Contents

- 1 ABSTRACT

- 2 The Role of Nuclear Energy in Modern Energy Systems: Innovations, Challenges and Financial Implications

- 3 Current Role of Nuclear Energy

- 4 Recent Developments in the Nuclear Market: Shifting Leadership and Construction Dynamics

- 5 Nuclear Power Generation: Breaking Records and Driving Global Energy Security

- 6 Drivers of Renewed Interest in Nuclear Energy: Policy and Technological Catalysts

- 7 Accelerating Nuclear Technology Development and Its Impact on Market Leadership

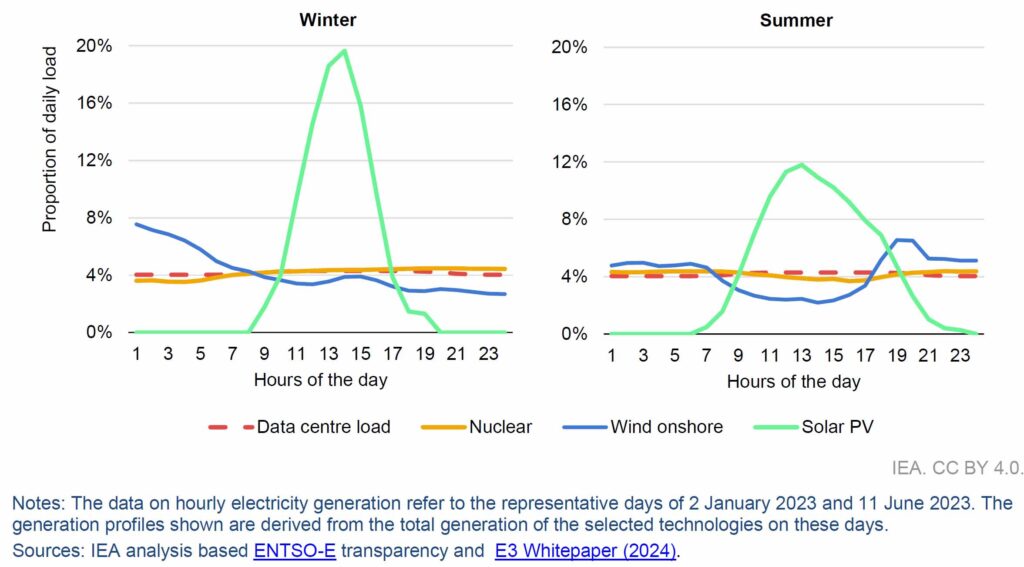

- 8 Data Centres: A Transformative Market for Nuclear Power

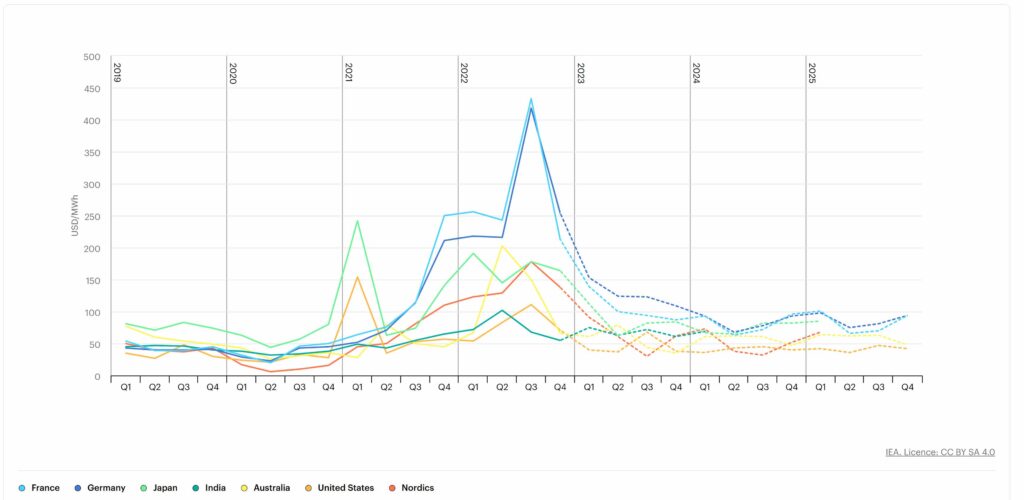

- 9 Wholesale Electricity Prices and the Evolving Energy Landscape

- 10 Global Outlook for Nuclear Energy: Investment, Policy, and Technological Trajectories

- 11 Cutting Construction and Financing Costs: A Key to Nuclear Competitiveness

- 12 The Future of AI and the Critical Role of Nuclear Energy in Powering Technological Growth

- 12.1 Escalating Energy Demands of AI Development

- 12.2 The Growing Need for Nuclear Energy in AI-Driven Systems

- 12.3 AI Projects Driving Nuclear Integration

- 12.4 Proposed AI-Nuclear Integration Models

- 12.4.1 Dedicated SMR Networks for AI

- 12.4.2 AI-Optimized Nuclear Operations

- 12.4.3 AI-Driven Demand Forecasting

- 12.4.4 As AI continues to revolutionize industries and reshape societal structures, the need for a robust, sustainable energy supply becomes increasingly evident. Nuclear power, with its unparalleled reliability and environmental benefits, stands as the most viable solution to meet the energy demands of an AI-driven future. By fostering innovation, investment, and collaboration, the integration of AI and nuclear energy can redefine the global energy landscape, ensuring technological progress without compromising sustainability.

- 12.5 Copyright of debugliesintel.comEven partial reproduction of the contents is not permitted without prior authorization – Reproduction reserved

ABSTRACT

Nuclear energy is on the cusp of a historic resurgence, poised to achieve record levels of electricity generation by 2025, according to the International Energy Agency (IEA). This milestone marks a pivotal moment in the global energy transition, driven by soaring electricity demand, technological advancements, and the imperative to reduce carbon emissions. However, the pathway to unlocking the full potential of nuclear energy is fraught with challenges, from geopolitical complexities and market concentration to financing hurdles and technological scalability.

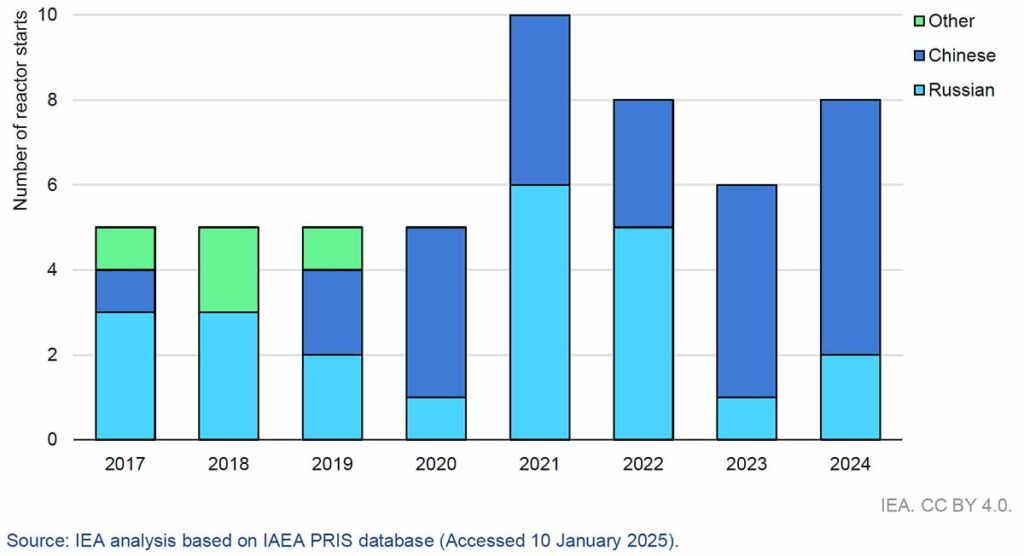

In 2023, global investment in nuclear energy reached $65 billion, with projections indicating growth to $75 billion by 2030. This investment surge reflects the recognition of nuclear energy’s critical role in providing reliable, low-emission power. Notably, 63 reactors under construction worldwide will add more than 70 gigawatts (GW) of capacity, but the dominance of Chinese and Russian technologies—responsible for 92% of reactors initiated since 2017—highlights risks to energy security. These include geopolitical tensions, supply chain vulnerabilities, and over-reliance on specific market players such as Russia, which controls 40% of global uranium enrichment capacity.

Emerging markets such as Kazakhstan exemplify the intersection of nuclear expansion and geopolitical complexity, as competing powers vie for influence in building the country’s first nuclear plant. Western nations are also taking measures to reduce reliance on Russian nuclear technology, yet supply chain limitations and production delays in alternative regions, such as France, expose critical vulnerabilities in global nuclear infrastructure. Addressing these issues necessitates coordinated international efforts to diversify supply chains and ensure market stability.

The rise of small modular reactors (SMRs) represents a transformative development in nuclear technology. Offering reduced construction times, lower capital costs, and enhanced safety, SMRs are particularly attractive to private-sector investors aiming to power energy-intensive applications like data centers. Despite their promise, SMRs face significant commercialization hurdles, including regulatory delays and cost escalations. Currently, only three operational SMRs exist globally, underscoring the need for accelerated technological advancement and international collaboration to achieve broader deployment. By 2040, SMRs could account for 10% of global nuclear capacity, provided their costs decrease and licensing processes become more streamlined.

The economic viability of nuclear energy remains a key determinant of its future trajectory. Large-scale projects are frequently marred by delays and cost overruns, as seen with Finland’s Olkiluoto 3 reactor, which experienced a decade-long delay and $5 billion in cost increases. To overcome these challenges, predictable cash flows through power purchase agreements (PPAs) and public-private partnerships are essential. Governments can play a pivotal role by offering incentives, loan guarantees, and streamlined regulatory frameworks to attract private capital. Major corporations, including Amazon and Google, are increasingly aligning their investment strategies with sustainability goals by entering agreements with nuclear developers to secure clean, firm power.

The integration of nuclear energy with artificial intelligence (AI) technologies represents a critical frontier. AI-driven industries, including hyperscale data centers, autonomous vehicle systems, and generative AI platforms, are driving exponential growth in electricity demand. Case studies highlight the energy requirements of projects such as Tesla’s Dojo supercomputer (300 MW annually by 2030) and Baidu’s Smart Cities Initiative (2 GW annually for AI-driven urban infrastructure). Nuclear energy, particularly SMRs, offers an unmatched solution to power these applications reliably and sustainably.

Proposed AI-nuclear integration models emphasize deploying regional SMR networks, AI-optimized nuclear plant operations, and AI-driven demand forecasting to align energy supply with fluctuating needs. Examples include NuScale’s VOYGR SMR design, AI-enabled predictive maintenance systems, and dynamic load management algorithms. These strategies ensure efficient, reliable, and environmentally sustainable energy for AI-driven operations.

Policy frameworks and international cooperation are indispensable in advancing nuclear energy. Stable regulatory environments, targeted incentives, and collaborative efforts to harmonize standards and promote technological innovation are essential. Organizations like the IEA and the International Atomic Energy Agency (IAEA) play a crucial role in fostering dialogue and enabling partnerships among nations.

