative force in the global energy landscape. By addressing challenges with resilience and foresight, and by capitalizing on opportunities for growth and innovation, the alliance is well-positioned to lead the global transition toward a sustainable and equitable energy future. As they continue to align their strategies, invest in advanced technologies, and expand infrastructure, Russia and China are not merely reshaping their bilateral relationship—they are redefining the very foundations of global energy collaboration.

Dynamics of Russian LNG and Pipeline Gas in a Shifting Global Energy Market

As global energy markets undergo significant realignments, the dynamics of Russian natural gas exports emerge as a case study in strategic foresight, economic resilience, and geopolitical adaptation. Encompassing both liquefied natural gas (LNG) and pipeline gas deliveries, Russia’s export strategy reflects its calculated efforts to secure long-term relevance amid shifting market demands, evolving geopolitical alliances, and intensifying competition. These dynamics are further shaped by the global pivot toward cleaner energy sources, regional competition, and the necessity of overcoming infrastructural and technological challenges to meet surging demand in Asia and other emerging regions.

Russian pipeline gas exports to China have become a cornerstone of this recalibration. Infrastructure projects such as the Power of Siberia pipeline, operational since 2019, exemplify this shift. Deliveries via this route are projected to reach 30 billion cubic meters (Bcm) in 2024 and achieve the pipeline’s full annual capacity of 38 Bcm by 2025. This expansion signifies more than the fulfillment of contractual obligations; it embodies a strategic pivot to eastern markets as Europe reduces its reliance on Russian energy. The broader implications extend to reshaping regional energy flows, ensuring that Russia remains a dominant energy supplier while leveraging Asia’s burgeoning demand to offset the economic repercussions of declining European dependency.

Complementing this strategy is the Sakhalin-Khabarovsk-Vladivostok (SKV) pipeline, designed to bolster connections between Russia’s Far East and China’s industrial centers. Expected to contribute an additional 10 Bcm annually, this auxiliary infrastructure reinforces Russia’s energy footprint in Asia. Such projects not only address China’s immediate energy needs but also mitigate the economic fallout of European diversification strategies. They illustrate how energy infrastructure transcends its functional role, becoming a geopolitical tool for influence and leverage.

LNG: A Parallel Strategy of Flexibility and Adaptation

In contrast to the fixed routes of pipeline gas, Russia’s LNG export strategy demonstrates remarkable flexibility and adaptability. In 2024, LNG exports to Europe accounted for 17% of Europe’s total LNG imports, marking a significant increase in trade during the January-to-October period. This growth underscores Russia’s ability to pivot toward regions offering more immediate economic benefits, even amidst mounting sanctions and logistical constraints. The reallocation of LNG volumes from Asia to Europe highlights the elasticity of trade flows, enabling Russian exporters to respond dynamically to fluctuating market conditions.

Despite this adaptability, sustaining an elevated LNG presence in Europe presents challenges. Analysts predict that increased global LNG supply, particularly from the United States, Qatar, and Australia, will exert downward pressure on prices by the late 2020s. This intensified competition, combined with the sanctions regime that restricts Russia’s access to advanced liquefaction technologies, could hinder the profitability of its LNG projects. Moreover, the high transportation costs associated with LNG shipments, exacerbated by logistical bottlenecks in Arctic routes, remain a significant obstacle to maintaining competitive pricing in global markets.

Regional Dynamics in China: Balancing Pipeline Gas and LNG Imports

Within China, the interplay between pipeline gas and LNG imports introduces additional layers of complexity for Russian exporters. Pipeline gas offers distinct cost advantages in northern and central China, where established infrastructure ensures relatively low transmission fees. However, this edge diminishes in southern provinces like Guangdong and Jiangsu, where transportation costs erode competitiveness. Analysts identify the Bohai Bay region and northeastern China as strongholds for Russian pipeline gas, but increasing LNG availability in southern hubs intensifies competitive pressures.

To secure market share, Russian exporters must adopt nuanced strategies that account for regional disparities. Competitive pricing models, long-term supply contracts, and strategic partnerships with Chinese state-owned enterprises are essential to maintaining relevance. Additionally, investing in localized storage and regasification facilities could enhance Russia’s ability to meet fluctuating demand in key markets.

Asia’s Expanding LNG Market: Opportunities and Challenges