In conclusion, nuclear energy stands at the intersection of technological innovation, geopolitical strategy, and sustainable development. By addressing challenges related to market concentration, financing, and regulatory barriers, nuclear power can secure its place as a cornerstone of the global energy system. Through the integration of advanced technologies, including AI, and the development of resilient infrastructure, the nuclear sector can meet the dual imperatives of decarbonization and energy security, ensuring a sustainable and prosperous future for all.

| Category | Detailed Information |

|---|---|

| Current Nuclear Energy Landscape | Nuclear energy is set to achieve record electricity generation by 2025, powered by nearly 420 operational reactors worldwide. The technology produces just under 10% of global electricity, making it the second-largest source of low-emission electricity after hydropower. Demand for electricity, driven by applications like data centers, electric vehicles, and artificial intelligence, is growing six times faster than overall energy consumption. China and Russia dominate nuclear technology, with 48 of the 52 reactors constructed since 2017 originating from these countries. |

| Small Modular Reactors (SMRs) | SMRs are emerging as a transformative technology due to their cost-effectiveness, modular design, and quicker deployment. They offer scalable and clean energy solutions tailored to growing demands from industries such as data centers. Under current policies, SMR capacity is expected to reach 40 GW by 2050 but could triple to 120 GW with policy alignment and cost reductions. Cost parity with large-scale reactors could further expand capacity to 190 GW. Investment in SMRs is projected to grow from $5 billion in 2023 to $25 billion by 2030 and $900 billion cumulatively by 2050, depending on accelerated development and deployment scenarios. |

| Investment Trends | Annual investment in nuclear energy, including new plants and extensions of existing ones, has increased by 50% since 2020, surpassing $60 billion in 2023. A rapid growth scenario requires doubling investment to $120 billion by 2030. Financing challenges stem from long construction timelines, capital intensity, and technical risks. Governments often play a central role in funding, while private financing is increasingly necessary. Mechanisms like power purchase agreements, green bonds, and regulated asset models are crucial for de-risking investments and ensuring predictable cash flows to attract private capital. |

| Geopolitical Challenges | The concentration of nuclear technologies and fuel supply in a few countries creates vulnerabilities. Russia holds 40% of global uranium enrichment capacity, while four countries dominate over 99% of enrichment capabilities. Diversifying supply chains is essential to reduce dependency on Russian and Chinese technologies. Advanced economies face aging nuclear fleets, averaging 36 years, while China is poised to surpass both the U.S. and EU in nuclear capacity by 2030. Efforts to rejuvenate advanced economies’ fleets face delays and cost overruns, complicating their ability to regain market leadership. |

| Role of Governments | Governments are instrumental in providing strategic vision, incentives, and robust policies to support nuclear expansion. This includes fostering innovation, ensuring supply chain resilience, maintaining skilled workforces, and creating regulatory environments conducive to investment. Public funding and de-risking mechanisms are critical to address financing gaps. Transparent safety regulations and provisions for waste management and decommissioning are essential for long-term sector sustainability. Tailored support for SMRs can significantly enhance their adoption and market impact. |

| Economic Benefits and Risks | SMRs represent a less risky investment compared to traditional nuclear projects due to modular designs, shorter construction timelines, and lower capital requirements. First-of-a-kind projects are key to establishing credibility and reducing perceived risks. Long-term agreements and partnerships with large energy consumers, such as data centers, provide financial stability. Nevertheless, uncertainties in construction costs and delays remain a significant hurdle, potentially prolonging the break-even point for large reactors to 20-30 years post-construction. Standardization and building reactors in series can mitigate these risks. |

| Future Outlook | The global nuclear landscape is shifting, with China and emerging markets leading capacity growth. Installed nuclear capacity in China is expected to triple by 2050, while advanced economies see modest growth due to aging fleets and slow project rollouts. By 2050, SMRs could account for up to 190 GW of global capacity if cost reductions and regulatory harmonization are achieved. Greater diversity in technology leadership, driven by SMR adoption and renewed investment in large-scale reactors, could help advanced economies reclaim market share. Collaborative international efforts and strategic policies will determine the future trajectory of nuclear energy. |

The Role of Nuclear Energy in Modern Energy Systems: Innovations, Challenges and Financial Implications

Nuclear energy has been a cornerstone of the global energy infrastructure for over half a century, consistently providing reliable electricity and heat across diverse geographies. As of 2024, nuclear power is poised to play an increasingly critical role in addressing the twin challenges of energy security and climate change, particularly in the context of ambitious global decarbonization targets. Over 40 nations currently integrate nuclear power into their energy portfolios, and innovative technologies, such as small modular reactors (SMRs), are driving renewed interest in nuclear energy as a sustainable and adaptable solution.

Despite its demonstrated benefits, the nuclear energy sector faces complex hurdles, ranging from financing and construction delays to public perception and geopolitical considerations. This article explores the multifaceted status of nuclear energy, delves into its technological and policy dimensions, and assesses the financial strategies essential for fostering its growth. Drawing on recent policy updates, technological advancements, and investment trends, the analysis offers a nuanced perspective on nuclear energy’s role in shaping a secure and sustainable energy future.

Nuclear energy has consistently demonstrated its capacity to enhance energy security and mitigate climate risks. As of 2023, the global fleet of over 410 reactors in 30 countries supplied approximately 9% of global electricity. This contribution made nuclear energy the second-largest source of low-emissions electricity, following hydropower, and placed it ahead of renewable sources such as wind and solar photovoltaic (PV) in terms of output. Over the past five decades, nuclear energy has avoided an estimated 72 gigatons (Gt) of CO2 emissions by displacing fossil fuel-based power generation. This achievement underscores its strategic importance in reducing greenhouse gas emissions while strengthening energy resilience by lessening dependency on imported fuels.

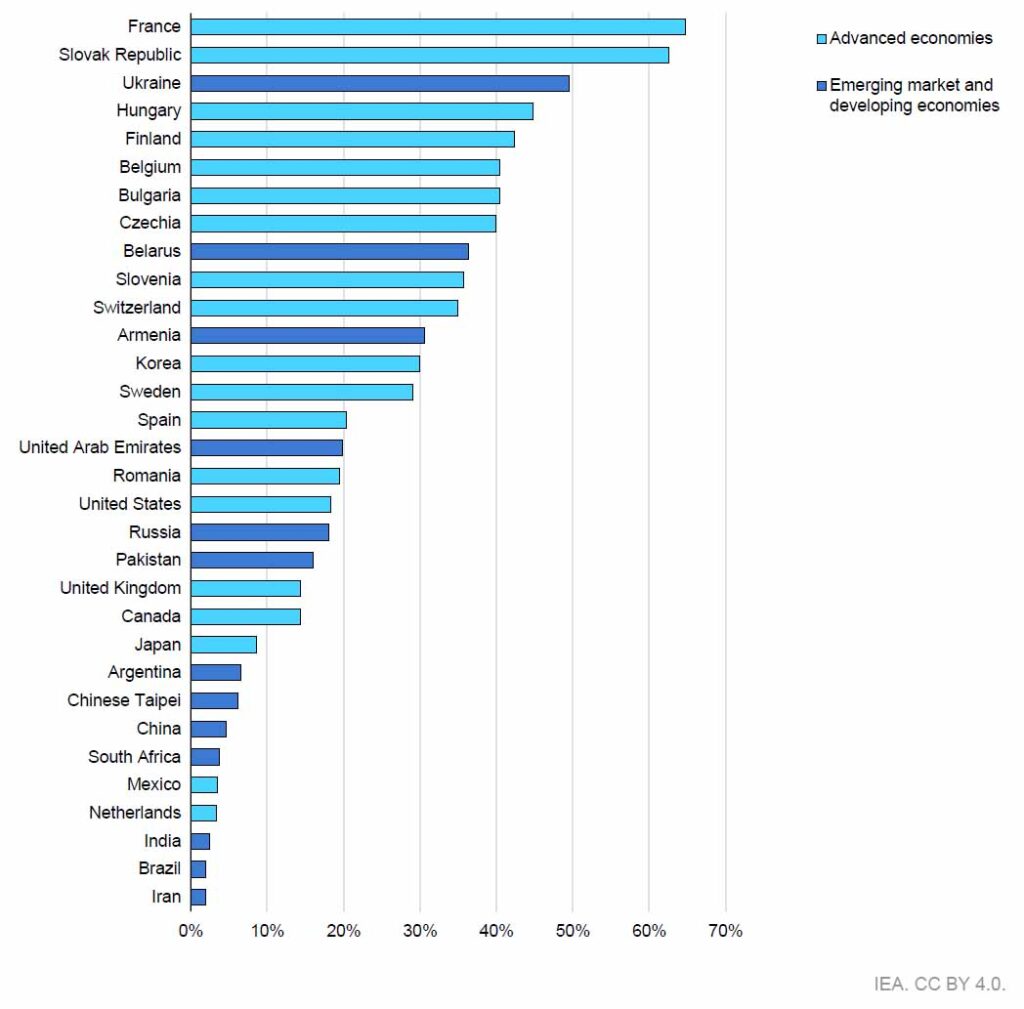

The advanced economies dominate the global nuclear landscape, hosting over 70% of the operational reactor fleet. However, this fleet is aging, with an average operational lifespan exceeding 36 years, compared to 18 years in emerging economies. France exemplifies nuclear reliance, with nuclear energy contributing 65% of its electricity generation, while the Slovak Republic follows closely with over 60%. In contrast, the European Union has witnessed a gradual decline in nuclear’s share of electricity generation, falling from a peak of 34% in 1997 to 23% today. The United States, which operates the world’s largest fleet of nuclear reactors, derives less than 20% of its electricity from nuclear power. This discrepancy highlights the need for modernization and strategic planning to sustain the role of nuclear energy in these regions.

Emerging economies, particularly China and Russia, are increasingly asserting leadership in the global nuclear arena. Between 2017 and 2024, 52 reactors began construction worldwide, with 48 designed by Chinese or Russian entities. By the end of 2024, 63 nuclear reactors, representing 71 gigawatts (GW) of capacity, were under construction. Notably, three-quarters of these projects were concentrated in emerging economies, with China alone accounting for half. This shift reflects the growing prioritization of nuclear energy in these regions as a means to meet burgeoning energy demands while minimizing carbon footprints.

Recent years have witnessed a resurgence of interest in nuclear power, driven by heightened energy security concerns, technological advancements, and the need for dispatchable low-emissions power. The global nuclear capacity is projected to reach unprecedented levels by 2025, fueled by supportive policies in over 40 countries and an ambitious initiative to triple nuclear energy capacity by 2050. Investment in nuclear energy has surged, reaching approximately USD 65 billion in 2023—a nearly twofold increase compared to a decade earlier. Small modular reactors (SMRs), with their scalable and flexible applications, have garnered particular attention, attracting investment commitments for up to 25 GW of capacity primarily targeting data center energy needs.

Nevertheless, the nuclear sector faces significant challenges that must be addressed to ensure its potential is fully realized. The construction of large-scale reactors in advanced economies has been plagued by delays and cost overruns, undermining investor confidence and impeding progress. Additionally, the market for nuclear technology remains highly concentrated, with a limited number of suppliers dominating the landscape. This concentration risks creating bottlenecks that could hinder the broader adoption and deployment of nuclear technologies. To overcome these obstacles, the industry must adopt innovative approaches to financing, workforce development, and supply chain optimization.

The Status of Nuclear Energy Worldwide

The operational status of nuclear energy varies significantly across regions, reflecting differing policy priorities, resource availability, and technological capabilities. Advanced economies, despite their historical dominance, are grappling with aging infrastructure and shifting policy landscapes. Emerging economies, on the other hand, are spearheading new construction and embracing nuclear energy as a cornerstone of their energy strategies.

In Europe, nuclear energy’s trajectory illustrates both its potential and its challenges. France remains a global leader in nuclear electricity generation, with its reactors providing a majority share of the national energy mix. However, policy debates and public sentiment have introduced uncertainty regarding the long-term role of nuclear power in the country. Germany’s decision to phase out nuclear energy following the Fukushima disaster exemplifies the challenges posed by public opposition and policy shifts. Yet, several European nations, including Poland and the Czech Republic, are exploring nuclear energy as a means to reduce reliance on coal and achieve climate targets.

In North America, the United States and Canada continue to rely on nuclear power for a significant portion of their electricity. The United States’ nuclear fleet, while extensive, faces challenges related to aging reactors and competition from cheaper natural gas and renewable energy sources. Canada, with its focus on innovative reactor designs, including the development of advanced fuel cycles, is positioning itself as a hub for nuclear innovation.

Asia, particularly China and India, represents the most dynamic region for nuclear energy development. China’s aggressive expansion of its nuclear fleet aligns with its broader goals of energy security and emissions reduction. The country has not only increased its domestic reactor capacity but has also emerged as a leading exporter of nuclear technology. India, with its unique thorium-based nuclear program, is exploring alternative fuel cycles to enhance energy independence and sustainability.

Technological Innovations and Small Modular Reactors

The advent of small modular reactors (SMRs) marks a transformative moment for the nuclear industry. These compact, scalable reactors offer several advantages over traditional large-scale designs, including reduced construction times, lower upfront costs, and enhanced safety features. SMRs are particularly well-suited for niche applications, such as powering remote communities, industrial processes, and data centers.

The modular nature of SMRs enables factory-based manufacturing, which can streamline production and reduce costs. This approach contrasts with the bespoke construction of large reactors, which often leads to delays and cost overruns. Additionally, SMRs’ passive safety systems and inherent design features minimize the risk of accidents, addressing longstanding public concerns about nuclear safety.

Several countries are at the forefront of SMR development. In the United States, companies such as NuScale Power are pioneering SMR technology, with the first commercial SMR expected to be operational by the late 2020s. Canada’s focus on SMRs includes initiatives to integrate them into remote mining operations, where reliable power is essential. Russia and China are also advancing SMR projects, with floating nuclear power plants representing a novel application of this technology.

Despite their promise, SMRs face challenges related to regulatory approval, financing, and public acceptance. Establishing standardized licensing frameworks and securing investment are critical steps in accelerating the deployment of SMRs. Public engagement and transparent communication about the benefits and safety of SMRs are equally important in fostering widespread acceptance.

Financial Challenges and Investment Strategies

The financing of nuclear energy projects represents a unique challenge due to the high upfront capital costs and long development timelines associated with reactor construction. Traditional funding mechanisms often struggle to accommodate the financial demands of nuclear projects, necessitating innovative approaches to mobilize investment.

Government support remains a cornerstone of nuclear financing, with public funding often playing a pivotal role in de-risking projects and attracting private investors. Mechanisms such as loan guarantees, tax incentives, and public-private partnerships have proven effective in facilitating nuclear investments. For example, the United Kingdom’s regulated asset base (RAB) model has been proposed as a means to finance new nuclear projects by ensuring cost recovery through consumer electricity bills.

Private sector involvement is also essential for scaling nuclear energy. Institutional investors, including pension funds and sovereign wealth funds, are increasingly recognizing the long-term value of nuclear energy in achieving sustainable investment goals. Green bonds and climate-focused investment funds present additional avenues for mobilizing capital, aligning financial returns with environmental objectives.

Addressing the risks associated with nuclear projects is crucial for unlocking investment. These risks include construction delays, cost overruns, and regulatory uncertainties. Implementing risk-sharing mechanisms, such as joint ventures and insurance schemes, can mitigate these challenges and enhance investor confidence. Furthermore, fostering a competitive and transparent market for nuclear technology suppliers can reduce costs and promote innovation.

Nuclear energy stands at a crossroads, offering unparalleled potential to address the global energy trilemma of security, sustainability, and affordability. As countries navigate the complexities of energy transitions, nuclear power’s role will depend on overcoming technological, financial, and societal barriers. By leveraging innovative technologies such as SMRs, adopting strategic investment frameworks, and fostering international collaboration, the nuclear industry can cement its position as a cornerstone of a clean and secure energy future.

Current Role of Nuclear Energy

Nuclear power remains an essential pillar in the global energy landscape, offering a dependable, high-density source of electricity that continues to adapt amidst transformative shifts in energy demand and supply paradigms. The modern Age of Electricity has ushered in profound changes, underpinned by an accelerating shift towards electrification across virtually all economic sectors. This shift has been catalyzed by surging adoption rates of electric vehicles (EVs), the proliferation of data-intensive technologies reliant on robust digital infrastructures, and the rising ubiquity of air conditioning systems, particularly in rapidly urbanizing and industrializing regions. These developments, coupled with extensive electrification in industries and households, have profoundly redefined the strategic significance of nuclear energy within the broader energy mix, necessitating a meticulous analysis of its evolving role.

In 2023, nuclear energy was responsible for approximately 9% of the global electricity supply, bolstered by a fleet of over 410 operational reactors distributed across more than 30 countries. This impressive contribution underscores nuclear energy’s capacity to deliver stable, round-the-clock power that complements and mitigates the intermittency challenges inherent to renewable sources such as solar and wind. Moreover, nuclear energy’s remarkable carbon abatement credentials have proven pivotal in combating climate change, with the sector having cumulatively avoided approximately 72 gigatonnes (Gt) of CO2 emissions since 1971. On an annual basis, the existing reactor fleet prevents an estimated 1.5 Gt of CO2 emissions, affirming its indispensable role in global climate mitigation strategies. Relative to other low-carbon energy sources, nuclear power’s output remains robust, producing 20% more electricity than wind power, 70% more than solar photovoltaic (PV) installations, and quadrupling the energy generated by bioenergy as of 2023.

Global CO2 emissions from electricity generation are projected to decline by over 2% in 2024, following a marginal 1% increase in 2023. This temporary rise in emissions during 2023 was largely attributed to a notable uptick in coal-fired electricity production, particularly in China and India, where diminished hydropower availability necessitated greater reliance on fossil fuels. Nonetheless, the broader trajectory for electricity sector emissions remains one of decline. The share of fossil fuels in global electricity generation is forecast to contract from 61% in 2023 to 54% by 2026, a pivotal milestone marking the first instance of this metric dropping below 60% since the International Energy Agency (IEA) began systematic records in 1971. The sustained expansion of clean electricity sources—comprising renewables and nuclear energy—continues to drive this transformative shift, displacing emissions-intensive fossil-fired generation and bolstering the sector’s long-term decarbonization prospects.

Electricity demand dynamics have undergone unprecedented evolution over the past decade, with global electricity consumption growing at twice the pace of overall energy demand. This trend reflects the mounting penetration of technologies reliant on electrification, such as electric vehicles (with global sales exceeding 10 million units in 2023), alongside the burgeoning expansion of data centers, telecommunication networks, and digital services. Concurrently, efforts to electrify traditionally fossil-fuel-dependent domains, including heating and industrial processes, have further amplified the demand for reliable, dispatchable power sources. Nuclear energy, with its unparalleled ability to generate vast quantities of low-carbon electricity, plays a critical role in addressing these heightened demands while ensuring grid stability and resilience.

The geographical distribution of nuclear power highlights significant disparities between advanced economies and emerging markets. Advanced economies maintain a disproportionately high share of operational nuclear capacity, with nuclear power accounting for 17% of their total electricity supply in 2023. France exemplifies the sector’s prominence, deriving 65% of its national electricity from nuclear power, while the Slovak Republic exceeds 60%. In contrast, the United States, despite operating the world’s largest fleet of nuclear reactors (94 units), derives under 20% of its electricity from nuclear sources. These figures underscore the strategic integration of nuclear energy into advanced economies as a means to enhance grid reliability and achieve substantial emissions reductions.

Conversely, emerging markets and developing economies (EMDEs) exhibit more selective adoption patterns for nuclear energy, influenced by financial, infrastructural, and policy considerations. Nuclear energy accounted for a modest 5% of total electricity generation across these regions in 2023, with several notable exceptions. Ukraine relies on nuclear power for approximately 50% of its electricity, while Belarus reports a nuclear share exceeding 35%. Other EMDEs with significant nuclear footprints include Armenia, the United Arab Emirates, Russia, and Pakistan, each surpassing 10% in national electricity contributions. These divergent adoption patterns reflect the complex interplay of regional priorities, resources, and institutional capacities in shaping nuclear energy’s role within diverse contexts.

Beyond its contributions to electricity generation, nuclear energy has proven adaptable to a broader spectrum of applications, particularly within industrial and environmental domains. In advanced economies, nuclear reactors are increasingly employed to supply high-temperature process heat for energy-intensive industries such as chemical manufacturing and steel production. This application not only reduces reliance on fossil fuels but also enhances operational efficiency and sustainability. Additionally, nuclear energy is gaining traction in desalination projects, addressing acute water scarcity issues in arid regions by providing a cost-effective and energy-efficient solution for large-scale freshwater production.

The investment landscape surrounding nuclear energy reflects a dual narrative of opportunities and challenges. Global investment in nuclear infrastructure surged to an estimated USD 65 billion in 2023, nearly doubling the levels recorded a decade prior. This revitalization has been spurred by a confluence of factors, including technological advancements, supportive policy frameworks, and growing recognition of nuclear energy’s pivotal role in clean energy transitions. Nonetheless, nuclear projects remain capital-intensive, characterized by substantial upfront costs and extended development timelines. Innovative financial models, such as green bonds and regulated asset base (RAB) mechanisms, have emerged as potential enablers for attracting private capital while mitigating project-specific risks.

Emerging technological advancements are poised to reshape the nuclear energy sector profoundly. The integration of advanced digital tools, including artificial intelligence (AI) and machine learning, into reactor management systems offers the potential to enhance operational safety, streamline maintenance, and optimize performance. These innovations directly address long-standing concerns regarding operational risks, positioning nuclear power as a technologically progressive and resilient energy solution. Concurrently, the development and deployment of next-generation reactors, notably small modular reactors (SMRs), represent a paradigm shift in nuclear energy scalability and accessibility. With capacities ranging between 50 and 300 megawatts (MW), SMRs are uniquely suited for deployment in remote or decentralized grids, offering tailored solutions to localized energy needs.

Governments and international institutions are increasingly acknowledging nuclear energy’s strategic value in meeting global climate objectives and ensuring energy security. Collaborative initiatives and knowledge-sharing platforms are pivotal in addressing persistent challenges, including public skepticism, regulatory complexities, and workforce development gaps. By fostering synergies between public and private stakeholders, the nuclear industry can overcome these barriers and solidify its role as an indispensable component of the global energy system.

Nuclear Combined Heat and Power: Expanding Efficiency and Utility

The application of nuclear energy extends far beyond electricity generation, with nuclear combined heat and power (CHP) systems exemplifying the versatility and efficiency of this technology. By simultaneously producing electricity and harnessing thermal energy from nuclear reactors, CHP systems offer an integrated approach that minimizes primary energy losses and maximizes output utility. This dual-purpose functionality is particularly significant in enhancing resource efficiency and addressing diverse energy demands.

Nuclear CHP systems capitalize on the inherent advantages of fission heat to reduce energy conversion losses, particularly when the direct use of thermal energy is prioritized. As of 2024, approximately 70 nuclear reactors worldwide support co-generation applications, underscoring the global relevance of this technology. These reactors provide process heat at varying temperatures suitable for district heating networks, seawater desalination, and selected industrial processes, such as paper production and chemical manufacturing. The scope of nuclear CHP, however, is influenced by the technical parameters of reactor designs and the specific temperature requirements of the intended applications.

Historical precedents demonstrate the longstanding viability of nuclear district heating. Notable examples include the Ågesta reactor in Sweden and the Calder Hall plant in the United Kingdom, both of which commenced operations in the 1960s, integrating heat supply for local networks alongside electricity production. By 2024, nuclear district heating systems have expanded to several countries, including Bulgaria, the Czech Republic, Hungary, Romania, Russia, Switzerland, and Ukraine. The Haiyang nuclear power plant in China serves as a contemporary model of large-scale nuclear district heating, operating since 2020. Its expansive pipeline infrastructure is set to provide heating to one million residents, showcasing economic and environmental benefits. During the 2021 fossil fuel price surge, Haiyang’s heating costs remained markedly lower, further validating the system’s cost-effectiveness.

Future projects also highlight the economic and environmental potential of nuclear district heating. In the Czech Republic, the Dukovany II nuclear plant will supply heat to Brno, covering 50% of the city’s heating demand and reducing consumer costs by an estimated 15%. Construction of this project—valued at USD 800 million—is slated to commence in 2027, with heat deliveries anticipated by 2031. Such initiatives reflect the growing alignment of nuclear technology with urban infrastructure modernization and decarbonization goals.

Beyond district heating, nuclear co-generation has emerged as a promising solution to the escalating global demand for desalinated water. With freshwater scarcity intensifying, the energy-intensive process of seawater desalination—estimated to consume 2,000 petajoules globally in 2023—is projected to double by 2030. Nuclear-powered desalination systems offer a sustainable alternative, leveraging low-carbon heat to produce potable water efficiently. Operational facilities in China, India, Egypt, and Russia exemplify the viability of this approach. India’s nuclear desalination plant, currently the largest of its kind, is scheduled for decommissioning in 2028 after a 25-year lifespan. Plans are underway to establish two replacement facilities, underscoring the country’s commitment to nuclear-driven desalination. Similarly, the Tianwan nuclear plant in China supports desalination alongside power generation, while Pakistan’s retrofitted KANUPP-1 reactor demonstrated the feasibility of nuclear desalination until its decommissioning in 2021.

In addition to addressing water scarcity, nuclear CHP systems contribute to industrial decarbonization by supplying low-carbon heat to energy-intensive processes. Switzerland’s Gösgen nuclear plant, for instance, provides steam at 220 °C to a nearby cardboard manufacturing facility, demonstrating the adaptability of nuclear energy to industrial applications. Advanced reactor designs, capable of generating heat at temperatures exceeding 800 °C, are poised to expand the range of potential applications further, enabling support for hydrogen production, advanced material processing, and chemical synthesis. The Qinshan nuclear power plant in China exemplifies this trajectory, with ongoing projects to supply industrial heat and district heating, expected to reach completion by 2025.

These advancements underline the transformative potential of nuclear CHP systems. By integrating cutting-edge reactor technologies with urban and industrial energy systems, nuclear co-generation serves as a cornerstone of sustainable energy transitions. Its ability to address multifaceted energy challenges—spanning urban heating, water security, and industrial decarbonization—positions nuclear CHP as a critical component of global strategies to achieve energy efficiency and resilience.

Image : Share of nuclear energy in total electricity generation by country, 2023 – source : IEA

| Aspect | Description |

|---|---|

| Definition of Nuclear CHP | Nuclear Combined Heat and Power (CHP) systems simultaneously generate electricity and utilize the thermal energy produced during nuclear fission. These systems maximize primary energy efficiency by reducing conversion losses, especially when thermal energy is the primary output. By directly using heat from fission processes, nuclear CHP avoids unnecessary waste and enhances resource utilization. |

| Global Utilization | Approximately 70 nuclear reactors worldwide are currently dedicated to nuclear co-generation, delivering both electricity and heat for various applications. These reactors predominantly serve district heating, seawater desalination, and low-temperature industrial processes, leveraging existing reactor technologies such as light water reactors (LWRs) and heavy water reactors. These systems provide heat at temperatures below 150°C, suitable for specific industrial and residential purposes. |

| Historical Examples | Nuclear district heating has been operational since the 1960s, with pioneering projects such as the Ågesta reactor in Sweden and Calder Hall in the United Kingdom. These reactors supplied heat to local networks in addition to generating electricity, demonstrating the feasibility of integrating nuclear power into urban heating systems. |

| Modern Applications | Countries such as Bulgaria, the Czech Republic, Hungary, Romania, Russia, Switzerland, and Ukraine have established nuclear district heating networks. Notable recent projects include China’s Haiyang nuclear plant, which began providing heat to up to one million residents through a 23-kilometer pipeline starting in 2020. This project demonstrated cost-efficiency during the 2021 fossil fuel price surge, as heating costs in Haiyang were significantly lower than in other regions. |

| Economic Impact | The Dukovany II power plant in the Czech Republic exemplifies the financial and consumer benefits of nuclear district heating. Scheduled for completion in 2031, the plant will supply 50% of Brno’s heating needs, reducing consumer heating costs by approximately 15%. The total project cost is estimated at USD 800 million, highlighting the economic viability of integrating nuclear energy into urban heating infrastructure. |

| Desalination Potential | Nuclear co-generation is increasingly utilized for seawater desalination, addressing the growing global demand for freshwater. In 2023, global desalination energy consumption reached 2,000 petajoules, with projections indicating a near doubling by 2030. Countries such as India, China, Egypt, and Russia have implemented nuclear desalination systems. India operates the world’s largest nuclear desalination plant, though it is scheduled for decommissioning by 2028 after 25 years of operation. Replacement facilities are already planned. |

| Industrial Applications | Nuclear co-generation supports low-temperature industrial processes, offering sustainable alternatives to fossil-based heat. Switzerland’s Gösgen nuclear plant supplies steam at 220°C to a cardboard manufacturing facility, reducing emissions and enhancing efficiency. In China, the Qinshan nuclear plant provides heat for industrial parks, public facilities, and residential heating, with project completion expected by 2025. Advanced reactor designs capable of exceeding 800°C output temperatures promise expanded applications, including hydrogen production and advanced material processing. |

| Technological Advancements | Advanced nuclear reactor designs are in development to expand the range of nuclear CHP applications. High-temperature reactors capable of producing heat above 800°C offer potential for diverse industrial uses, such as chemical synthesis and hydrogen production. Integration of digital tools, such as artificial intelligence and machine learning, is enhancing reactor safety, efficiency, and maintenance, positioning nuclear CHP as a forward-looking solution for sustainable energy challenges. |

| Environmental Benefits | By leveraging low-carbon heat, nuclear CHP systems contribute significantly to reducing greenhouse gas emissions. This approach minimizes reliance on fossil fuels for heating and desalination, aligning with global decarbonization goals. Projects like Haiyang and Dukovany II demonstrate the capacity of nuclear CHP to deliver cost-effective, environmentally sustainable energy solutions at scale. |

Age Dynamics of Global Nuclear Fleets and Strategic Implications

The operational age of nuclear reactors varies significantly across global regions, reflecting disparities in historical adoption timelines, infrastructure development, and policy frameworks. This age distribution not only influences the current performance and safety profiles of nuclear fleets but also dictates future strategies for reactor upgrades, decommissioning, and the construction of new facilities. These age-related factors underscore the urgent need for targeted investments to sustain and modernize nuclear capabilities while ensuring their alignment with emerging energy demands and decarbonization goals.

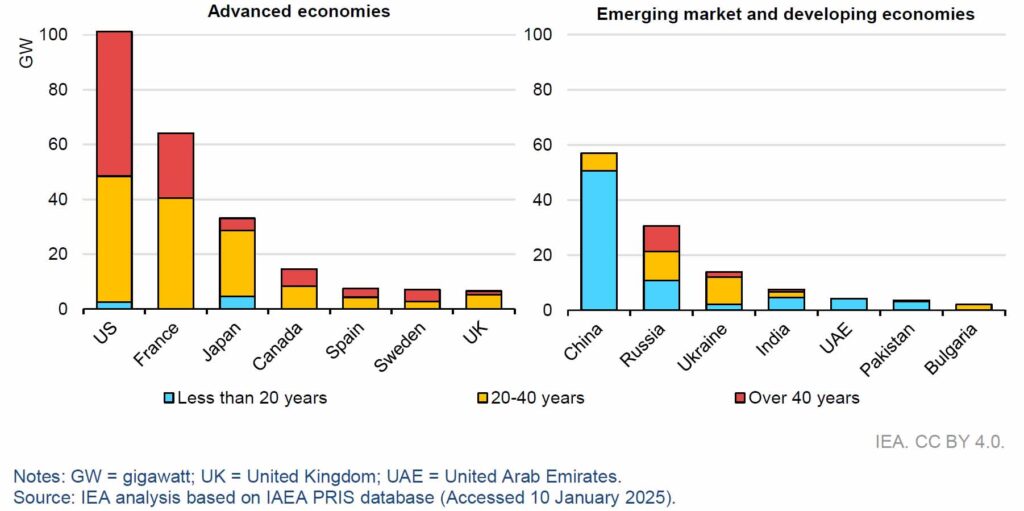

In advanced economies, the average operational age of nuclear reactors exceeded 36 years by the end of 2023. Over one-third of these reactors have been in operation for more than 40 years, with the majority having operational lifespans of between 20 and 40 years. Only a minor fraction—under 10%—of reactors in advanced economies are less than two decades old. These figures underscore the maturity of nuclear fleets in developed regions, where initial adoption occurred during earlier waves of energy diversification and technological exploration.

The United States, as the world’s largest producer of nuclear energy, exemplifies the aging dynamic with an average reactor age of 41 years. This advanced fleet, established during the 1970s and 1980s, operates under stringent licensing regimes, predominantly 40-year permits. Extensions to these operational licenses are increasingly essential to maintain the fleet’s contributions to national energy security and carbon reduction objectives. France, the second-largest nuclear energy producer globally, maintains a slightly younger average fleet age of 37 years, while Japan’s reactors—following significant safety overhauls and regulatory reforms—average 32 years of operation.

In stark contrast, the nuclear fleets of emerging market and developing economies (EMDEs) present a substantially younger profile, averaging less than 18 years of operational age. China’s rapid expansion of its nuclear program has positioned the country as the third-largest operator of nuclear reactors globally, with an average fleet age of just nine years. This youthfulness reflects the country’s aggressive investment in advanced reactor designs and its strategic commitment to low-carbon energy generation. Similarly, nations such as India, the United Arab Emirates, and Pakistan boast younger nuclear fleets, aligning with their more recent entry into the nuclear energy sector and their ambitions to expand clean energy capacity.

By comparison, Eastern European and Eurasian regions present a mixed profile. Approximately one-third of Russia’s nuclear reactors have surpassed 40 years of operation, requiring ongoing maintenance and upgrades to ensure continued safety and performance. Ukraine’s nuclear fleet, pivotal to its national energy strategy, also demonstrates significant aging, with an average operational age exceeding 30 years. These dynamics emphasize the critical role of lifetime extension projects and advanced safety protocols in regions where aging infrastructure forms the backbone of energy security.

The advanced age of reactors in many economies necessitates a proactive approach to lifetime extension initiatives. Extending operational licenses by an additional 10 to 20 years typically involves comprehensive refurbishment and modernization efforts, addressing key systems such as pressure vessels, control rods, and cooling mechanisms. These upgrades not only enhance the safety and efficiency of aging reactors but also defer the high costs and extended timelines associated with new reactor construction. For instance, life-extension projects in the United States have proven cost-effective, providing stable electricity supplies at competitive rates while avoiding the economic disruptions of premature reactor closures.

Conversely, regions with younger nuclear fleets face different challenges and opportunities. Countries like China and the United Arab Emirates are leveraging their relatively modern infrastructure to incorporate advanced technologies, including small modular reactors (SMRs) and next-generation designs, which promise enhanced safety, scalability, and efficiency. The strategic deployment of these technologies in younger fleets positions these nations as global leaders in the future of nuclear energy innovation.

The interplay between aging reactors in advanced economies and youthful fleets in emerging regions reflects broader trends in global energy transitions. Older fleets require significant investment to remain operational and to contribute to decarbonization goals. At the same time, emerging economies must navigate the complexities of integrating cutting-edge technologies with existing energy infrastructures. Coordinated international efforts, including technology transfer, regulatory harmonization, and joint ventures, will be crucial in addressing these diverse challenges and ensuring the sustainable evolution of global nuclear energy systems.

Image : Installed nuclear power capacity by country and age, end-2023 – source IEA

Recent Developments in the Nuclear Market: Shifting Leadership and Construction Dynamics

The nuclear energy landscape has undergone profound changes in recent years, characterized by a pronounced shift in leadership and construction activities from advanced economies to emerging markets. This evolution reflects significant disparities in technological innovation, project execution capabilities, and regulatory environments across regions. These trends have not only reshaped the distribution of nuclear energy production but also introduced new challenges and opportunities for global energy transitions.

Emergence of China and Russia as Technological Leaders

By the end of 2024, the global nuclear market had become increasingly dominated by China and Russia, as advanced economies grappled with aging infrastructure, limited new reactor construction, and regulatory hurdles. Despite holding two-thirds of global nuclear capacity, advanced economies accounted for only four of the 52 reactors whose construction commenced between 2017 and 2024. These were two reactors in the United Kingdom utilizing European designs and two reactors in Korea employing domestic technology. By contrast, China and Russia accounted for the vast majority of new projects, with 25 Chinese and 23 Russian-designed reactors under construction during the same period.

This concentration of construction activities among Chinese and Russian developers highlights the waning diversity of reactor designs in the global market. Such dominance poses potential risks to innovation and market competitiveness, as future development could be constrained by the limited number of active technology providers. As of the close of 2024, 63 nuclear reactors were under construction worldwide, representing a combined capacity of 71 GW. China alone accounted for nearly half of this total, with 29 reactors under construction providing 33 GW of capacity. Among these projects, most were based on Chinese designs, complemented by four reactors of Russian origin.

Russia also reinforced its position as the leading exporter of nuclear technology, with 23 GW of reactors under construction in six countries, including Türkiye, Egypt, Bangladesh, and Ukraine. Domestically, Russia had an additional 4 GW of reactor capacity under construction. India, Türkiye, and Egypt further contributed to the global construction landscape, with each nation hosting around 5 GW of capacity, primarily leveraging Russian designs.

Image: Nuclear power plant construction starts by national origin of technology, 2017-2024 – source IEA

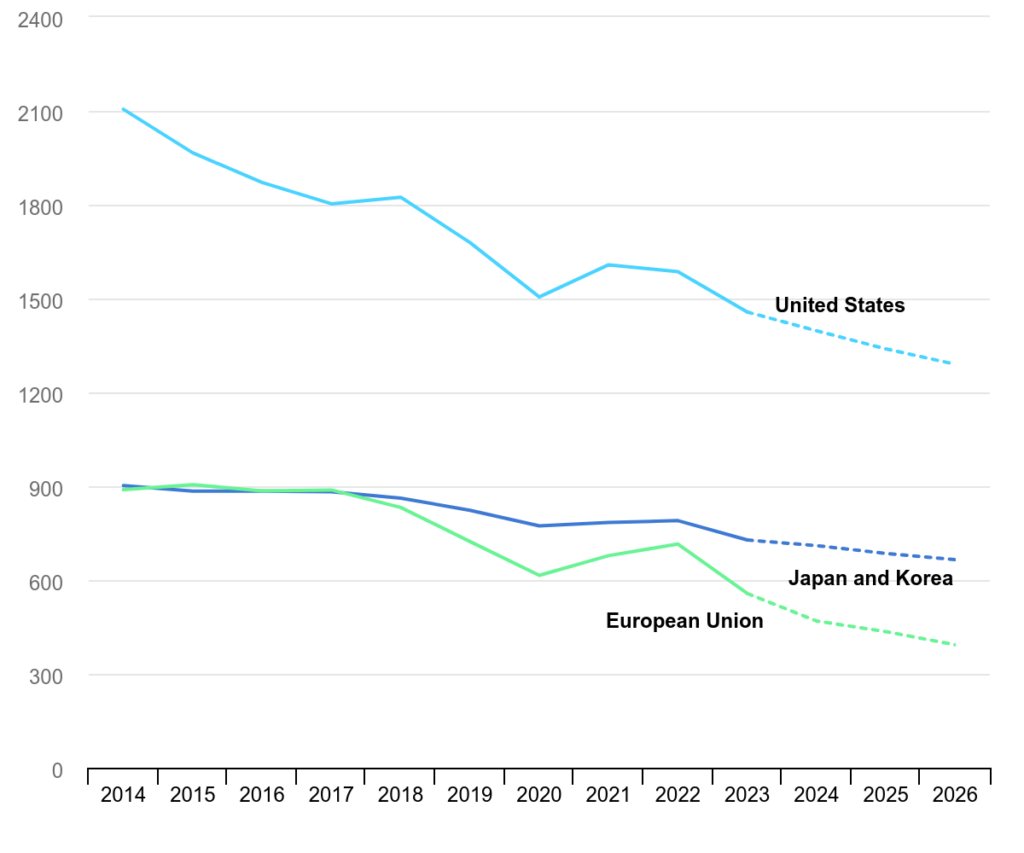

In stark contrast to the activity in emerging markets, advanced economies have witnessed a steady decline in nuclear energy’s share of total electricity generation. This decline, from 24% in 2001 to 17% in 2023, reflects a combination of factors, including aging reactor fleets, insufficient new construction, and decisions to phase out nuclear power. The European Union exemplifies this trend, with nuclear’s contribution to electricity generation falling from a peak of 34% in 1997 to 23% by 2023. Similarly, in the United States, nuclear power’s share has remained stagnant at approximately 20% for two decades, despite a marginal 3% increase in absolute generation over the same period.

Japan’s nuclear trajectory illustrates the severe impacts of regulatory and public perception challenges. Following the Fukushima Daiichi disaster in 2011, the nation’s nuclear share plummeted from 25% to zero, recovering to only 10% by 2023 as reactors gradually returned to service under stringent safety standards. This recovery underscores the difficulties faced by advanced economies in revitalizing nuclear power amidst public opposition and complex regulatory landscapes.

Challenges in Construction Timelines and Costs

The construction of nuclear power plants in advanced economies has been increasingly characterized by delays and cost overruns, exacerbating the financial and operational challenges of deploying new reactors. On average, building a nuclear reactor globally has taken seven years since 2000, with advanced economies often exceeding this timeline. High-profile projects, such as the Vogtle Units 3 and 4 in the United States, illustrate these challenges. Originally estimated at USD 5,600 per kilowatt (kW) in 2023 terms, the project’s costs escalated to USD 14,700/kW, with completion timelines extending to over a decade.

European projects have faced similar issues. Finland’s Olkiluoto 3, initially slated for completion in 2009, became operational only in 2022 after significant delays and cost increases, with final costs reaching USD 7,200/kW. The United Kingdom’s Hinkley Point C project has seen its budget rise from USD 8,700/kW to USD 16,000/kW, with the timeline extending to 2029-2031. France’s Flamanville 3 project, which came online in 2024, experienced a 12-year delay and cost escalation from USD 3,200/kW to USD 11,000/kW. These setbacks have been attributed to regulatory changes, supply chain disruptions, and the challenges associated with deploying new reactor designs.

Efficiency in Emerging Markets

By contrast, emerging markets have demonstrated greater efficiency in nuclear construction. China, in particular, has completed several large-scale reactor projects within an average of seven years, including first-of-a-kind designs. Some projects were completed in as little as five years, reflecting streamlined regulatory processes and robust project management. Korea’s Saeul 1 and 2 reactors similarly achieved completion with moderate delays and cost increases, with costs reaching USD 2,700/kW. The Barakah nuclear plant in the United Arab Emirates represents another example of efficient execution, with minimal cost overruns and delays comparable to those in Korea.

Strategic Implications

The contrasting experiences of advanced economies and emerging markets in nuclear construction underscore the critical importance of policy frameworks, workforce expertise, and industrial readiness. Advanced economies face the dual challenge of modernizing aging fleets and rebuilding nuclear industrial bases after decades of limited new construction. Emerging markets, leveraging younger fleets and integrated project management approaches, are poised to lead the next phase of nuclear energy development.

Addressing these disparities will require international collaboration, targeted investments in R&D, and the development of standardized, scalable reactor designs. By aligning technical capabilities with policy support, the global nuclear industry can overcome its current challenges and unlock its potential as a cornerstone of sustainable energy transitions.

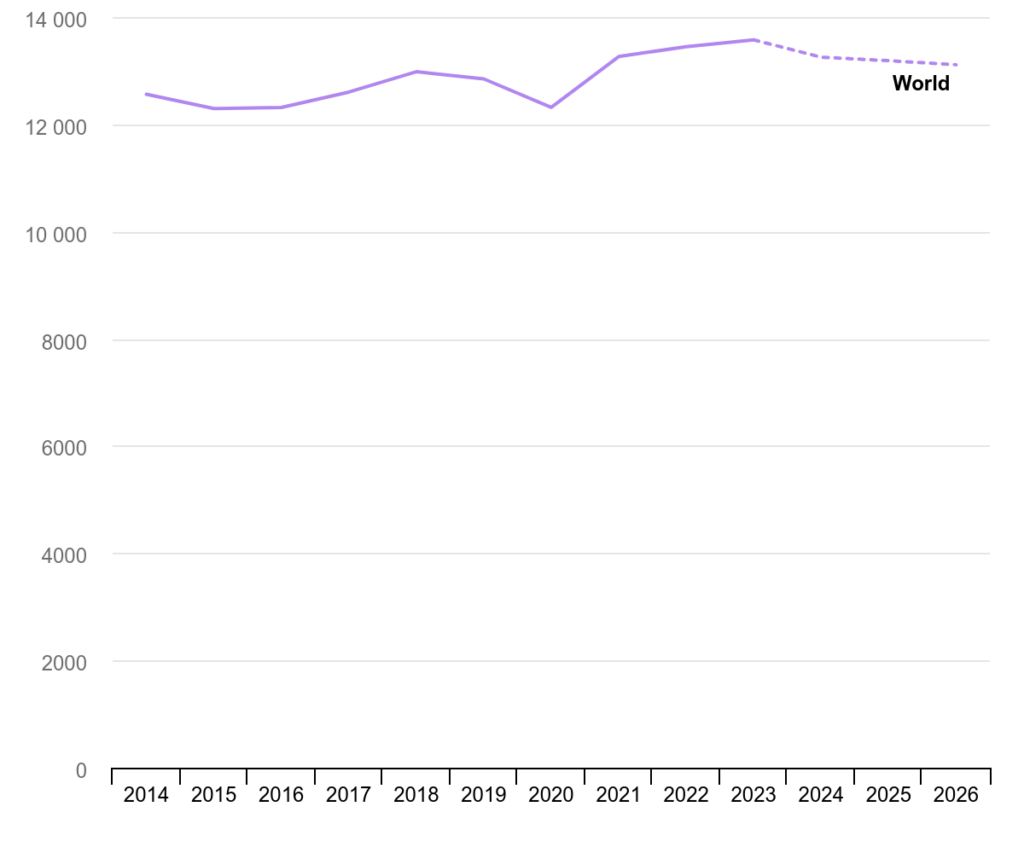

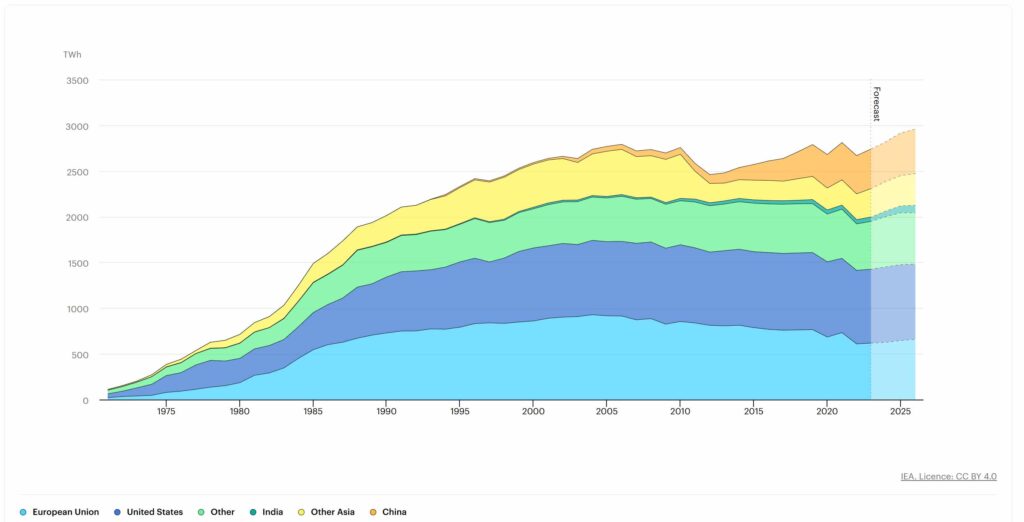

Nuclear Power Generation: Breaking Records and Driving Global Energy Security

The trajectory of global nuclear power generation is poised for a historic milestone, with projections indicating a record-high output by 2025. This growth underscores the resilience and adaptability of nuclear energy in the face of geopolitical, environmental, and economic challenges. The forecasted average annual increase of nearly 3% in nuclear generation through 2026 is a testament to the sector’s capacity to address pressing global energy needs while contributing significantly to decarbonization efforts. This acceleration is facilitated by strategic initiatives, technological advancements, and coordinated international commitments to expand nuclear energy’s footprint.

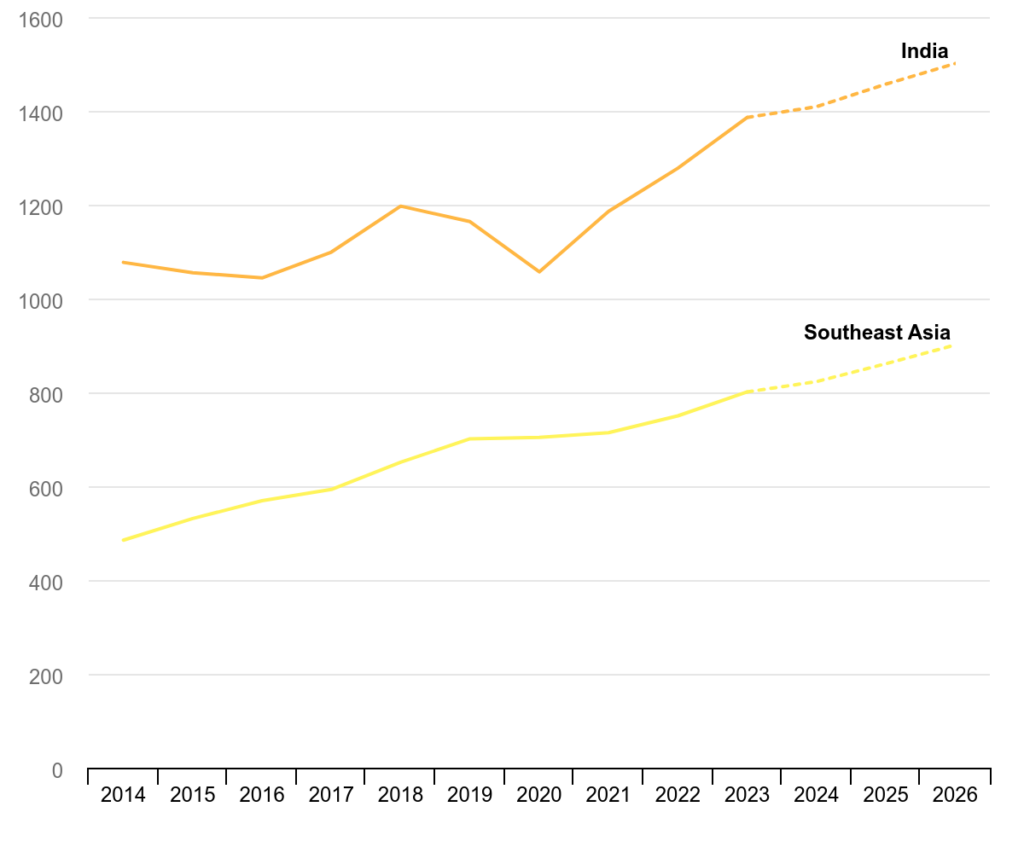

Critical to this expansion is the resolution of maintenance bottlenecks and the strategic reactivation of dormant facilities. In France, extensive maintenance and upgrades are expected to restore full operational capacity to its nuclear fleet, addressing disruptions that previously constrained output. Similarly, Japan’s phased restart of nuclear plants, following rigorous safety enhancements, marks a pivotal turnaround in the country’s energy policy, bolstering its capacity to meet domestic electricity demand while reducing reliance on imported fossil fuels. Concurrently, the initiation of new reactors in key markets—notably China, India, Korea, and parts of Europe—is set to drive significant capacity additions, reinforcing nuclear energy’s role as a cornerstone of energy security and climate strategy.

The momentum behind nuclear energy has been further solidified by high-profile international agreements and declarations. At the COP28 climate conference in December 2023, over 20 nations endorsed a collective commitment to tripling global nuclear capacity by 2050. This ambitious target necessitates concerted efforts to overcome persistent challenges, particularly those associated with construction timelines, regulatory compliance, and financing complexities. Addressing these hurdles will require innovative approaches to project execution and risk management, alongside enhanced collaboration between governments, private sector stakeholders, and financial institutions.

Asia’s ascendance as the epicenter of nuclear energy growth is a defining feature of the current global landscape. By 2026, the region is projected to account for 30% of worldwide nuclear generation, surpassing North America to become the leader in installed nuclear capacity. This shift is underpinned by substantial investments in new reactor projects across the continent, with China and India leading the charge. Collectively, these two nations are expected to bring more than half of all new reactors online during the outlook period, underscoring their pivotal role in shaping the future of nuclear energy.

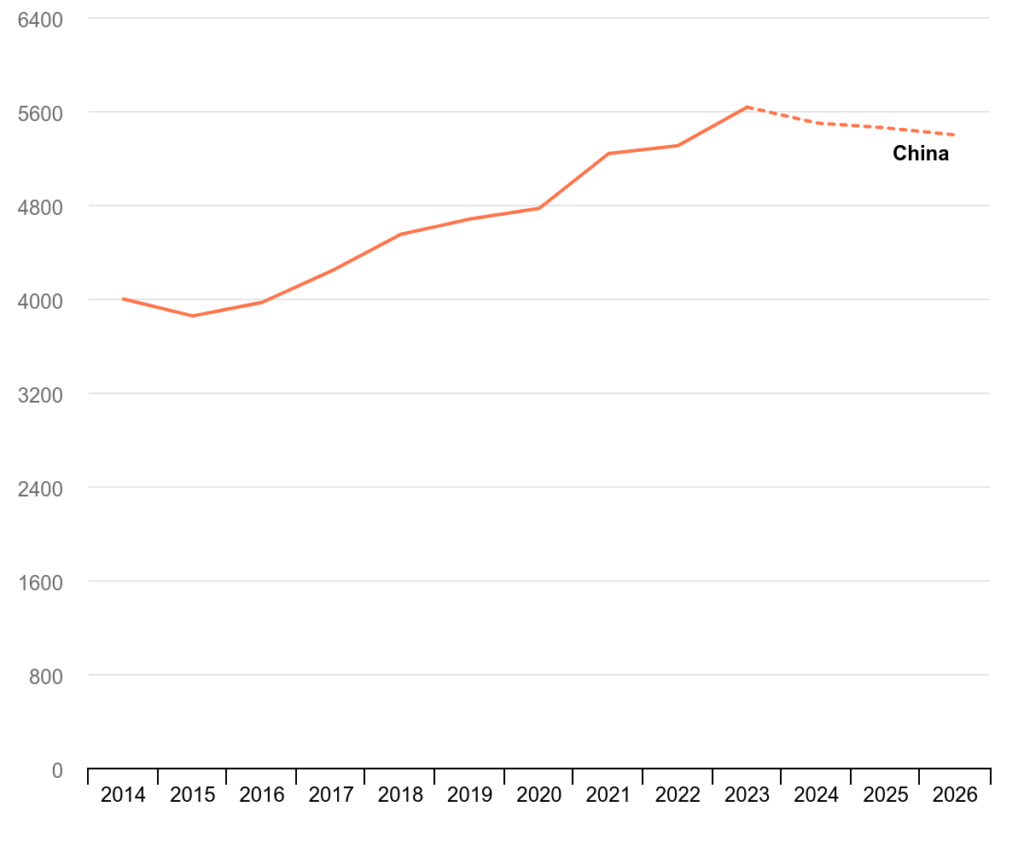

China’s achievements in nuclear power are particularly noteworthy, with capacity additions of 37 GW over the past decade representing nearly two-thirds of its current nuclear capacity. This rapid expansion has elevated China’s share of global nuclear generation from 5% in 2014 to approximately 16% by 2023. The commercial operation of China’s first fourth-generation reactor in December 2023 highlights the nation’s leadership in cutting-edge nuclear technology, setting new benchmarks for safety, efficiency, and environmental performance.

India’s nuclear program, while less expansive than China’s, remains a critical component of its energy strategy. With multiple reactors under construction, India is poised to make significant contributions to global capacity growth. These developments align with the country’s broader goals of enhancing energy independence, diversifying its energy mix, and reducing greenhouse gas emissions. Meanwhile, Korea continues to build on its reputation for efficient and cost-effective reactor construction, further cementing its role as a key player in the global nuclear market.

The burgeoning interest in small modular reactors (SMRs) adds another dimension to the nuclear energy landscape. Although still in the early stages of development and deployment, SMRs represent a transformative opportunity for the sector. Their modular design and smaller footprint offer scalability, flexibility, and reduced financial risk, making them particularly attractive for emerging markets and regions with limited grid infrastructure. Ongoing research and development efforts are expected to accelerate the commercialization of SMRs, unlocking new applications and broadening the accessibility of nuclear technology.

This dynamic environment underscores the necessity for coordinated global efforts to ensure that nuclear power achieves its full potential as a reliable, scalable, and sustainable energy source. By addressing the challenges associated with financing, construction, and public acceptance, the nuclear industry can deliver on its promise to meet the dual imperatives of energy security and climate mitigation. The record-breaking growth anticipated by 2025 is not merely a testament to the sector’s capabilities but a call to action for sustained investment and innovation in the decades to come.

Image:Evolution of nuclear power generation by region, 1972-2026 – source IEA

| Year | European Union | United States | Other | India | Other Asia | China |

| 1971 | 22 | 41 | 39 | 1 | 8 | 0 |

| 1972 | 34 | 58 | 50 | 1 | 10 | 0 |

| 1973 | 40 | 89 | 62 | 2 | 10 | 0 |

| 1974 | 47 | 121 | 82 | 2 | 20 | 0 |

| 1975 | 79 | 184 | 93 | 3 | 26 | 0 |

| 1976 | 92 | 203 | 108 | 3 | 35 | 0 |

| 1977 | 113 | 266 | 123 | 2 | 32 | 0 |

| 1978 | 136 | 293 | 130 | 3 | 65 | 0 |

| 1979 | 152 | 270 | 143 | 3 | 80 | 0 |

| 1980 | 185 | 266 | 165 | 3 | 94 | 0 |

| 1981 | 266 | 289 | 182 | 3 | 102 | 0 |

| 1982 | 291 | 300 | 195 | 2 | 119 | 0 |

| 1983 | 346 | 311 | 228 | 4 | 142 | 0 |

| 1984 | 452 | 347 | 277 | 4 | 171 | 0 |

| 1985 | 545 | 407 | 326 | 5 | 205 | 0 |

| 1986 | 601 | 439 | 329 | 5 | 224 | 0 |

| 1987 | 627 | 483 | 358 | 5 | 261 | 0 |

| 1988 | 671 | 559 | 402 | 6 | 250 | 0 |

| 1989 | 705 | 561 | 405 | 5 | 259 | 0 |

| 1990 | 729 | 612 | 378 | 6 | 288 | 0 |

| 1991 | 749 | 649 | 396 | 6 | 305 | 0 |

| 1992 | 751 | 656 | 396 | 7 | 314 | 0 |

| 1993 | 773 | 647 | 421 | 5 | 342 | 2 |

| 1994 | 770 | 679 | 409 | 6 | 363 | 15 |

| 1995 | 792 | 714 | 411 | 8 | 394 | 13 |

| 1996 | 831 | 715 | 433 | 9 | 414 | 14 |

| 1997 | 839 | 666 | 430 | 10 | 433 | 14 |

| 1998 | 833 | 714 | 413 | 12 | 459 | 14 |

| 1999 | 848 | 772 | 424 | 13 | 458 | 15 |

| 2000 | 860 | 798 | 428 | 17 | 472 | 17 |

| 2001 | 889 | 793 | 449 | 19 | 470 | 17 |

| 2002 | 902 | 805 | 454 | 19 | 455 | 25 |

| 2003 | 907 | 788 | 469 | 18 | 410 | 43 |

| 2004 | 928 | 813 | 473 | 17 | 455 | 50 |

| 2005 | 916 | 811 | 477 | 17 | 494 | 53 |

| 2006 | 914 | 816 | 493 | 19 | 494 | 55 |

| 2007 | 872 | 837 | 481 | 17 | 450 | 62 |

| 2008 | 885 | 838 | 476 | 15 | 452 | 68 |

| 2009 | 825 | 830 | 480 | 19 | 472 | 70 |

| 2010 | 854 | 839 | 481 | 26 | 482 | 74 |

| 2011 | 838 | 821 | 501 | 32 | 304 | 86 |

| 2012 | 812 | 801 | 506 | 33 | 211 | 97 |

| 2013 | 806 | 822 | 510 | 34 | 195 | 112 |

| 2014 | 813 | 831 | 519 | 36 | 205 | 133 |

| 2015 | 787 | 830 | 530 | 37 | 215 | 171 |

| 2016 | 768 | 840 | 531 | 38 | 219 | 213 |

| 2017 | 759 | 839 | 538 | 38 | 214 | 248 |

| 2018 | 762 | 841 | 538 | 38 | 236 | 294 |

| 2019 | 765 | 843 | 534 | 45 | 253 | 348 |

| 2020 | 684 | 823 | 521 | 45 | 240 | 366 |

| 2021 | 732 | 812 | 538 | 44 | 276 | 408 |

| 2022 | 609 | 804 | 508 | 46 | 282 | 418 |

| 2023 | 618 | 808 | 523 | 48 | 311 | 433 |

| 2024 | 626 | 825 | 550 | 62 | 322 | 435 |

| 2025 | 645 | 830 | 567 | 76 | 330 | 467 |

| 2026 | 660 | 822 | 560 | 82 | 348 | 486 |

Table Evolution of nuclear power generation by region, 1972-2026 – copyright debugliesintel.com

Drivers of Renewed Interest in Nuclear Energy: Policy and Technological Catalysts

The global resurgence of nuclear energy interest reflects a strategic realignment of energy policies and technological advancements that are reshaping the sector. This revival is characterized by the dual objectives of enhancing energy security and accelerating the transition to low-carbon power systems. The growing demand for reliable, around-the-clock energy—driven by the increasing electrification of economies and the rise of data centers—has amplified the role of nuclear power as a cornerstone of energy strategies worldwide.

Strengthened Policy Support as a Catalyst for Nuclear Expansion

Policy frameworks are increasingly recognizing the critical role of nuclear energy in achieving clean energy transitions and reinforcing energy security. Recent legislative and regulatory developments across multiple countries demonstrate a robust commitment to supporting both the extension of existing nuclear reactors and the construction of new facilities.

Key policy milestones include the authorization of lifetime extensions for 64 reactors across 13 countries over the past five years, representing a total capacity of approximately 65 GW, or 15% of the global nuclear fleet. These extensions reflect a growing consensus on the economic and environmental value of maintaining existing nuclear capacity while new reactors are developed.

United States: The Inflation Reduction Act has significantly enhanced the economic viability of nuclear energy by extending clean energy tax incentives to operating reactors. As of 2024, all U.S. reactors that have been operational for at least 30 years have applied for an additional 20-year operating license, with over 20% pursuing a second 20-year extension. In total, 22 operational reactors have submitted applications for lifetime extensions in the past five years, solidifying nuclear’s role in the country’s decarbonization efforts.

Japan: Legislative reforms under the Green Transformation (GX) initiative have redefined the operational timelines for nuclear reactors. The Electricity Business Act was revised in 2023 to exclude periods when reactors were offline due to unforeseeable circumstances, allowing them to operate beyond 60 years. Additionally, the Long-Term Decarbonised Capacity Auction, introduced in 2023, guarantees fixed income for decarbonized power sources, covering operational costs and incentivizing investments in nuclear power.

France: The Grand Carénage project represents a comprehensive initiative to modernize the country’s nuclear fleet. As part of this strategy, France confirmed plans in 2021 to extend the operational lifetimes of all 20 reactors with 1,300 MW capacity each. These measures underscore France’s commitment to maintaining its leadership in nuclear energy within Europe.

Europe: Several European countries have announced substantial investments in extending reactor operations. Belgium is extending reactors with a combined capacity of 2.2 GW, Hungary and the Czech Republic are each extending 2.0 GW, Finland and Spain 1.1 GW each, Romania 0.7 GW, and the Netherlands 0.5 GW. These initiatives reflect a broader regional commitment to leveraging nuclear energy as a critical component of clean energy transitions.

Emerging Markets: Mexico and South Africa have each committed to extending the lifetimes of reactors that represent half of their respective nuclear capacities. These decisions highlight the growing role of nuclear energy in diversifying energy portfolios in emerging economies.

Commitments to Building New Capacity and Supporting SMRs

The expansion of nuclear energy is not limited to extending existing reactors. More than 40 countries have announced plans to build new reactors or are actively considering doing so, including approximately 10 nations that currently lack nuclear capacity. In December 2023, over 20 countries pledged to collectively triple global nuclear capacity by 2050, with six additional nations joining the initiative at COP29 in 2024.

Small Modular Reactors (SMRs) are emerging as a focal point of nuclear innovation, with over 30 countries actively developing or considering the deployment of this technology. SMRs offer a scalable, cost-effective alternative to traditional large-scale reactors, making them particularly attractive for regions with limited grid infrastructure or lower energy demands.

Key Policy Developments Supporting SMRs:

- Canada: The Enabling Small Modular Reactors Program provides CAD 5 million (USD 3.7 million) in funding for SMR research and development projects, fostering innovation in reactor technology.

- France: The France 2030 Investment Plan allocates EUR 1 billion to the development of innovative reactors, including SMRs, reflecting the country’s commitment to maintaining its technological leadership in the nuclear sector.

- United States: The Advanced Reactor Demonstration Program commits over USD 3 billion to support the deployment of advanced reactors, including SMRs. This initiative aims to accelerate the commercialization of next-generation nuclear technologies.

The confluence of strengthened policy support, technological innovation, and international collaboration is driving a renewed focus on nuclear energy. By addressing challenges such as construction and financing risks, the industry is poised to play a pivotal role in meeting the global demand for clean, reliable, and scalable energy solutions.

Table 1.1 Recent decisions on lifetime extensions of existing reactors by country, 2019-2024

| Country | Decision | Total operating capacity (GW) | Recently extended capacity (GW) | Long- term plans |

| Armenia | A plan to extend lifetime of Armenian Unit 2 by 2036 | 0.4 | 0.4 | Expansion |

| Belgium | Lifetime extensions of the Doel 4 and Tihange 3 reactors for 10 years (to 2035) | 4.1 | 2.2 | Phase-out |

| Czech Republic | The four reactors at Dukovany are expected to obtain 20-year operating lifetime extensions to 2045-2047 | 4.2 | 2.0 | Expansion |

| Finland | Approval to extend the lifetime of the two- unit Loviisa power plant to the end of 2050 | 4.6 | 1.1 | Expansion |

| France | The Grand Carenage programme to extend the lifetime of all nuclear reactors beyond 40 years | 64.0 | 27.4 | Expansion |

| Hungary | Parliamentary approval of plans to further extend the lifetime of the four units of the Paks nuclear plant by 20 years | 2.0 | 2.0 | Expansion |

| Japan | The revised Electricity Business Act allows over 60 years of operation in some cases by excluding periods when reactors were suspended for safety reasons | 13.3 | 3.5 | Restart |

| Mexico | Plans to extend the lifetime of the 775 megawatt (MW) Unit 2 of the Laguna Verde nuclear power plant by 30 years to April 2055 | 1.6 | 0.8 | Expansion |

| Netherlands | Possible extension of the lifetime of the Borssele nuclear power plant | 0.5 | 0.5 | Expansion |

| Romania | Planned refurbishment of Cernavoda unit 1 to extend its operating lifetime to 60 years | 1.4 | 0.7 | Expansion |

| South Africa | Granting of licence for Koeberg unit 1 to continue operating for another 20 years to 2044 (Koeberg unit 2 is still under assessment) | 1.9 | 1.0 | Expansion |

| Spain | Extension of the operating licence of the Trillo nuclear power plant for 10 years to 2034 | 7.4 | 1.1 | Phase-out |

| United States | The Inflation Reduction Act provides a production tax credit to the existing fleet | 102.4 | 22.7 | Expansion |

Table 1.2 Recent policy decisions and nuclear energy developments in selected countries

| Country | Recent policy decisions and nuclear energy developments | SMR included |

| Countries with operational reactors | ||

| Argentina | CAREM (SMR) is currently under construction with a capacity of 25 MW | ● |

| Armenia | The construction of a new nuclear power plant by 2036 is under consideration | ● |

| Belarus | Belarusian Unit 2 started operation in 2023 and the country is considering additional reactors depending on future electricity demand growth | N/A |

| After a public consultation about the Angra 3 nuclear power plant, construction can restart after several stops in recent years | ||

| Brazil | ● | |

| Bulgaria | A plan to construct two AP1000 reactors with a total capacity of 2.3 GW, due to start operation from mid-2030s A memorandum of understanding (MoU) to explore the construction of an SMR in Bulgaria signed by NuScale Power (a US developer) and Kozloduy Nuclear Power Plant New Build (KNPP-NB) | ● |

| Canada | Announced up to CAD 50 million investment for Ontario’s new large-scale nuclear plant The Enabling Small Modular Reactors Program, which provides up to CAD 5 million of funding for R&D projects for SMRs | ● |

| China | The 14th Five-Year Plan (2021-2025), which targets nuclear capacity of 70 GW The development of the ACP100 SMR by China National Nuclear Corporation (CNNC), with completion by 2026 | ● |

| Czech Republic | Updated National Energy and Climate Plan, which includes a plan to continue the construction of a new nuclear plant in Dukovany by 2036 and consider other possible sites The Czech SMR Roadmap, which explores potential SMR deployment | ● |

| A total of 10 to 20 SMRs are currently under consideration in the country to produce both electricity and heat, with total thermal output of 1 GW to 3 GW | ||

| Finland | ● | |

| France | A plan to build six EPR2 reactors and consider the need for an additional eight EPR2 reactors France 2030 investment plan, which provides funding of EUR 1 billion to develop innovative reactors including SMRs, with the aim of building a first SMR in France by 2035 | ● |

| The Paks II nuclear power plant, comprising two reactors (1 200 MW each), is due to start construction in mid-2020s and come online in the early 2030s | ||

| Hungary | N/A | |

| India | National Electricity Plan 2023, which expects a total of about 13 GW of new nuclear capacity by 2032, with several reactors currently under construction The government has announced plans to develop SMRs in co-operation with the private sector | ● |

| The Atomic Energy Organization of Iran (AEOI) has announced the start of construction of a nuclear plant with a total of 5 GW | ||

| Iran | N/A |

| Country | Recent policy decisions and nuclear energy developments | SMR included |

| Countries with operational reactors | ||

| Argentina | CAREM (SMR) is currently under construction with a capacity of 25 MW | ● |

| Armenia | The construction of a new nuclear power plant by 2036 is under consideration | ● |

| Belarus | Belarusian Unit 2 started operation in 2023 and the country is considering additional reactors depending on future electricity demand growth | N/A |

| After a public consultation about the Angra 3 nuclear power plant, construction can restart after several stops in recent years | ||

| Brazil | ● | |

| Bulgaria | A plan to construct two AP1000 reactors with a total capacity of 2.3 GW, due to start operation from mid-2030s A memorandum of understanding (MoU) to explore the construction of an SMR in Bulgaria signed by NuScale Power (a US developer) and Kozloduy Nuclear Power Plant New Build (KNPP-NB) | ● |

| Canada | Announced up to CAD 50 million investment for Ontario’s new large-scale nuclear plant The Enabling Small Modular Reactors Program, which provides up to CAD 5 million of funding for R&D projects for SMRs | ● |

| China | The 14th Five-Year Plan (2021-2025), which targets nuclear capacity of 70 GW The development of the ACP100 SMR by China National Nuclear Corporation (CNNC), with completion by 2026 | ● |

| Czech Republic | Updated National Energy and Climate Plan, which includes a plan to continue the construction of a new nuclear plant in Dukovany by 2036 and consider other possible sites The Czech SMR Roadmap, which explores potential SMR deployment | ● |

| A total of 10 to 20 SMRs are currently under consideration in the country to produce both electricity and heat, with total thermal output of 1 GW to 3 GW | ||

| Finland | ● | |

| France | A plan to build six EPR2 reactors and consider the need for an additional eight EPR2 reactors France 2030 investment plan, which provides funding of EUR 1 billion to develop innovative reactors including SMRs, with the aim of building a first SMR in France by 2035 | ● |

| The Paks II nuclear power plant, comprising two reactors (1 200 MW each), is due to start construction in mid-2020s and come online in the early 2030s | ||

| Hungary | N/A | |

| India | National Electricity Plan 2023, which expects a total of about 13 GW of new nuclear capacity by 2032, with several reactors currently under construction The government has announced plans to develop SMRs in co-operation with the private sector | ● |

| The Atomic Energy Organization of Iran (AEOI) has announced the start of construction of a nuclear plant with a total of 5 GW | ||

| Iran | N/A |

| Country | Recent policy decisions and nuclear energy developments | SMR included |

| Japan | The country is progressively restarting reactors; TAKAHAMA-1 and TAKAHAMA- 2 (with a combined capacity of about 1.7 GW) restarted commercial operation in 2023; ONAGAWA-2 and SHIMANE-2 (with a combined capacity of about 1.6 GW) restarted in 2024 | ● |

| Korea | Shin Hanul Unit 2 started its operation in 2024 with a capacity of 1.4 GW 10th Basic Plan for Long-term Electricity Supply and Demand, which aims to increase the share of nuclear in total electricity generation to over 30% by 2036 | ● |

| Netherlands | A total of EUR 14.5 billion allocated by the government to the Climate Fund, including EUR 65 million to support the Dutch SMR programme | ● |

| Pakistan | Country is finalising to start construction of new plant, expecting to start operation by 2030 | N/A |

| Romania | Integrated National Energy and Climate Plan Change, which confirms plans for two new Candu units with a combined capacity of 1.4 GW at Cernavoda by 2032 The Romanian and US governments signed an agreement on the front-end engineering and design study for a SMR using NuScale technology | ● |

| Russia | The development of several SMR designs, including the country’s first land- based SMR, which is due to be commissioned by 2028 Draft plan for electric power facilities, in which the share of nuclear in total electricity generation is targeted to rise from 18.9% in 2023 to 24% by 2042 | ● |

| Slovakia | Government approval of a plan to build a new nuclear reactor with a capacity of up to 1.2 GW at the Jaslovske Bohunice site Draft update of the Integrated National Energy and Climate Plan, in which nuclear energy, potentially including SMRs, is expected to dominate its electricity sector by 2050 | ● |

| Slovenia | Draft update of the Integrated National Energy and Climate Plan, which supports the continued expansion of nuclear energy and the consideration of SMRs | ● |

| South Africa | The development of two SMR designs (HTMR-100 and A-HTR-100) | ● |

| Sweden | A roadmap for new nuclear energy in Sweden, which aims to add new capacity of 2.5 GW by 2035 and foresees further expansion thereafter | ● |

| Switzerland | Energy Strategy 2050 aims to phase out nuclear energy by 2050, though the government has announced its intention to lift a ban on the construction of new nuclear plants | N/A |

| Ukraine | Draft National Energy and Climate Plan of Ukraine 2025-2030, which discusses potential development of SMRs | ● |

| United Arab Emirates | Updated Energy Strategy 2050, which aims to promote nuclear energy and encourages investments in the country’s renewable and clean energy sector | N/A |

| United Kingdom | British Energy Security Strategy (2022), which targets eight new large reactors as well as SMRs to achieve nuclear power capacity of 24 GW by 2050 Great British Nuclear (GBN), launched in 2023 to support the 2050 target | ● |

| United States | A federal government plan to add new capacity of 35 GW by 2035 (including plants under construction), with deployment of 200 GW capacity by 2050 to at least triple the country’s nuclear capacity The Advanced Reactor Demonstration Program, which provides over USD 3 billion in funding for SMRs and other advanced reactor designs | ● |

| Countries with reactors under construction or considering introducing nuclear energy | ||

| Bangladesh | Integration Energy and Power Master Plan (IEPMP) 2023, which discusses thepotential of nuclear energy including SMRs, targeting future capacity of between 4.8 GW and 7.2 GW by 2050 | ● |

| Estonia | Draft update of the National Energy and Climate Plan, which consider the potential of SMRs and highlights their advantages given limited generation capacity that can be integrated in the Estonian electricity system | ● |

| Country | Recent policy decisions and nuclear energy developments | SMR included |

| Ghana | Long-term National Development Plan of Ghana (2018-2057), which envisions its first nuclear power reactor to come online by 2030 | ● |

| Jamaica | MoU signed with Canadian organisations in 2024 to explore the potential of nuclear energy to diversify the country’s energy mix | ● |

| Jordan | Jordan Atomic Energy Commission is exploring the potential for deploying SMRs, including for desalination, by shortlisting the most viable SMR designs from internationally recognised vendors | ● |

| Morocco | Morocco has been reviewing opportunities to introduce nuclear in its energy mix by 2030 | N/A |